Even before the pandemic, the electronics and information technology industry was witnessing multi-year growth.

Technological advancements in artificial intelligence (AI) and the development of the Internet of Things (IoT) both created sustained demand for semiconductors and electronic components.

Interestingly, the pandemic has accelerated the adoption of digital workplaces and further pushed up the demand for electronics.

This trend has caused the electronics sector to continue its pre-crisis boom, with many companies reporting rising sales and profits.

Two companies within this sector are AEM Holdings Ltd (SGX: AWX) and Valuetronics Holdings Limited (SGX: BN2).

As a quick summary, AEM offers application-specific intelligent system test and handling solutions for both the semiconductor and electronics companies that serve the 5G and AI markets.

Valuetronics is an electronic manufacturing service provider that focuses on the design and development of a wide range of products for both the consumer electronics and industrial and commercial electronic sectors.

Let’s take a look at these two companies to compare which could be a better buy.

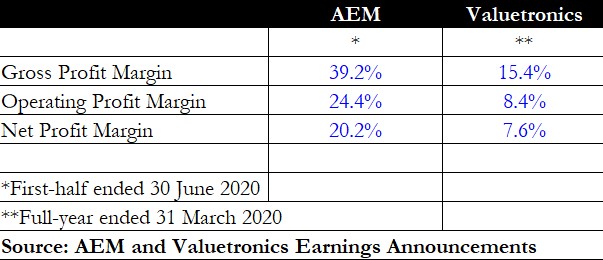

Margins

First off, we take a look at the margins for each business. These include the gross, operating and net profit margins.

The gross margin is an indicator of the pricing power of a business.

AEM’s gross margin stands at 39.2%, more than double that of Valuetronics’ 15.4%.

The fatter margins implies that AEM can price its products more competitively as compared to Valuetronics. It may also suggest that Valuetronics is dealing with more commodity-like products where pricing power is weaker.

Correspondingly, AEM’s operating and net margin are also higher compared to Valuetronics.

Notably, the difference between the gross and operating margin is larger for AEM, at around 15 percentage points, compared to Valuetronics, which stands at just seven percentage points.

The observation shows that AEM has a higher layer of expenses (as compared to its revenue) versus Valuetronics.

This cost could work against the company should AEM’s sales volume decline.

Winner: AEM

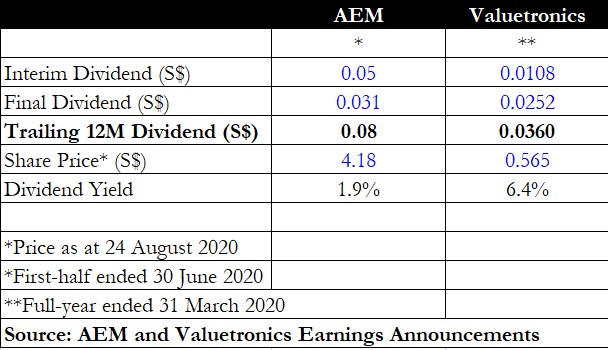

Dividend yield

Next, we look at dividend yield.

Both companies pay a half-yearly dividend. In fact, AEM had recently bumped up its interim dividend from S$0.02 to S$0.05.

The trailing 12-month dividend for AEM stands at S$0.081, giving shares a dividend yield of 1.9%.

For Valuetronics, it declared a full-year 2020 dividend of HK$0.20, which translates to around S$0.036.

At the last traded share price of S$0.565, Valuetronics’ shares offer a 6.4% dividend yield, more than triple that of AEM.

Winner: Valuetronics

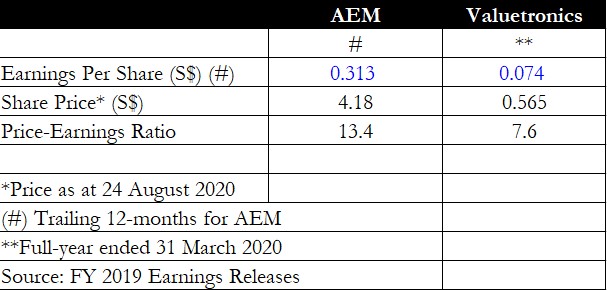

Valuation

Finally, we take a look at valuation to assess which stock is more expensive.

Based on the trailing 12-month earnings per share for AEM, its price-earnings ratio stood at 13.4 times.

Valuetronics, on the other hand, is trading more cheaply at just 7.6 times earnings, almost half that of AEM.

Winner: Valuetronics

Get Smart: Gunning for growth

Although Valuetronics came out ahead for both dividend yield and valuation, investors should not only look at these two factors in making an investment decision.

AEM has seen its revenue and net profit increase by 82% and 148%, respectively, for the first half of 2020.

Valuetronics, however, has suffered a decline in revenue of 16.8% year on year for its full fiscal year 2020.

The contract manufacturer’s net profit weakened by 10.3% year on year.

Besides, AEM has been increasing its annual dividends over the last three years, and its recent 150% year on year increase in its interim dividends is a strong sign of further increases to come.

Valuetronics, on the other hand, has kept its total ordinary dividend constant at HK$0.20 (excluding the HK$0.05 special dividend paid out in the fiscal year 2019).

Hence, given the choice, AEM appears to be the better stock to consider as the company is enjoying strong growth, along with healthy margins.

In time to come, dividends should also rise in tandem with higher profitability, pushing up the dividend yield assuming the share price stays constant.

Want to know what stocks we like for our portfolio? See for yourself now. Simply CLICK HERE to scoop up a FREE copy of our special report. As a bonus, we also highlight 6 blue chips stocks trading at a 10-year low. But you will want to hurry – this free report is available for a brief time only.

Click here to like and follow us on Facebook and here for our Telegram group.

Disclaimer: Royston Yang does not own shares in any of the companies mentioned.