The financial world is on “FIRE”, with the word “retirement” rapidly becoming the buzzword of our generation.

Over the last few years, the “FIRE” (Financial Independence, Retire Early) movement has been gaining momentum all around the world, with more and more people exploring ways to retire.

To achieve financial independence, it’s important to ensure that we have sufficient funds to last us through our golden years so that we do not need to worry when we have silver in our hair.

However, what exactly is “enough” for retirement?

The word could mean different things to different people over different timeframes.

So, let’s try to define certain metrics and aspects of what constitutes “enough” so that investors can get a better handle on what it takes to achieve retirement.

Creating a financial cushion

Let’s start with the basics, which involves building a strong enough financial cushion to buffer against emergencies.

Think of it as an “emergency fund”, which ideally should be at least 12 to 24 months of your monthly expenses.

This emergency fund acts as a cushion against unexpected events that may occur in life such as (touch wood!) an accident or major illness for example.

Though insurance should be a part of prudent financial planning, certain financial situations may require some additional funds to tide us over, and this is where the emergency fund can act as a lifesaver.

For instance, a person’s critical illness cover could cover up to a sum of $250,000. But if the total medical expenses incurred ends up exceeding this amount, we may need to draw-down from our emergency fund.

Once this financial buffer has been set up, an investor can then plan for a suitably-sized pot of money to draw down and generate a stream of income to last through retirement.

A pot of money

For some, retirement is about stashing away a large pot of money to serve as a retirement “draw-down” fund.

One way to calculate how much you need is based on your family expenses incurred every month.

For instance, if you spend roughly $3,000 a month, it adds up to $36,000 a year.

Next, we need to figure out how long we are expected to live.

With better healthcare options and improved medical technology, most people can expect to live well into their 80s (maybe even 90s) in 30 years’ time.

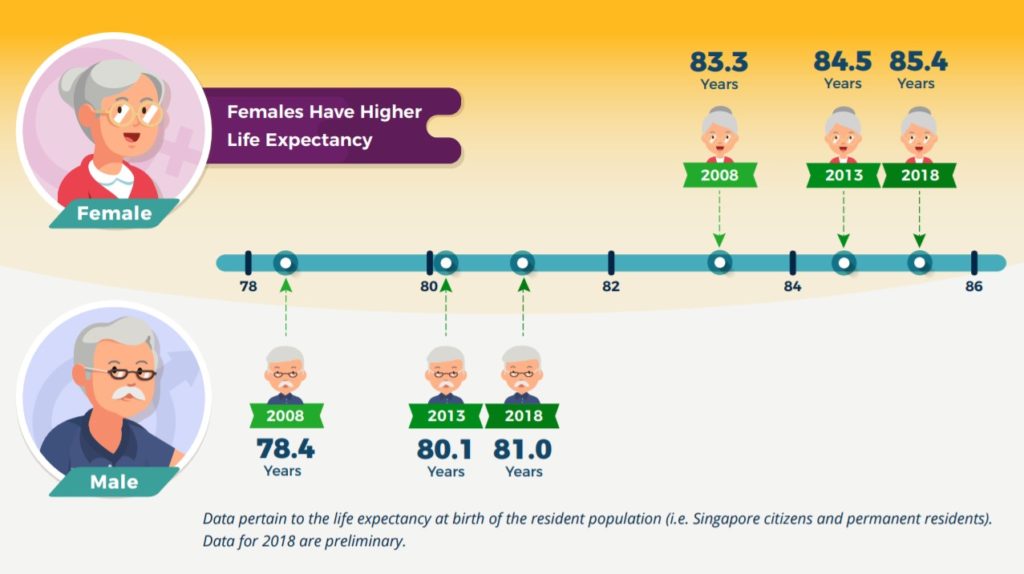

Life Expectancy DIagram. Source: Singstat.gov.sg

Along that vein, if we assume we will retire at 67 years old, that means we will have between 15 and 20 more years without any income.

Those years will have to be funded by our savings.

If we use the longer period of 20 years, that will add up to S$720,000 for us to live our golden years after 67 years old.

A flow of cash

Not everyone likes the concept of having a pot of money lying around to be drawn down.

There is some merit behind their concern.

There is a high chance that our pot of money will be unable to keep up with inflation (after all, food and transportation do get progressively more expensive as time goes by).

Beyond that, the retirement fund is also not replenished.

Meanwhile, as we draw down on our retirement funds, the overall amount is constantly being depleted, which can leave us with less peace of mind as time goes by.

One way to fill the gap is dividend investing.

By investing in stocks with pay a dividend, retirees can stand to earn an additional stream of income into their golden years.

If we assume a portfolio size of $500,000 which has an overall dividend yield of 5%, that sums up to dividend income stream of $25,000 a year, or a little over $2,000 a month.

This layer of passive income acts as a supplement to the pot of money concept described above, and can also allow a retiree to enjoy the occasional splurge without feeling too guilty.

Get Smart: Is it ever enough?

The final aspect to highlight is the psychological aspect related to the word “enough”.

Being a nation of worrywarts, it’s natural to question if any amount is ever considered sufficient.

Though it’s true that no one can predict the future, I believe that being adequately prudent and prepared should stand us in good stead for a happy and worry-free retirement.

The idea is to allow for a wider buffer in order to minimize the risk of getting things wrong.

For example, if $3,000 is estimated to be needed per month for expenses, bumping this up to $4,000 or even $4,500 and then computing the amount required from there provides for a bigger financial cushion.

We have to remember that as investors, we can continue to be active even during our retirement years, allocating capital to great opportunities and building up an ever-stronger portfolio.

Planning should not be a static affair, and we have to remember that we have a responsibility to ensure our retirement is well taken care of.

With smart planning and astute investing, we will end up enjoying a blissful retirement.

Accelerate your retirement plans with these 5 SGX stocks. Their dividends are climbing, and are well-positioned to weather through storms in the future. We think at least one of them deserves a spot in your portfolio. To find out their names, grab a copy of your FREE special report: “Dividend Stocks That Can Pay You For Life” today. Click here to download now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

None of the information in this article can be constituted as financial, investment, or other professional advice. It is only intended to provide education. Speak with a professional before making important decisions about your money, your professional life, or even your personal life.

Disclaimer: Royston Yang does not own any of the companies mentioned.