Picture this. You are entering a stadium to watch a football match.

The big game is about to start. The stadium is filled to the brim with fans, all waiting in anticipation for the match to kick off.

The atmosphere is electric. You take your seat. Everyone around you is pumped, willing for the match to start.

And then … the moment arrives. The game kicks off.

But something odd happens. Despite the wait, not a single fan in the stadium is watching the game on the field.

Instead, everyone in the stadium is looking at the scoreboard, staring intently.

Their eyes are glued to the score, completely oblivious to the football match that is happening right in front of them.

How odd indeed.

If you find the situation to be weird, you’re not alone.

Unfortunately, the story above mirrors what happens in the stock market all too often.

And yes, the behaviour of investors can be as odd as the scoreboard-staring fans.

Up and down

I get it. I really do.

Everyone likes watching stock prices. Especially for the stocks they own.

Your money is tied to the movement of the stock price, after all.

When stock prices fall, you might feel terrible because your wealth is shrinking. And when prices go up, your ego may rise alongside.

But the knowledge of how much your shares have fallen or risen will not help you become a Smarter Investor.

By watching the stock price alone, you will be behaving like the odd, scoreboard-staring fans in the story above.

And like the oddball fans, all you see in a stock price is the final outcome, but not the business events that led up to it.

Smart Investors know that it is more important to watch the business game, and not the scorecard.

… that is because whatever happens on the field will eventually turn up on the scoreboard.

Therefore, you are better off spending time looking at the business behind the stock — and not the stock price.

If you can commit to that, I dare say that your chances of investing well will increase accordingly.

The curious case of a stalled bus

Previous members of the Motley Fool Singapore’s Stock Advisor service will be familiar with one of our most successful SGX stock picks, SBS Transit (SGX: S61).

At the close of the services at the end of October last year, shares delivered total returns of 80%. While the final result was pleasing, the lead up to the returns required us to stay focused on the right things — and most of all, exercise patience.

Let me explain why.

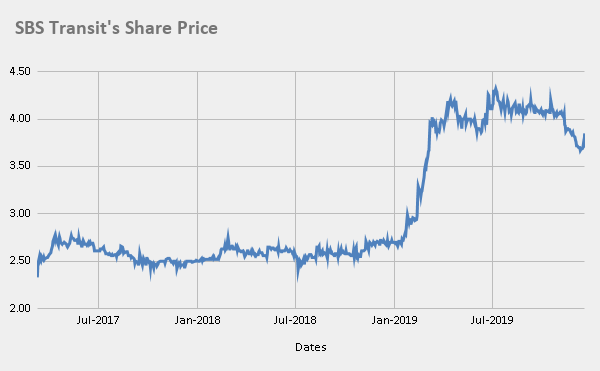

We recommended SBS Transit on 9 March 2017. For the next 22 months, up till the end of 2018, the stock price looked like this …

Source: S&P Global Market Intelligence

In short, SBS Transit shares essentially went nowhere for a period of 22 months.

Zero. Nada. We were essentially sitting on a bus that had broken down.

That is … if you were watching the stock price alone.

But if you were looking at SBS Transit’s business, you would have gotten a very, very different picture.

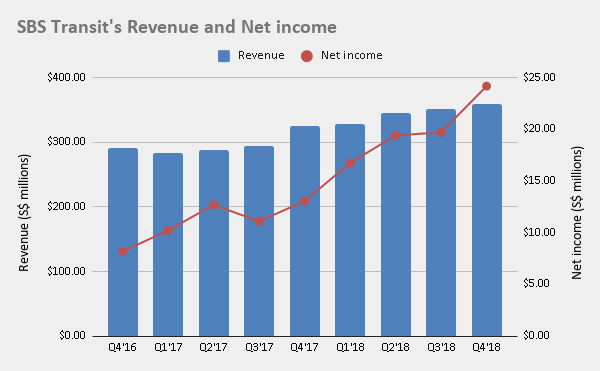

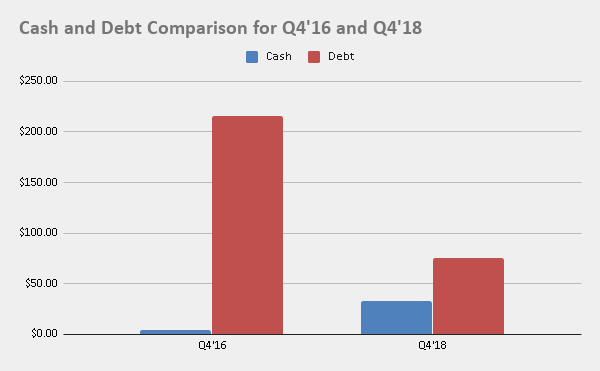

Source: S&P Global Market Intelligence

In the chart above, there was little doubt that SBS Transit’s revenue and profit were on an uptrend. For the same period, the bus operator’s debt, which stood at S$216 million at the end of 2016, fell to S$75 million by the end of 2018.

That was what we saw when we focused on the business, not the stock price.

Any reasonable investor would see that SBS Transit’s business was thriving.

Riding your way to riches

The lack of upward stock price movement for the first 22 months was frustrating.

But we were unperturbed.

We were steadfast in our belief that the results we see in the business will eventually turn up on the stock price.

And it did, with a vengeance …

Source: S&P Global Market Intelligence

Within months, the share price of SBS Transit shot up, reflecting the results that the business had been delivering.

Within months, SBS Transit went from a meandering performer to a top performer.

In short …

If you were looking at the stock price, chances are high that you will get frustrated by the lack of movement and sell out too soon.

In effect, you’ll be behaving like the scoreboard-watching fans, oblivious to what is happening to the business.

But if you were watching the game itself, that is SBS Transit’s business, you would likely have held on its shares.

Get Smart: Dividends by the busload

The capital gain was not the only pleasing thing for patient shareholders of SBS Transit.

From the start of our recommendation to today, SBS Transit’s dividends grew from S$0.0505 to S$0.1425, a stunning increase of over 280%.

Using today’s dividend, SBS Transit shares are yielding almost 6% on the initial recommended price.

If that’s not growth, I don’t know what is.

The best part of the story is that we endured far less stress compared to the stock-price watching investors.

Business results are released every three months, and that was where we spent our time. We were uninterested in the minute-by-minute movement of the stock price every day.

Stock prices tell us little to nothing about what was happening.

So, if you’re checking stock prices every day or every hour, consider taking a step back. Instead, sit back and learn about the business every quarter.

Come and join The Smart Investor on the next step of our investing journey. You’ll be able to learn about how to build a stable and profitable stock portfolio that can last generations. From now until Sunday, 19 January, we are running a special opening promotion for new service, The Smart Dividend Portfolio.

Click HERE to find out more about The Smart Dividend Portfolio, and how it can help you grow your wealth.

The Smart Investor is not licensed or otherwise regulated by the Monetary Authority of Singapore, and in particular is not licensed or regulated to carry on business in providing any financial advisory service.

Accordingly, any information provided on this site is meant purely for informational and investor educational purposes and should not be relied upon as financial advice. No information is presented with the intention to induce any reader to buy, sell, or hold a particular investment product or class of investment products. Rather the information is presented for the purpose and intentions of educating readers on matters relating to financial literacy and investor education. Accordingly, any statement of opinion on this site is wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader. The Smart Investor does not recommend any particular course of action in relation to any investment product or class of investment products. Readers are encouraged to exercise their own judgment and have regard to their own personal needs and circumstances before making any investment decision, and not rely on any statement of opinion that may be found on this site.

Disclosure: Chin Hui Leong does not own shares in any companies mentioned.