As seen on:

As seen on:

Latest Articles

Even at market highs, 3 AI leaders continue to offer innovation, strong fundamentals, and long-term growth potential for investors.

At a time when most REITs have been reducing their distribution, Keppel DC REIT announced a 12.8% increase from the prior year.

With interest rates easing, the real question is how OCBC or UOB will adapt.

NVIDIA is everywhere when people talk about AI but it isn’t the only one shaping the industry’s future. These three tech giants are slowly advancing and may fuel the next wave.

Better Buy: CapitaLand Integrated Commercial Trust vs Frasers Logistics and Commercial Trust

With CapitaLand Integrated Commercial Trust (CICT) recently increasing its distribution payout, investors might wonder if it is a better buy now than logistics-focused Frasers Logistics & Commercial Trust (FLCT). In this article, we compare both companies to shed some light.

These three Singapore companies could power your retirement with dependable dividends and sustainable cash flow.

Popular

If your purpose is to filter out dependable blue-chip stocks to include in your portfolio, these four deserve your attention.

Global markets delivered plenty of drama: Intel’s rally to multi-decade highs, TikTok’s US-China deal, and Singapore stocks and REITs took centre stage.

Centurion Accommodation REIT (CAREIT) will be the first pure-play living accommodation REIT to list on the Singapore Exchange.

Four blue-chip stocks stand out even as the STI hovers above 4,300.

Stocks

There are pros and cons to every investment move you make, the trick is to go in with the right expectations.

Discover four resilient blue-chip dividend stocks that offer steady income, stability and long-term peace of mind for a stress-free retirement.

High dividend yields catch your eye for all the right reasons. But what looks like a generous payout today may be a warning sign of trouble tomorrow.

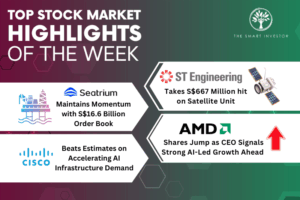

Singapore’s engineering giants saw mixed fortunes while US tech rallied on strong AI spending, highlighting the week’s key market developments from writedowns to record orders and earnings strength.

Getting Started

Managing a pool of money is not rocket science; in fact, it is something that many of us can do for ourselves.

My challenge today is to get you to remember three investing concepts that are simple to understand but easy to forget.

Here’s why the US Mexican fast-food chain has been one of my most rewarding investments.

Do you know what to look for in a balance sheet and cash flow statement? Royston Yang breaks it down for you.