As Singaporean investors, we’re pretty lucky.

The local stock market gives us plenty of options when it comes to dividend-paying companies.

Think about it: Singapore Exchange (SGX: S68) and ST Engineering (SGX: S63) have been paying dividends for over two decades.

And the big three banks, namely DBS (SGX: D05), OCBC (SGX: O39), and UOB (SGX: U11), have steadily raised their dividends over time.

That’s a pretty solid track record, right?

But here’s the catch: dividends are never guaranteed.

A company isn’t obligated to keep paying them, and if business conditions take a turn for the worse, those payouts can shrink — or even disappear.

So, how do you know if a company’s dividends are sustainable?

Let’s break it down.

1. Declining Profits or Losses

Most companies have a dividend policy that ties their dividend payouts to a percentage of their profits. This means that dividends are closely linked to a company’s earnings. If profits fall, dividends often follow.

Take SATS (SGX: S58) as an example.

Before the pandemic, SATS consistently paid out 70-90% of earnings as dividends.

But when losses hit in fiscal year 2021 (FY2021), the payout vanished.

It took three years before dividends finally made a comeback in FY2024.

And SATS wasn’t the only one.

Even blue-chip companies investors usually consider “safe”, were forced to slash or suspend their dividends during that period.

So the real question is: if business conditions change suddenly, will the company you’re holding be resilient enough to keep rewarding shareholders?

2. Negative Free Cash Flow

Free cash flow is the lifeblood of dividends.

While profits are important, it’s the cold, hard cash that funds payouts.

For example, SGX’s fiscal 2023 (FY2023) free cash flow (FCF) was S$392 million.

In the following year (FY2024), this figure picked up to S$551 million, and for FY2025, FCF rose further to nearly S$774 million.

That’s exactly the kind of momentum you want to see: a business building real cash reserves to keep rewarding shareholders.

Then there’s ST Engineering.

FCF came in at S$638 million in 2023, before soaring to S$1.23 billion in 2024, and is projected to be between S$818 million and S$1.1 billion for 2025.

Sure, it’s a dip from last year, but these are still very healthy numbers, more than enough to comfortably sustain dividends.

Both SGX and ST Engineering have shown a long history of generating consistent cash flow, which is key for maintaining reliable dividends.

On the flip side, not every company is so fortunate.

If a business is bleeding cash, dividends can only last so long.

Here’s the question: would you feel comfortable relying on a company whose payouts are funded by debt?

3. Payout Ratio Exceeding 100%

Don’t you think it’s a little crazy that some companies actually pay out more in dividends than they earn?

Well, it happens, and it’s not as rare as you might think.

For most healthy businesses, a payout ratio between 40% and 60% is the sweet spot.

Once it shoots past 100%, that’s a major red flag.

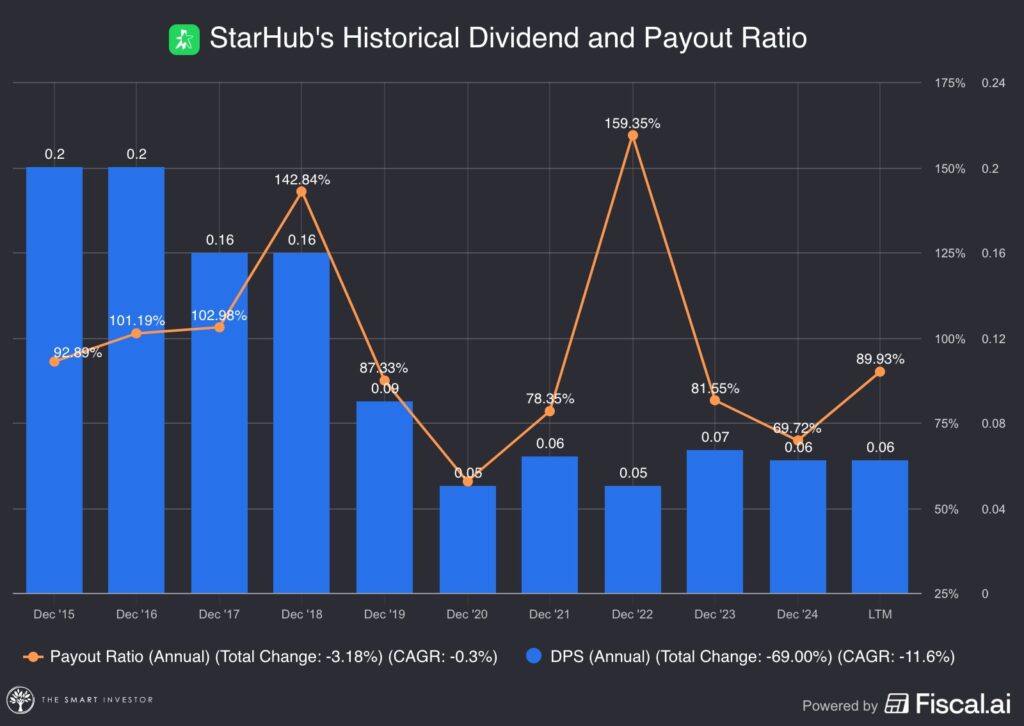

StarHub, for instance, kept a steady dividend of S$0.20 per share annually between 2010 and 2016.

On the surface, everything looked fine, but dig a little deeper, and you’d see its payout ratio exceeded 100% of its earnings per share (EPS) in 2016.

Unsurprisingly, that wasn’t sustainable.

By 2017, StarHub’s profits dipped, prompting a dividend cut to S$0.16, which was further reduced to S$0.05 in 2020, before edging up to S$0.06 in 2024, reflecting a modest recovery.

These days, StarHub has taken a much more cautious approach to dividends, targeting 80% of net profit.

For 2024, its payout was less than 70%, which is more sustainable than in the past, as long as the company can maintain its profit levels.

This approach is far more reasonable, but, ultimately, the long-term sustainability of its dividends will still depend on the company’s ability to generate stable earnings.

Get Smart: Staying vigilant

While dividends can be a valuable source of income, it’s essential to be vigilant.

By monitoring these three key indicators – declining profits, negative free cash flow, and excessive payout ratios – you can better assess the sustainability of a company’s dividend policy and make better investment decisions.

Attention: Investors aiming for both growth and peace of mind.

We’ve pinpointed 5 SGX stocks known for consistent dividends. If you want to build a retirement portfolio, but don’t want the stress of stock watching, this report is for you. Click HERE to download now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Renee Wee does not own any of the shares mentioned.