Stock markets around the world have tumbled swiftly and suddenly.

What started as a localised viral outbreak centred in Wuhan Province in Hubei, China, has now morphed in one of the most severe pandemics in modern times.

Industries that have been directly hit include travel, tourism and hospitality. Some will hold up better than others, as we outlined here.

Banks, however, are not directly in the line of fire.

Yet, bank shares have tumbled sharply over the last fortnight, hitting levels last seen three years ago.

In every macro-economic crisis, though, banks do suffer from some fallout.

Businesses that are under stress may fail to keep up with their loans, leading to more defaults and write-offs for the banks.

As banks are the bluest of blue-chips, it’s time to examine if they are attractive to buy now. In this article, we’re going to examine three: DBS Group Holdings Ltd (SGX: D05), United Overseas Bank Ltd (SGX: U11), and Oversea-Chinese Banking Corp Limited (SGX: O39),

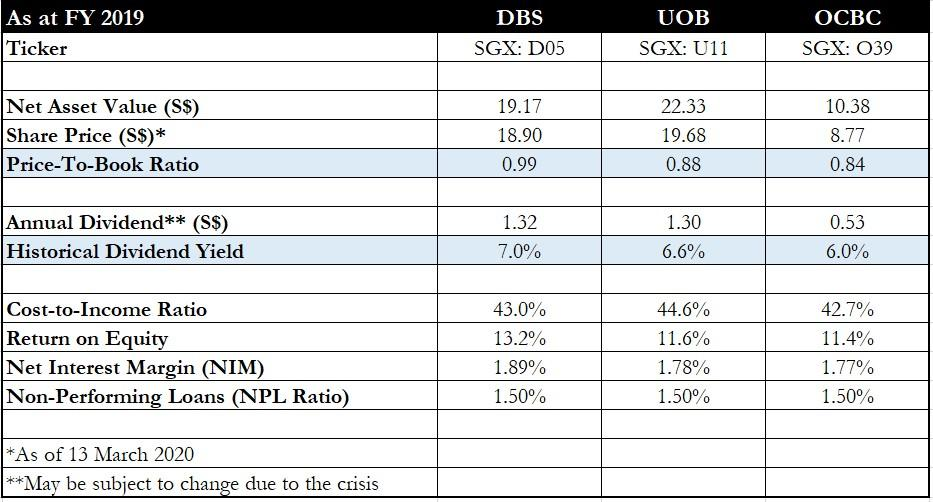

Bank stocks in crisis: a quick comparison

Source: Banks’ earnings reports; author’s compilation

The above table summarises the main operational and financial metrics for all three local banks.

First off, we look at the net asset value (NAV) of the banks to determine if they are cheap, or expensive.

Based on the current share price, we compute the price-to-book ratios for all three.

DBS is the most expensive of the three banks now, but the good news is that all three banks are trading below their respective book values.

Before the crisis, the banks were trading at around 1.1x to 1.3x their book values.

OCBC has the lowest cost-to-income ratio of 42.7%. This metric measures the level of expenses incurred by the bank in relation to its revenue. A smaller number means that the bank is more efficient at operating its business.

However, DBS sports the highest return on equity (ROE) at 13.2%. ROE measures the amount of profit generated per dollar of capital used in the business.

DBS is in a league of its own with 13.2%, with OCBC and UOB having ROE levels below 12%.

Interest rates at lower for longer

Next, we look at the net interest margin (NIM) for the banks. This measures the difference between what banks pay to depositors for their savings, versus the loan rates charged by the banks when they dole out loans.

A higher NIM is better as it means that the banks earn a larger spread between their loan and deposit rates.

DBS is again the leader here with NIM of 1.89%, while UOB and OCBC have NIMs hovering around 1.78%.

Investors should note though, that with interest rates likely to hover lower for longer, banks’ NIMs are likely to come under pressure in the months ahead.

Potential defaults and write-downs

The non-performing loans ratio (NPL ratio) measures the ratio of loans that have gone bad (i.e. the borrower has defaulted) versus the bank’s total loan book.

All banks are at the same level here at an NPL ratio of 1.5%.

With more companies under stress due to falling revenue and profits, we may start to see banks’ NPL ratios head up over the next few quarters.

Show me the money

Finally, we look at the dividend yields sported by the banks.

For DBS, it has raised its quarterly dividend to S$0.33 for the fourth quarter of the fiscal year 2019 and stated that, barring unforeseen circumstances, its full-year dividend will be S$1.32 hereon.

That would give the bank the highest dividend yield among the three, at 7%.

Both of these banks pay half-yearly dividends.

Investors should be mindful that dividends can be reduced if there is a major crisis like the one we are witnessing now.

DBS and OCBC had cut their dividends before during the Global Financial Crisis back in 2008-2009, and could very well do so again.

Get Smart: Banks are the bedrock of the economy

Banks form the pillar of Singapore’s economy.

Without them, Singapore as we know it would not be able to function. But the position comes with a great responsibility. As the local economy wobbles, banks will take their fair share of losses if loans weaken.

In response, share prices of banks have taken a big hit in the short-term as investors digest the worsening news on Covid-19.

While there are short term challenges, we have been presented lower stock prices to compensate for the risks we see today.

As all the banks are now trading below their respective book values, we believe that all three will offer good long-term value for investors.

FREE special report: The Bear Market Survival Guide. If you’d like to learn how to survive this bear market, CLICK HERE to download our special free report.

Get more stock updates on our Facebook page or Telegram. Click here to like and follow us on Facebook and here for our Telegram group.

Disclaimer: Royston Yang owns shares in DBS Group Holdings Ltd. Chin Hui Leong owns shares in DBS Group Holdings Ltd, OCBC Limited and United Overseas Bank Ltd and Joanna Sng owns shares in DBS Group Holdings Ltd, OCBC Limited and United Overseas Bank Ltd.

[Editor’s note on 26 March 2020 10:47pm: In our earlier version of the article, we had erroneously said that OCBC cut its dividend during the GFC — that has been corrected.]