With US Federal Reserve rate cuts expected in the near future, the Singapore REIT (S-REIT) sector is gaining attention from investors again.

S-REITs will benefit from lower borrowing costs as interest rates come down which shows up as higher profits (read: higher DPU) and the ability to acquire accretive assets.

That said, the S-REIT market is diverse.

Consequently, depending on individual REITs’ debt structures, property types, and geographic exposure, the impact of the decreased interest rate will vary.

If that’s the case, should you just invest in a S-REIT ETF to ride the recovery of the sector?

A case for investing in S-REIT ETF

The main advantage of investing in an ETF is that you get immediate diversification, which helps reduce the risk of picking the wrong REITs.

For instance, taking a stake in Lion-Phillip S-REIT ETF (SGX: CLR) will give you access to 18 high quality S-REITs screened by Morningstar, across seven sectors including industrial, office, and retail.

Consequently, the ETF should be able to withstand underperformance of any individual REIT or even an entire sector, limiting the negative impact on your overall return.

Furthermore, this diverse holding comes with an attractive yield of 4.9% (as of market close last Friday), which is almost a full 3% higher than the latest Singapore Savings Bond’s 10-year average interest rate of 1.93%.

Beyond the diversification and yield, another reason to invest in S-REIT ETF is that you don’t need to deal with equity fund-raising (EFR) exercises by individual REITs.

In other words, you don’t have to scrutinise the proposed acquisitions, or put up more cash to participate in these exercises should it involve a rights issue.

You can choose not to participate, of course.

But in doing so, it would lead to a diluted stake in the REIT, especially if the acquisitions aren’t accretive.

Which S-REIT ETF to buy?

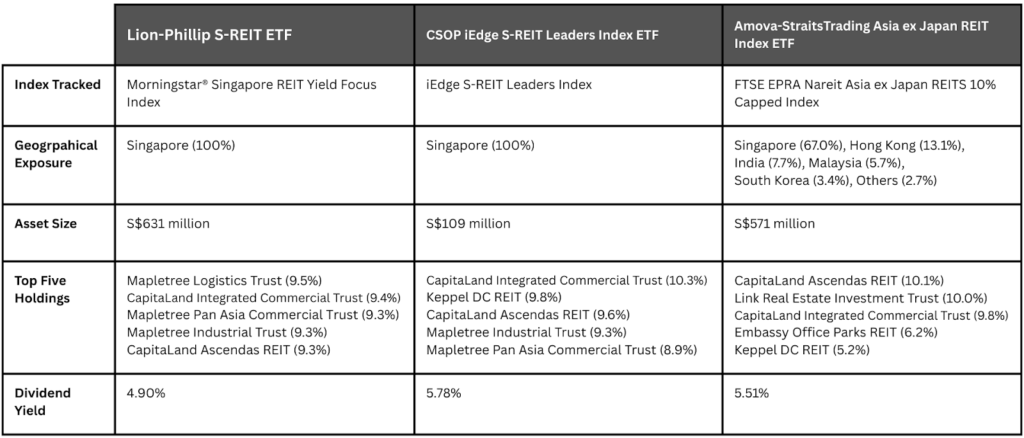

Being the first S-REIT ETF listed on Singapore Exchange (SGX: S68), Lion-Phillip S-REIT ETF (SGX: CLR) is also the largest, with a fund size of S$631 million.

The other two REIT ETFs with majority of their holdings consisting of S-REITs are CSOP iEdge S-REIT Leaders Index ETF (SGX: SRT) and Amova-StraitsTrading Asia ex Japan REIT Index ETF (SGX: CFA), or Amova-STC AREIT.

While the CSOP S-REIT Leaders Index ETF is also a pure S-REITs ETF, it differs from the Lion-Phillip S-REIT ETF in its stock selection methodology, with 21 S-REITs weighted by its adjusted free-float market capitalisation.

As for Amova-STC AREIT, 67% of its holdings are S-REITs, with the remaining allocated in REITs listed in other Asia countries, including Hong Kong and India.

Interestingly, only Amova-STC AREIT can be invested via the CPF Investment Scheme (CPFIS).

Additionally, unlike individual REITs, ETFs are not capped by the 35% stock limit after setting aside S$20,000 in your Ordinary Account (CPFOA).

Your choice of the S-REIT ETF boils down to your personal preference, which might include geographical exposure, tracking methodology and your sources of funding.

The following table provides a summary of the key characteristics of these three ETFs.

A case for investing in individual S-REITs

There are clear advantages to investing in an S-REIT ETF, but here are some downsides to consider.

Firstly, investing in an ETF comes with additional fees beyond the brokerage charges. Although the total expense ratio of a maximum 0.60% isn’t high, it nonetheless eats into your return.

Another downside is accepting the ETF’s composition, which might give you less exposure to a specific REIT or sector you prefer.

For example, Parkway Life REIT (SGX: C2PU), a healthcare S-REIT which has grown its core distribution per unit (DPU) for 17 years since its listing, takes up only about 2% to 3% of these S-REIT ETFs.

Expanding on that point, you will also need to accept that the S-REIT ETFs may consist of individual REITs that you would otherwise not invest in.

Finally, investing in S-REIT ETFs means you lose the privilege of directly interacting with management at Annual General Meetings.

Get Smart: You can have the best of both worlds

Should you invest in S-REIT ETFs or individual S-REITs?

In truth, you don’t have to choose one over the other.

Think of the question this way: you’re renovating your home.

It’s likely that you want to customise key parts of your home, like the living room or kitchen, to reflect your taste. But for the rest of the house, you might be happy with a standard, well-designed layout.

Similarly, you can use a broad-based S-REIT ETF for the sector’s recovery, and complement it with direct investments in your favorite individual S-REITs to personalise your portfolio.

The mix is up to your preference.

If you want to retire with a constant stream of dividends, these 5 stocks might be all you need. We’ve found 5 SG stocks that have kept paying (and growing) through inflation, rate hikes, and recessions. See what they are with our latest free report for SGX dividend investors. Click here to get instant access.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Kin Chuah owns shares of Amova-STC AREIT and Parkway Life REIT.