When it comes to investing, people naturally think of stocks first.

After all, it is the growth of companies that drive wealth creation.

But when there are geopolitical tensions or interest rate cuts, the world gets shaky and attention shifts to gold, a timeless safe haven.

Shining at Records High

With the growing expectations of the US Federal Reserve interest rate cut and weakening dollar, we have seen this play out again.

SPDR Gold Shares SGX (GSD.SI), an etf that tracks the London Bullion Market Association’s afternoon gold fix (LBMA Gold Price PM), was last priced at S$477, on 12 October 2025.

So, should you be putting your money into stocks or gold?

The truth is that they play very different roles in your portfolio.

Let’s explore both sides.

Gold – The Stabilisers

It is no breaking news that gold has consistently acted as a safe haven in times of crisis because of its ability to maintain its value.

Traditionally, gold prices move in the opposite direction of interest rates: when rates drop, gold tends to climb, and when rates rise, gold tends to fall.

However, this pattern broke when the US interest rates started to fall last year, yet gold prices continued to rally.

According to the World Gold Council, investors and central banks have been increasing their gold holdings to shield themselves from economic turbulence.

The precious metal tends to move inversely to the stock and bond markets during economic downturns.

Simply put, when prices of stocks and bonds drop, gold prices often rise, making it a useful safety net for investors.

Depending on the type of gold purchased, investors may also benefit from portfolio liquidity.

Gold ETFs for instance, can be bought and sold easily on the exchange.

Whereas, physical gold is less liquid and comes with storage and security conditions.

That said, gold has its limitations.

The yellow metal’s long-term return potential is significantly lower than stocks because they do not generate earning or payout dividends.

My take: Gold will be more suitable for wealth preservation and protection rather than wealth creation.

Stocks – The Builders

On the other hand, stocks are the builders of wealth.

Investors gain from capital growth as businesses grow and increase in profits.

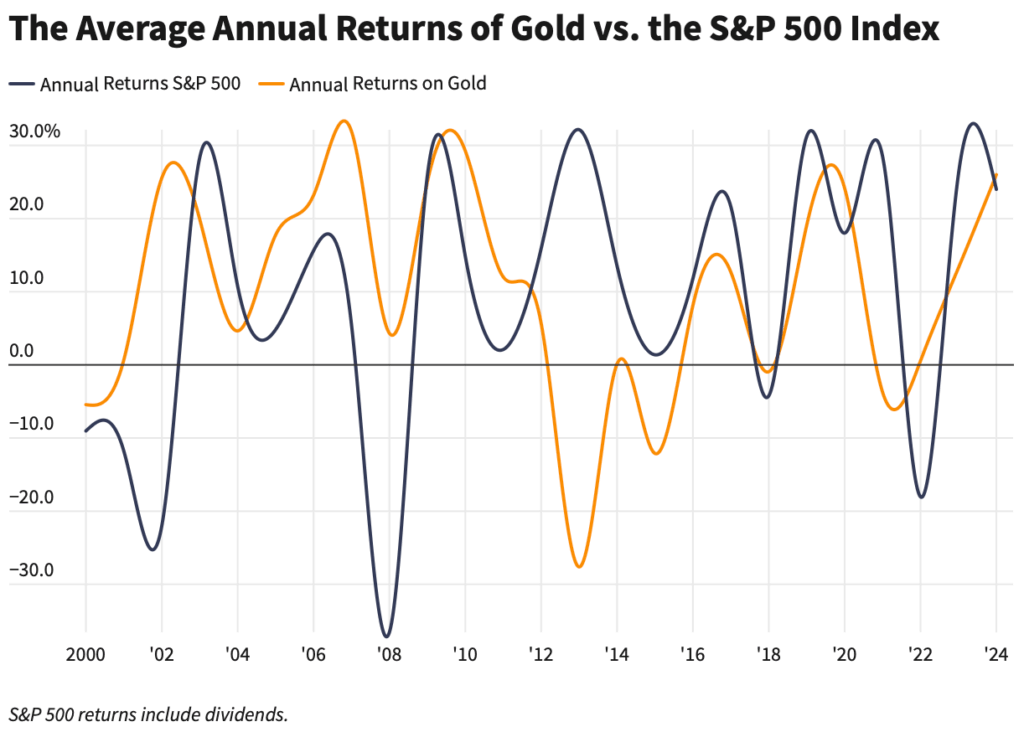

For example, the S&P 500 index has delivered a 10-year annualised return of 12.52%, far outpacing the performance of gold of only 3.92% over the same period.

Additionally, investors can obtain recurring income streams through dividends paid out by companies — in addition to gains from capital appreciation.

The mix of growth and income is what makes stocks the main driver of long-term wealth.

Investors are also able to spread their portfolio risk through diversification across different industries and geographies.

Compared to gold, stocks also have high liquidity, allowing them to be traded easily on the exchange.

Financial statements and material information of these publicly listed companies are also required to be disclosed.

With access to key information, retail investors can then evaluate performance and make informed decisions.

On the flip side, stocks often come with more volatility.

Depending on the economic cycles and interest rates, stock prices will change.

In the event of significant price fluctuations, investors may be tempted to panic-sell rather than hold onto their investments.

My take: Stocks remain the most effective tool for growing wealth in the long-run.

Get Smart: Balance Growth with Stability

The answer is not “gold or stocks”.

Instead, it is finding the right balance of both to help you build your wealth with confidence while enjoying a peace of mind.

Let stocks be the foundation of your portfolio, driving long-term growth and steady income through dividends.

Gold can play a smaller role, around 5-10% to protect you during turbulent times.

When the market is unpredictable, where can you park your money with confidence? Our latest FREE report reveals 5 Singapore dividend-payers built to withstand global storms. Get it now and see what’s still worth holding.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Charlyn does not own shares in any of the companies mentioned.