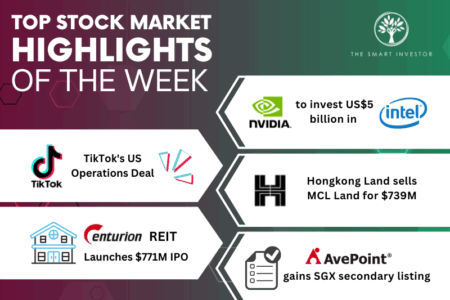

Global markets delivered plenty of drama: Intel’s rally to multi-decade highs, TikTok’s US-China deal, and Singapore stocks and REITs took centre stage.

Browsing: REITs

Centurion Accommodation REIT (CAREIT) will be the first pure-play living accommodation REIT to list on the Singapore Exchange.

These four REITs look set to boost their DPUs and should be on income investors’ radars.

Are there better days ahead for these three REITs?

Worried that the market has peaked? Here are three REITs still offering dividend yields above 6%.

These four Singapore REITs rank high on reliability and dependability.

With stocks peaking and Fed cuts ahead, learn what lower interest rates could mean for investors.

There’s nothing better than having cash drop into your bank account like clockwork.

These REITs have done well this year, but can they continue to surge higher?

Want a retirement you can enjoy? Here’s how dividends and growth stocks can get you there.

Here are five stocks that will dish out dividends this month.

With the market pricing in interest rate cuts soon, real estate investment trusts (REITs) could be among the first to benefit.

Here are four REITs that hold overseas properties and boast dividend yields of 6.8% or better.

The Fed is expected to cut interest rates in September 2025, setting the stage for a major shift in Singapore’s stock market. REITs like CICT could gain fresh momentum as financing costs ease, while banks such as DBS, OCBC, and UOB brace for margin pressure. Here’s what Singapore investors need to know to position their portfolios.

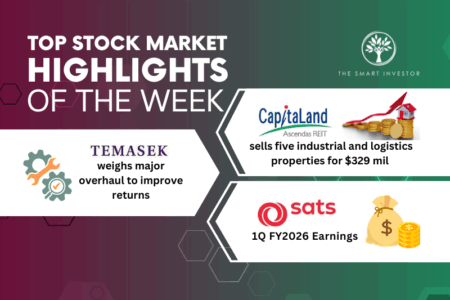

We look at the latest divestment by Singapore’s oldest industrial REIT and a potential makeover at Temasek Holdings.

We showcase three REITs with overseas properties that managed to increase their distribution per unit.

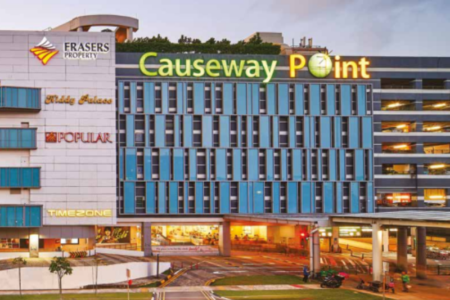

Have you ever wanted to invest in property without the hassle of being a landlord? REITs may be your answer.

We compare two Mapletree REITs to determine which is the more attractive pick.

Diversified REITs can provide resilience during real estate downturns.

The STI is at new highs, but can it last? Watch our webinar recording to get a strategic edge and navigate the opportunities and risks ahead.