With the Straits Times Index (SGX: ^STI) recently extending its run to hit a new record high, many stocks are also hitting their respective all-time highs.

One of these stocks is Singapore Technologies Engineering (SGX: S63), or STE.

The technology and engineering giant saw its share price soar 32% in the past year and has settled at S$5 after hitting its all-time high of S$5.06.

Investors are feeling optimistic about the blue-chip engineering group as it grows its order book and posts higher revenue and profits.

Can STE continue its run to break new highs in 2025? Let’s find out.

A strong financial performance

STE delivered a strong performance for the first half of 2024 (1H 2024).

Its revenue rose 13.5% year on year to S$5.5 billion while operating profit climbed 17.7% year on year to S$522.9 million.

Net profit came in at S$336.5 million, nearly 20% higher than the previous year.

The engineering firm also generated healthy free cash flow of S$523 million, in line with the S$521.1 million churned out a year ago.

The robust performance has carried on for STE’s latest business update for the first nine months of 2024 (9M 2024).

Revenue jumped 14% year on year to S$8.3 billion for 9M 2024, continuing the group’s streak of revenue increases.

The group will release its 2024 earnings in the morning of 27 February.

Steadily growing its order book

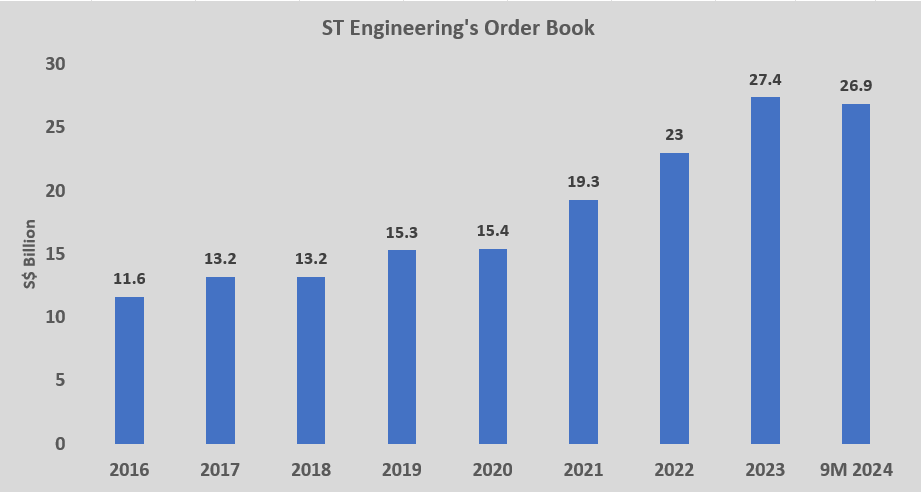

A good indication of the trajectory of STE’s revenue and earnings can be found by looking at its order book over the years.

A snapshot of the engineering group’s order book progression can be seen in the chart below.

Since 2016, the group has more than doubled its order book from S$11.6 billion to S$27.4 billion in 2023.

The contract momentum stayed strong in 9M 2024 with S$8.3 billion of contracts snagged, the bulk of which went to its Defence & Public Security segment (S$3.6 billion).

The remainder went to its Commercial Aerospace segment (S$2.9 billion) and Urban Solutions & Satcom division (S$1.8 billion).

Of its S$26.9 billion order book as of 30 September 2024, around S$2.6 billion will be delivered by the end of 2024.

A slew of new contract wins

STE has continued to clinch contracts in the past several months as it works to grow its order book further.

Back in December 2024, the group made its first foray into central Asia with a strategic partnership secured with Kazakhstan Paramount Engineering to set up production capabilities for a new military vehicle.

STE will provide engineering and technical support for the construction of this vehicle, commencing this year.

In the same month, the engineering giant snagged a S$180 million rail contract in Bangkok, Thailand, to provide the latest communication systems, supervisory control and data acquisition system, and agil platform screen door solution for the project.

Just last month, STE won a tender to deploy public electric vehicle (EV) charging points.

These will mainly be in industrial areas to increase the options available for EV users.

STE reported that it clinched a total of S$4.3 billion in contracts for the fourth quarter of 2024 (4Q 2024).

This level of contracts is nearly double of the S$2.2 billion secured in 3Q 2024, and is a good sign that the group can continue to grow its order book beyond the peak of S$27.4 billion.

A steady payer of quarterly dividends

Apart from growth in revenue and profits, STE has also been a very reliable dividend payer.

The group has been paying an annual dividend of S$0.15 since 2017 but increased this to S$0.16 back in 2022, paid out in quarterly dividends of S$0.04 each.

Should STE’s profits continue to grow and if free cash flow remains healthy, there is a chance that the engineering firm may increase its quarterly and annual dividend moving forward.

At S$0.16 per year, STE’s shares offer a trailing dividend yield of 3.2%.

Get Smart: The best is yet to be

STE has done well in the last few years in building its order book.

Remember that the engineering firm managed to do this even through the COVID-19 period, which makes its achievements all the more impressive.

Management intends to host an Investor Day some time in 2025 where the CEO will detail the group’s strategic priorities and set goals for the next few years.

Seeing the business’s momentum, investors should feel confident that STE’s run can probably continue.

Explore Singapore’s top “evergreen” stocks with our FREE report. It spotlights 7 Singapore blue-chip stocks with solid dividends and growth potential. Click here to download it now to create a flow of dividend income, regardless of market conditions.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang does not own shares in any of the companies mentioned.