We live in turbulent times. As an investor, you might be feeling it too. Singapore’s Straits Times Index (SGX: ^STI) has fallen to around 3,100 points.

You may have heard that US President Donald Trump is trying to fend off the threat of impeachment. Amid all the White House drama, the US is still engaged in a prolonged trade dispute with China. And it’s not that the Middle Kingdom is without its own problems.

By now, you should be aware of the mass protest in Hong Kong which is entering its fifth month. Unfortunately, there doesn’t seem to be a resolution in sight.

Meanwhile, over in the UK, the nation is facing the possibility of exiting the European Union without a deal. The ramifications of a no-deal Brexit, should it happen, are significant.

We live in turbulent times. There is no shortage of things to worry about. As the events around the world unfold, stock markets may seem to be more volatile than usual.

Markets will be volatile, but it always has been

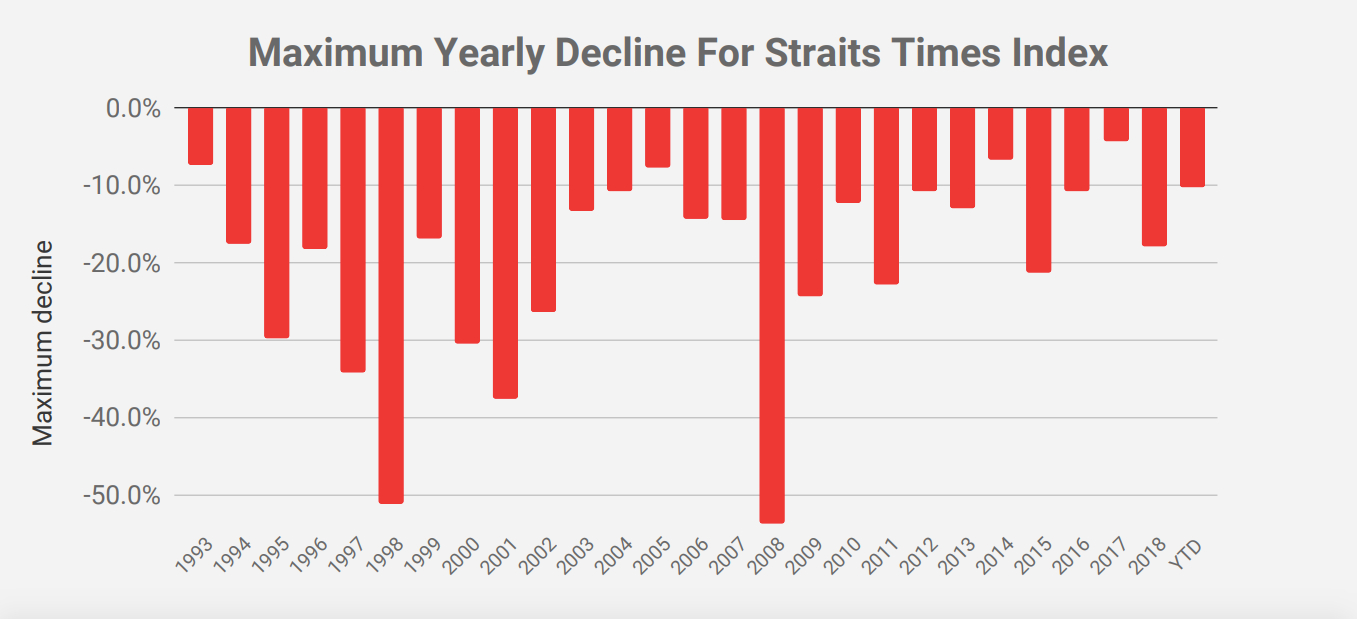

For the year to date, the STI’s maximum decline, from peak to trough, is around 10%.

Now, you may feel that a double-digit decline is sizable. But if you zoom out and look at the bigger picture, you’ll find that a 10% decline in any one year is pretty normal. The chart below, which shows the maximum yearly decline for the STI across 26 years, puts this year’s decline into perspective.

Source: S&P Global Market Intelligence; author’s calculations

For context: Since 1993, the STI has declined 10% in nine out of every 10 years. The index has also fallen 20% or more four times in every decade. And larger declines of 30% or more happen around one-fifth of the time. On two rare occasions, in 2008 and 1998, the STI fell by over 50% from peak to trough.

The statistics above clearly point out that market volatility is a normal occurrence. As such, we should come to expect that market swings up or down are part and parcel of investing.

Up and to the right

Despite the STI’s fluctuations, the index’s returns have not disappointed. Based on data provided by State Street Global Advisors, the STI has delivered a near-7% in total returns per year between April 2002 and September 2019.

The return on investment may sound satisfying for you, but there’s a big caveat to the statistic above.

From one year to the next, the STI’s returns can differ greatly. In fact, between 2014 and 2018, the yearly returns of the Singapore index have varied from a 21.1% positive return to a 10.7% negative return. But if the STI was held over longer periods of time, the earlier data point shows that the returns will average out at around 7%.

In other words, to achieve the returns that you want, you will need to hold for the long term.

But here’s the problem: On one hand, you are now aware that the stock market can be volatile. On the other hand, you also know that you will need to hold through all the inevitable fluctuations with the aim resurface on the other side with positive returns.

Get Smart: Being comfortable with the uncomfortable

“A ship in the harbour is safe, but that is not what ships are built for”

A quote from John Augustus Shedd

We should first accept that 10% declines are indeed a common occurrence. You should expect it to happen. The trick is in finding a way to brave through the inevitable storms that will happen along the way.

Instead of being fearful of market falls, you should prepare for them. If you want to take it a step further, I would like to share three effective strategies that have worked for me as an investor:

1. Keep emergency cash and a cash position: What you want to avoid is selling when stock markets are down. To do so, you should have adequate cash on the side for potential emergencies. With what is left, only invest the money that you are unlikely to use in the next five years. On top of that, I make it a point to keep a cash position because keeps me level-headed when the going gets tough. You can try that too.

2. Invest in amounts that you are ready to hold for five years or more: Most investors run into trouble when they invest too much, too fast. Never be in too much of a hurry. Always remember that we are in it for the long haul. As such, take your time to invest in amounts that you are comfortable to hold for five years or more. There is no point in trying to pour in large sums of money to the point where becomes too much for your heart to handle. Remember, markets can get rough from time to time, and if you can handle it, you are more likely to make a mistake.

3. Take your time to invest: There is no need to pour in all of your hard-earned savings into the market at a single point of time. As investors, you can choose to deploy your money in regular stages, always taking your time to assess the businesses that you are interested in, before adding more money to the stock market. The decision to invest more is always in your hands to decide.

Simple rules work best, in my view, as they are easy-to-remember rules of thumb that you can lean on especially when markets become tough to stomach. If you can stick to them, I believe that you would have a more than decent chance of gaining a satisfying return in the long run.

To learn more about the different types of investing strategies, and how you can apply them in your investing journey, sign up for our free investing education newsletter, Get Smart! Click HERE to sign up now.

None of the information in this article can be constituted as financial, investment, or other professional advice. It is only intended to provide education. Speak with a professional before making important decisions about your money, your professional life, or even your personal life.