Frasers Property Limited (SGX: TQ5), or FPL, is trying its luck for the second time in three years.

The property giant is attempting to privatise Frasers Hospitality Trust (SGX: ACV), or FHT, through a trust scheme of arrangement at S$0.71 per unit.

Back in September 2022, FPL had tried to privatise FHT at S$0.70 per unit, but this attempt was voted down by stapled securityholders, with 74.88% approving the deal, just shy of the 75% required for the scheme meeting to be successful.

The offer price of S$0.71 represents a healthy 36% premium to the hospitality trust’s volume-weighted average price (VWAP) and implies a price-to-net asset value (NAV) multiple of 1.11 times.

Should securityholders accept the offer this round, or are there other factors to consider?

A detailed strategic review

The directors of FHT’s managers, along with financial advisors DBS Group (SGX: D05) and United Overseas Bank (SGX: U11) carried out a detailed strategic review to explore options to unlock value for securityholders.

The review looked at several options and took into account how these options affected trading performance and valuation, the potential value unlocked, and the timing and degree of certainty for securityholders.

Some options considered included increasing the yield of the existing assets through asset enhancement initiatives or divesting these assets and recycling capital into yield-accretive acquisitions.

Alternatively, FHT could rebalance its portfolio and expand its mandate to include alternative hospitality assets.

These options above would keep the trust listed.

If the manager wished to effect a sale of FHT, several options considered included the sale of FHT’s platform to a third party or the liquidation of assets and return of capital to securityholders.

After considering the above, it was concluded that a scheme of arrangement offered strong deal certainty and will allow securityholders to immediately realise their investment at a premium to NAV.

Structural challenges for FHT

FHT further explained that structural challenges have adversely impacted the trust’s trading performance and valuation.

Hospitality trusts, as an asset class, have not done well compared to other REIT sub-classes.

Shorter stays expose hospitality trusts to more business volatility compared to a REIT with a long weighted average lease expiry (WALE).

Hence, income investors prefer asset classes providing more defensive income streams.

In addition, FHT’s smaller size with respect to larger peers such as CapitaLand Ascott Trust (SGX: HMN) has led to a higher cost of equity and lower debt headroom.

These attributes limit its ability to scale up, and with a smaller market capitalisation, FHT is unable to enjoy index inclusion and institutional investor participation.

Furthermore, FHT’s properties are located in geographies where their currencies have depreciated by between 20% to 30% against the Singapore dollar since its IPO in 2014, creating a further headwind for the trust.

Continued headwinds impacting valuation and growth prospects

Apart from the structural factors listed above, the manager also reminded that FHT’s distribution per stapled security (DPS) has not recovered to pre-pandemic levels.

This is despite the trust’s revenue per available room (RevPAR) exceeding COVID-19 levels.

Factors such as inflation, higher interest rates, and depreciating currencies all played a part in depressing the trust’s DPS.

COVID-19 also resulted in a significant and lasting impact on valuations across the hospitality trusts, with the price to NAV (P/NAV) in the post-pandemic period below the average of the pre-pandemic period.

The latest headwind to appear is Trump’s raft of reciprocal tariffs, which threaten to re-ignite inflation.

The US could also start a trade war with various nations that will increase the risk of a recession and lead to heightened economic uncertainty, depressing spending and causing travellers to tighten their wallets.

With distributions staying depressed and not having much chance for growth, the manager decided that a scheme of arrangement provided the best way for securityholders to realise the value of their shares.

A clean exit

The CFO of FPL, Loo Choo Leong, commented that this offer safeguards the interest of FHT’s securityholders and is in line with the property giant’s long-term strategy.

The P/NAV of 1.1 times exceeds the P/NAV multiples of many Singapore REIT privatisations since 2020 and also exceeds the average P/NAV multiple of hospitality trust peers of 1.04 times.

The offer price of S$0.71 will also imply a total return of 27.8% for any securityholder who bought shares at its IPO and subsequently subscribed for FHT’s rights issue.

Investors should also note that the scheme consideration price accounted for FHT’s latest valuation as of 30 April 2025, with the latest adjusted NAV at S$0.63904 per unit.

Get Smart: Scheme meeting and delisting timeline

Faced with tough structural issues and the inability to grow its DPS, securityholders should view this proposed privatisation as a good way to exit the trust and realise the value of their investment.

The proceeds from this scheme of arrangement could be deployed to other more promising investment targets.

Like the previous scheme meeting, approval for this scheme requires at least 75% of securityholders voting in favour.

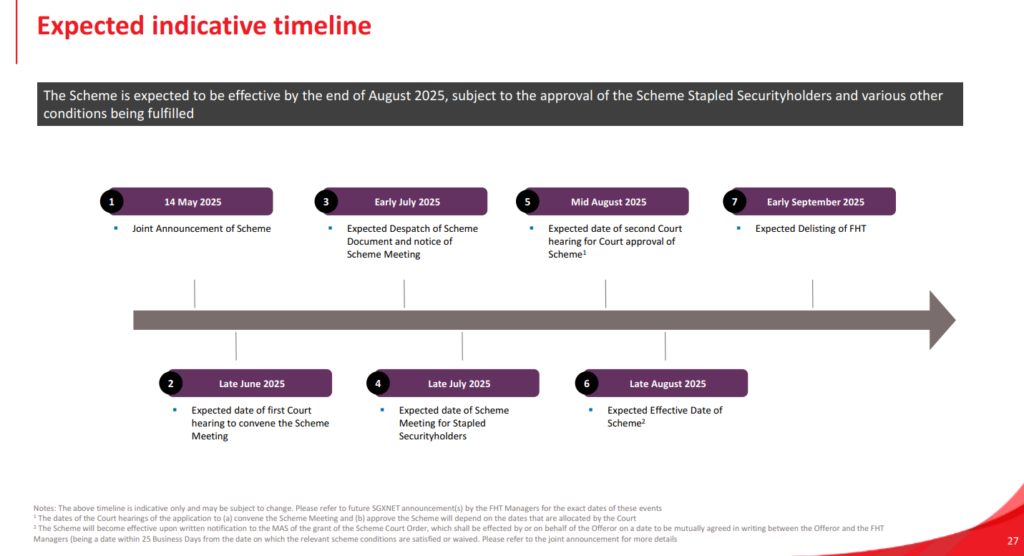

The scheme meeting is expected to be held in late July 2025, and if approved, FHT should be delisted by early September 2025.

Explore Singapore’s top “evergreen” stocks with our FREE report. It spotlights 7 Singapore blue-chip stocks with solid dividends and growth potential. Click here to download it now to create a flow of dividend income, regardless of market conditions.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of DBS Group.