I recently took the plunge and participated in the OCBC Cycle Singapore 20 km event for the first time.

Before the event, I took time to check that my helmet was secure, brakes were functional, and that my tyres were sufficiently pumped.

In short, to ensure a smooth journey, I was minimising anything that could go wrong during the cycle.

As investors, we need to do the same for any investment that we make.

Chasing the upside, ignoring the downside

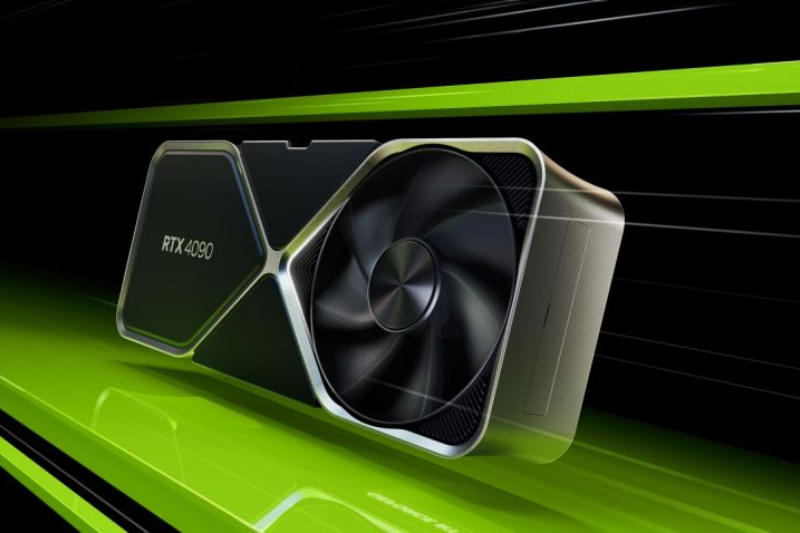

Many investors were left dazzled by the recent big gains chalked up by technology darling Nvidia (NASDAQ: NVDA).

As of 19 June, shares of the GPU manufacturer were up 215% over the past year and have shot up a whopping 34 times in the last five years.

With these heady gains, it’s easy to let your guard down and chase what seems to be a sure thing.

My point here is not to opine on the direction of Nvidia’s share price.

What I am asking you to do is to be aware of the downsides of investing in a red-hot stock rather than simply focusing on the potential gains.

We have seen this scenario playing out before.

Back during the pandemic years, investors were enamoured with stocks that catered to the work-from-home trend.

One pertinent example is exercise bike manufacturer Peloton (NASDAQ: PTON).

The previous pandemic darling became something of a fad back in 2021 as people stayed home to work out.

Peloton’s share price scaled a high of US$167 at the beginning of January.

As the world reopened, the company’s product fell out of favour and demand plummeted.

Peloton ended up cutting numerous jobs, had a change of CEO, and is now attempting to revive the business by selling content subscriptions rather than pricey hardware.

Just last month, Peloton launched a global refinancing to shore up its balance sheet as it struggles with slow sales and remains deeply in the red.

Its current share price is now at US$3.61, plunging by almost 98% from its peak more than three years ago.

Take time to review the risks

Peloton’s example may sound extreme, but the key message here is to always review the risks of any investment you make.

Too many investors get sucked in by glowing reports and marketing mania and end up throwing caution to the wind.

Remember to review not just the risks of any investment you plan to make, but also those of the stocks that are currently within your portfolio.

Treat the process as a financial health check, if you will.

Every time a company releases a business update or earnings report, take time to review it and think about possible risks to the business.

Over time, as you gain a deeper understanding of the underlying business, it’s easier to spot areas where something could go wrong.

Measures you can take to mitigate risks

Identifying risks is just the first step, though.

You may be wondering how you should react if you uncover risks that you may not feel comfortable with.

With the business world being dynamic and ever-changing, it’s a common occurrence to read about risks that may pop out of seemingly nowhere.

One measure you can take is to stop adding to your position if you already own some shares.

Monitor the business for a period of time and if the risks subside and you feel comfortable with the business again, then you can continue to increase your stake.

By limiting your exposure to the stock, you reduce the loss you suffer should something go awry.

Get Smart: An iterative process

Reviewing your investments should be something you do regularly.

It is also an iterative process as you learn more and adapt to changes in the business environment.

Remember to always keep the risks of any investment at the forefront of your thought process.

By tempering your enthusiasm, you can proceed with a calm mind and prevent yourself from chasing the hottest stocks.

At The Smart Investor, we understand the allure of chasing hot stocks. But we also know the importance of a balanced approach.

That’s why we go beyond simply reporting on market trends. We aim to educate our readers to invest smartly. At our portfolio services, we also provide in-depth analyses that consider both the upside and the downside, helping our members make well-rounded investment decisions.

We want you to become a more confident investor, capable of identifying and mitigating risk.

As for me, I am happy to report that I completed my 20 km cycling event without incident.

We have just revealed the top 7 US tech stocks poised for remarkable growth. In today’s fast-paced market, betting on these giants could mean more money in your pocket. With a focus on solid fundamentals and innovative prowess, these selections should earn a place in your portfolio. Click here to grab your FREE report now and start investing in the future, today.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang does not own shares in any of the companies mentioned.