Oil and gas companies are having a very tough time.

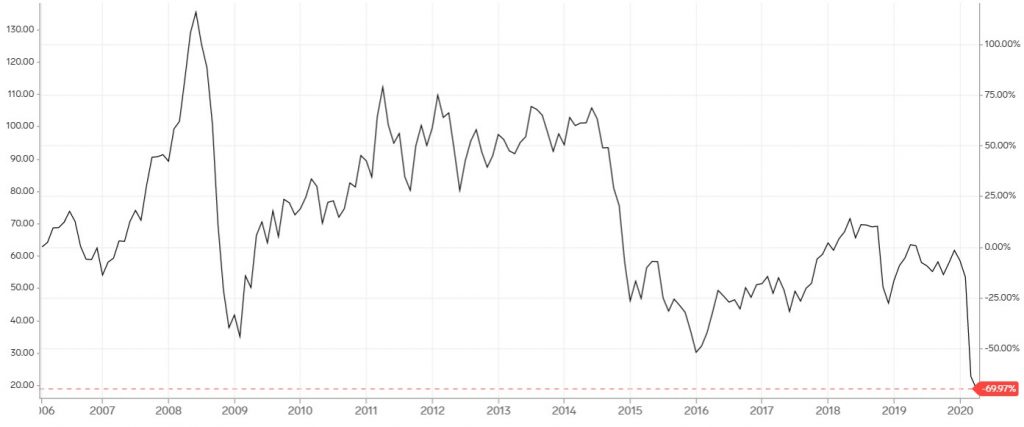

The last major crash in oil prices occurred in 2015 when prices plunged from a high of US$110/barrel to around US$40/barrel.

One of the reasons was because of a new category of oil producers known as shale oil drillers who were able to extract oil from shale rock, thus driving up supply.

As China continued to grow, the demand for oil rose in the years after 2015, leading to a slow but steady recovery in the oil price.

However, the long-awaited recovery proved to be short-lived.

The COVID-19 pandemic has resulted in both a glut in oil supply, as well as a plunge in oil demand.

Source: Markets Insider

Prices recently plunged to a 21-year low of around US$20/barrel.

With demand unlikely to return anytime soon, are oil and gas companies at risk of collapsing?

Cancelled and delayed orders

I looked at two of the biggest rig builders in the world — Keppel Corporation Limited (SGX: BN4) and Sembcorp Marine Limited (SGX: S51), to get an idea how the situation was.

Keppel Corporation is a conglomerate with multiple divisions such as offshore and marine, property and infrastructure.

For the first quarter of 2020, offshore and marine division took up 30% of group revenue.

The group reported that oil majors are curtailing exploration and production (E&P) spending and that the division will face “very challenging conditions” in the near future.

The division has, however, undertaken extensive rightsizing by reducing overheads since the crash in 2015.

Although net order book stood at S$4 billion at end-March, Keppel Corporation envisions that the flow of new orders will slow.

Fortunately, the division has pivoted away from oil and into gas and renewables. This helps to mitigate some of the damage from the oil price collapse.

For Sembcorp Marine, though, the pain is much more acute.

The group has witnessed delays in the execution and completion of existing projects, while the securing of new orders has also been adversely impacted.

The delay in existing projects is expectedly to materially impact revenue and profitability, with the group warning of further losses in the foreseeable future.

Casualties building up

Casualties have already begun to build up due to the carnage in the oil market.

Mainboard-listed Nam Cheong Limited (SGX: N4E), an offshore support vessel builder, has announced that it is reviewing its options as it seeks to restructure its business.

The group’s shares have been suspended since 28 April and last traded at S$0.004.

Its latest first quarter 2020 earnings report showed a huge loss arising from an impairment charge of RM 96.4 million, while its balance sheet had just RM 65.6 million in cash versus a debt load of RM 905.2 million.

Oil trader Hin Leong was placed under judicial management last month as it restructures billions of dollars in debt.

The latest victim of the oil bust is ZenRock Commodities Trading, which owes more than US$600 million to creditors and is applying for moratorium relief.

Get Smart: Only the strongest will survive

From the examples above, it can be seen that many firms are suffering acute pain from the oil price crash.

Companies with huge debt loads and weak balance sheets will inevitably become insolvent as they struggle to generate sufficient cash flows to settle their obligations.

Only the strongest oil and gas companies, such as Keppel Corporation, stand a good chance of surviving through this protracted downturn.

Investors may wish to avoid the sector altogether until more clarity emerges.

Want to know what stocks we like for our portfolio? See for yourself now. Simply CLICK HERE to scoop up a FREE copy of our special report. As a bonus, we also highlight 6 blue chips stocks trading at a 10-year low. But you will want to hurry – this free report is available for a brief time only.

Disclaimer: Royston Yang does not own shares in any of the companies mentioned.