Can dividends beat inflation on their own? We take a look at CICT, DBS, OCBC and Parkway Life REIT to show which yields actually sustain.

Browsing: REITs

Despite market headwinds, these five Singapore REITs delivered higher DPUs, showing that quality assets and prudent management still pay off.

Having recently raised its payout, we examine if CapitaLand Integrated Commercial Trust is a buy here.

From healthcare to commercial and industrial assets, these three Singapore REITs show why quality income can truly last a lifetime.

Income investors should focus on the stability and sustainability of the dividends they receive from companies; in this article, we take a look at three Singapore names that have maintained reliable pay-outs for more than a decade.

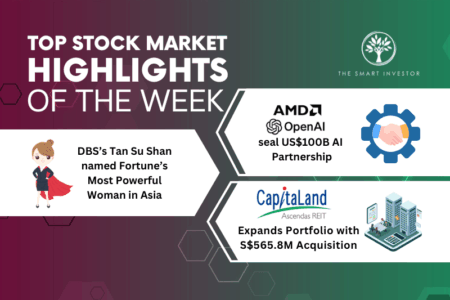

From a record-breaking AI chip deal to a historic leadership milestone and major real estate moves, this week’s market highlights showcase how innovation, influence, and investment continue to shape opportunities for investors in 2025.

October brings fresh opportunities for dividend investors as we look at three Singapore REITs that stand out in a changing market landscape.

Lower interest rates make high yields (>5%) more attractive .

Markets rise and fall. Here’s a quick guide to bull vs bear market Singapore cycles and the smart strategies to invest with confidence through both.

CAREIT(SGX: 8C8U) made a strong IPO debut with its price up over 6%. Yields look appealing, but here are 3 things investors should take note of.

Here’s why diversification is important in investing and how you can achieve it for your investment portfolio.

From income to growth, REITs are a powerful tool to achieve financial freedom and early retirement.

Discover if high-yielding REITs like AIMS APAC, CapitaLand China Trust, and United Hampshire US REIT are true bargains or hidden traps for income investors.

These four REITs possess strong attributes and can help you navigate your retirement smoothly.

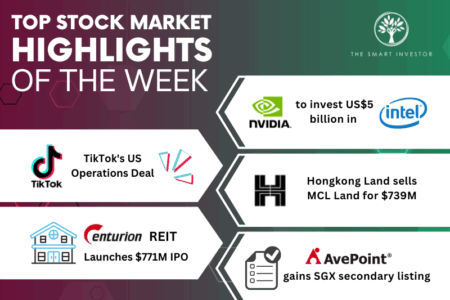

We look at a landmark AI infrastructure deal between two tech giants, a major data centre acquisition in Japan, Centurion Accommodation’s REIT’s debut, and Singapore’s booming construction sector.

Should you buy Singapore REITs after the US Fed rate cut? The right answer depends on your expectations.

These four companies are announcing moves that seek to improve their businesses and realise more value for shareholders.

Acquisitions can help to drive growth in both the REIT’s asset base and its distribution per unit.

After three years of higher interest rates, could Singapore’s largest REIT see better days ahead?

Global markets delivered plenty of drama: Intel’s rally to multi-decade highs, TikTok’s US-China deal, and Singapore stocks and REITs took centre stage.