2021 will be remembered as a year of a bull market.

The widely-followed S&P 500 index, which comprises 505 of the largest US companies in the stock market, returned 28.7%, well ahead of its long-term annualised return of around 9%.

But that’s only half the story. While the major index witnessed a big upward, many smaller cap tech stocks did not do so well. In particular, “high-growth tech stocks” collectively had a terrible year.

The ARK Innovation ETF, an investment fund managed by Catherine Wood that invests in companies that deploy “disruptive technology,” fell by 24.1% in 2021. Although most of the high-growth companies in ARK’s portfolio continue to produce excellent revenue growth, valuation-compressions have driven their stock prices lower.

With high-growth stocks starting 2021 at relatively high multiples, decelerating growth from the highs of 2020 understandably caused some investors to ditch high growth stocks for value stocks whose valuation multiples have expanded.

Some of the biggest pandemic winners of 2020, such as Zoom Video Communications (NASDAQ: ZM( (-49%), Peloton (NASDAQ: PTON) (-75%), and Teladoc Health (NYSE: TDOC) (-54%) sank the most in 2021.

Long-term secular trends

So is this the end of an era for high-growth tech companies?

Personally, I doubt so. Companies that are serving large and growing industries and are disrupting older technologies are likely going to experience durable revenue growth for many years. It is also not uncommon for high-growth stocks to experience valuation swings. One group of high-growth stocks that has seen frequent valuation contractions and expansions is the software-as-a-service (SaaS) stocks.

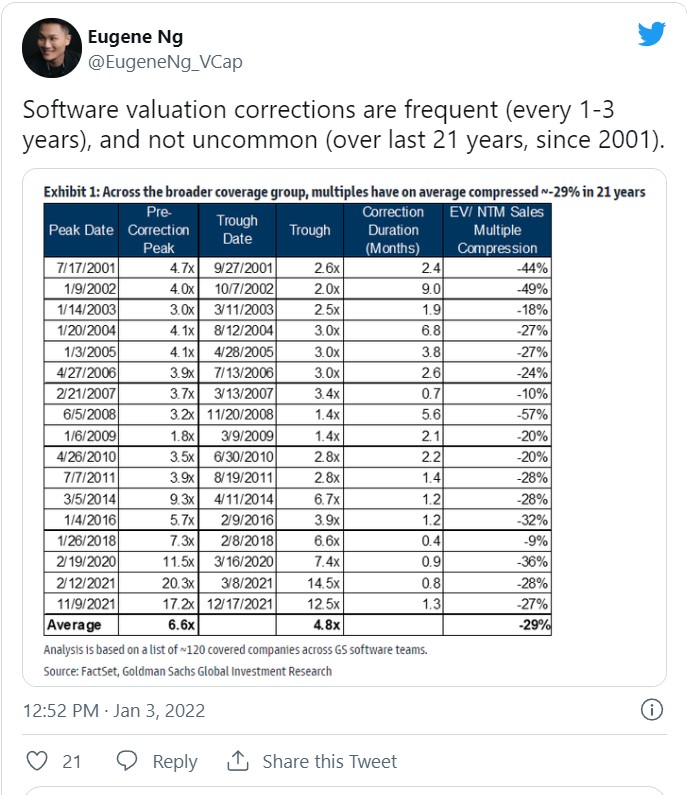

My friend Eugene Ng, who is a seasoned investor shared this interesting table on Twitter recently:

What it shows is that SaaS stocks have experienced numerous valuation-contractions in the past 20 years and yet eventually return to higher multiples. Although current SaaS valuation ratios are still higher than at most times in history, these high ratios could persist as long as superior revenue growth can continue.

In the past, investors had chronically underappreciated the durability of revenue growth of SaaS companies. Today investors have wisened up to this and are giving SaaS stocks deservedly higher valuation ratios compared to the past. So it is very possible for their valuation ratios to expand again.

Moreover, even with slowing revenue growth which I mentioned earlier, many high-growth stocks are still expected to grow their revenues in the mid-twenties percentage range for years. We could witness higher stock prices for high-growth SaaS stocks in the future even from strong revenue growth alone.

Don’t fret

If you’re one of the many high-growth tech investors who have underperformed the market in 2021, what should you do?

First off, don’t fret. Even though it’s not pleasant knowing that your investments have underperformed an “unmanaged” basket of stocks (the S&P 500), know that underperforming for a short time period is not uncommon, even for the best investors.

In the 1950s and 1960s, Warren Buffett was a running an investment fund. When he shut his fund in 1969, he recommended his investors to invest with Bill Ruane, a friend of his. Unfortunately, Ruane underperformed the S&P 500 for five years straight from 1970 to 1974. But he eventually had the last laugh. From 1970 to 1984, Ruane’s fund produced an excellent annual return of 17.2% for its investors, far in excess of the S&P 500’s 10.0% annual gain.

The beauty of investing is that it is not a short-term game. What matters is how you fare over your entire investing time frame. Most of us, investors, are playing a multi-year or even multi-decade game. Despite its relatively weak performance in 2021, the ARK Innovation ETF is still well ahead of the S&P 500 since its inception in 2015.

As investors with a long time horizon, it is important to look at the bigger picture.

2022 and beyond…

With the start of the new year, I’ve read numerous articles about how investors should position their portfolios for 2022. Although the authors of these articles mean well, it is extremely difficult to make single-year predictions. As such, I believe the real question should be how do you position a portfolio for a multi-year time frame.

So instead of thinking about how a portfolio could do in just the next 12 months, I prefer to consider what a portfolio could do over a five-year time horizon at least. By thinking in multi-year time frames, I give time for long-term secular trends to play out. I also don’t have to worry about short-term mispricings in the stock market, knowing that eventually, stock prices trend towards their true value (all its future cash flow discounted to the present).

By looking at the multi-year growth potential of a company, I can focus on what really matters over the long term rather than just near-term estimates. This helps me crystalise my investing strategy to optimise for my entire investment life.

Note: An earlier version of this article was published at The Good Investors, a personal blog run by our friends.

In our latest Special FREE Report, we cover the best performing stocks, blue chips, and REITs in the Singapore market in 2021. Look forward to 2022 as we cover the industries and sectors that are poised to do well in the year ahead. Click HERE to download for free now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Jeremy Chia owns shares of Zoom Video and Teladoc Health.