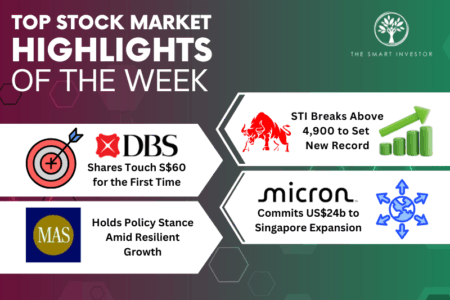

With markets pushing higher into 2026, investors are grappling with familiar questions around timing, income safety, and valuation. This week’s Smart Reads looks at blue-chip REITs and banks in focus, whether it’s too late to buy or sell familiar names like DBS, SGX, and Nvidia, and how to spot safer income stocks in the year ahead. We also revisit SATS’ recovery story and explore whether small caps deserve a place in long-term portfolios.

Here are this week’s top articles:

3 Singapore Blue-Chip REITs to Watch This Week

These REITs are in focus as investors track earnings, rates, and income stability.

DBS Is at an All-Time High. Should I Sell Now?

A closer look at whether taking profits makes sense after DBS’ strong run.

Singapore Banks in 2026: What Dividend Investors Need to Know

We break down what lies ahead for bank dividends as conditions shift this year.

Is It Too Late to Buy SGX?

SGX has rallied strongly, here’s how investors should think about it now.

The Smart Investor Guide to Spotting Safe Income Stocks in 2026

A practical framework to help investors separate reliable income from risky yield.

SATS’ Recovery Story: Can the Share Price Finally Take Off?

We revisit SATS’ turnaround and what could drive the next phase.

Small-Cap Stocks in Singapore: A Smarter Way to Invest?

Do small caps deserve more attention in a long-term portfolio? We explore the case.

Nvidia at Trillion-Dollar Heights: Too Late to Buy?

Nvidia’s rise has been extraordinary, here’s how investors should think about it today.

Here’s the best way to spend 5 minutes each week: Smart Reads. It gives you a fast, focused investing roundup so you don’t waste hours scrolling through the news.

We handpick the best stories, ideas, and market updates that matter. Whether it’s dividend gems, capital growth plays, or key market shifts, you get them all in one email for free.

Click here to join our community in Smart Reads, your smartest 15-minute read of the week.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!