We profile four stocks that are touching a year-low to determine if they could be good buys.

Browsing: Blue Chips

Insights from JPMorgan Chase’s management on the health of American consumers and businesses in the third quarter of 2023.

The asset manager is rewarding shareholders with cash dividends and shares of two listed companies.

Every investor views risk differently.

Rising interest rates are the main culprit in dampening demand for property. We look at four stocks that could be negatively impacted.

As earnings season kicks off, we identified four blue-chip stocks that may report higher profits.

Just as we add on knowledge cumulatively, your wealth can also multiply when you invest it in the stock market.

Here are several dependable Singapore stocks you can accumulate for your CPF account.

Looking for reliable high-yield stocks? These four blue-chip companies may do the trick.

In a quest for high yield, you can turn your attention to these four promising stocks.

We look at an acquisition by an integrated healthcare player and the latest move by the world’s largest social media company to charge its users.

Looking for a great mix of growth and dividends? You can turn your attention to these four stocks.

These three Singapore stocks have seen their share prices sliding due to pessimism, but could they be a screaming buy?

There is good news on the inflation front. Consumer prices have slowed for a third straight month with economists expecting…

We look at the latest inflation reading for Singapore and City Development Limited’s latest transaction to grow its property portfolio.

We look at three blue-chip stocks with announcements that could send their share prices upwards.

Investors may be wondering if Sembcorp Industries’ share price can continue to power on.

You don’t need to check stock prices everyday.

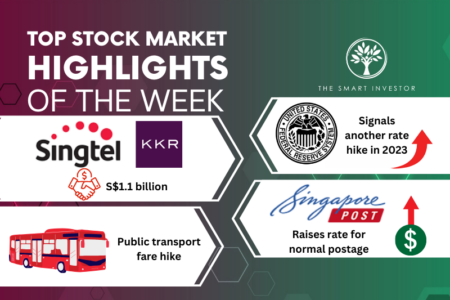

We look at the US Federal Reserve’s latest move and examine the impact of public transport fare hikes on two companies’ top line.

Managing your investment portfolio is not an easy task, but here are some tips on how to do so successfully.