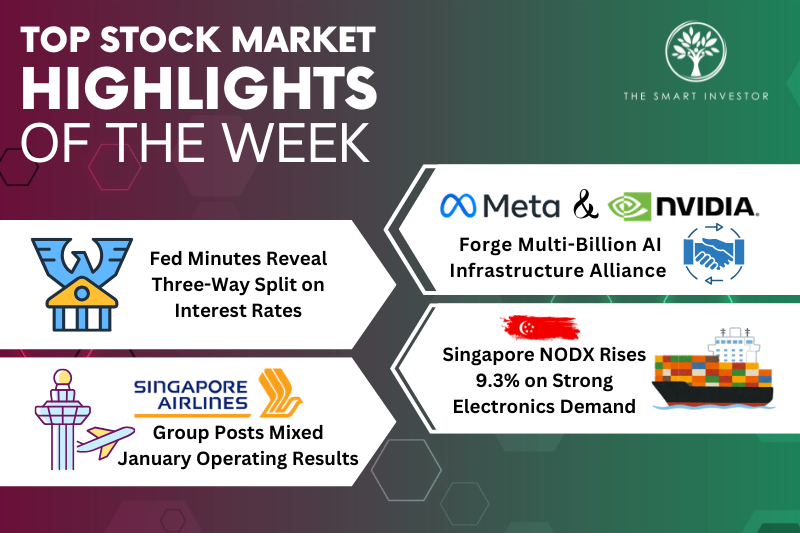

This week saw major developments spanning global technology and monetary policy through to Singapore’s trade performance.

A landmark AI infrastructure deal reinforced the ongoing boom in AI-related spending, whilst minutes from the US Federal Reserve’s latest meeting revealed a more fractious debate over interest rates than anticipated.

Closer to home, Singapore’s export figures pointed to resilient electronics demand, and the SIA Group released its January 2026 operating statistics.

Meta and Nvidia Cement a Multi-Billion AI Infrastructure Alliance

Meta Platforms (NASDAQ: META) and Nvidia (NASDAQ: NVDA) announced a sweeping multiyear partnership this week to build hyperscale AI data centres, a deal analysts estimate could be worth tens of billions of dollars.

The agreement covers millions of Nvidia’s current Blackwell and upcoming Rubin GPUs, alongside Spectrum-X Ethernet networking equipment.

Notably, Meta will be the first to deploy Nvidia’s Grace CPUs as standalone chips in large-scale production.

These CPUs are designed to run AI inference and agentic workloads more efficiently, offering a twofold performance improvement per watt over earlier solutions.

This comes as Meta commits up to US$135 billion to AI infrastructure in 2026 for its Meta Superintelligence Labs.

Nvidia CEO Jensen Huang highlighted the deep co-design across hardware and software, cementing Nvidia’s dominance.

While Meta and Nvidia shares rose, rival Advanced Micro Devices (NASDAQ: AMD) fell 4% as investors interpreted the alliance as a barrier to competitors.

Federal Reserve Minutes Reveal a Three-Way Split on Rates

Minutes from the 27-28 January 2026 FOMC meeting revealed a central bank more divided than markets expected.

While the benchmark rate held steady at 3.5% to 3.75%, officials are now split into three camps.

One group supports further cuts if inflation declines, another prefers holding steady, and a third “hawkish” group suggested rate hikes remain on the table if inflation persists above the 2% target.

Currently, the Fed’s preferred PCE gauge remains roughly 1% above target.

Two governors, Christopher Waller and Stephen Miran, dissented in favour of an immediate cut due to labour market concerns.

Adding to the uncertainty, Trump-nominee Kevin Warsh has publicly backed lower rates, though markets do not price in a cut until June at the earliest.

Singapore’s NODX Climbs 9.3% in January, Powered by AI-Driven Electronics Demand

Singapore’s non-oil domestic exports (NODX) grew 9.3% year on year (YoY) in January 2026.

While positive, this fell short of the 12.1% growth forecast by analysts.

The expansion was almost entirely driven by electronics, which surged 56.1% – fuelled by AI demand and a favourable base effect.

Integrated circuits led the growth at 80.5%, followed by disk media at 70.2%.

In contrast, non-electronics exports declined by 3.0%, hampered by weakness in specialised machinery and petrochemicals.

Geographically, demand was uneven; exports to China, Hong Kong, and the EU saw double-digit growth, while shipments to the US and Indonesia declined.

Despite the miss, EnterpriseSG recently upgraded its full-year 2026 NODX forecast to 2%–4%, reflecting broader trade momentum and strong 4Q2025 GDP growth of 6.9%.

SIA Group Reports Mixed January 2026 Operating Statistics

Singapore Airlines (SGX: C6L) reported a mixed start to the year.

At the parent airline level, passengers carried slipped 0.3% to 2.35 million, with the passenger load factor decreasing to 86.1%.

However, the broader SIA Group – including Scoot – showed more resilience.

Group passengers carried climbed 4.1% to 3.66 million, though the group load factor softened to 86.6% as capacity growth outpaced traffic volumes.

On the cargo front, volumes rose a modest 1.2%, with the cargo load factor improving to 52.1%.

SIA shares rose 0.57% to S$7 following the news.

Looking forward, the carrier remains confident in travel demand, announcing capacity expansions for the 2026 Northern Summer season, including increased frequencies to Bangkok and other Southeast Asian hubs.

If you’re nervous, confused, or worried about buying your first stock, then our latest beginner’s guide to investing can help. It’s easy to read yet packed with valuable insights. Download it for free today, and buy your first stock in the next few hours. Click here to get started.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!