As seen on:

As seen on:

Latest Articles

We profile five companies growing their revenues during their latest business update.

These five stocks’ share prices may have hit their year-low, but they could represent bargains waiting to be picked up.

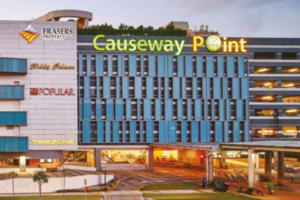

Singapore investors are blessed with plenty of REIT options.

3 US Growth Stocks with Share Prices Punching Past Their 52-Week Highs: Are They a Compelling Buy?

These three stocks could be worthy of your attention.

These changes could signal more inflows and listings in due course.

Stock prices have recovered, but the business impact has yet to kick in.

Popular

These four stocks were beaten down last year but could they witness a rebound in 2025?

We look at a chip maker’s latest expansion plans and see how the Straits Times Index notches up a record with last year’s performance.

The stock market has been breaking records in 2024, and everyone’s talking about it.

The signing of the landmark agreement comes after an MOU and two signing delays.

Stocks

Discover five high-growth US tech stocks that could be your next big winners.

These four stocks performed worse than the benchmark, but could they be ready to surge?

Looking for higher dividends? These four Singapore REITs managed to increase their payouts despite a tough macroeconomic environment.

Here are four solid consumer stocks that can provide you with consistent growth and dividends.