You don’t need a lot of cash to start investing. What matters is picking good companies from the get-go.

Top-notch stocks make great building blocks.

These are the big names in their field with a solid track record, steady payouts, and strong businesses that can handle ups and downs in the economy.

If you have S$10,000 to put in the market today, these five companies can help you build a robust, income-generating foundation: CapitaLand Integrated Commercial Trust (SGX: C38U), Frasers Centrepoint Trust (SGX: J69U), Singapore Exchange (SGX: S68), ST Engineering (SGX: S63), and SATS (SGX: S58).

CapitaLand Integrated Commercial Trust — Income from Singapore’s City Core

CapitaLand Integrated Commercial Trust (CICT) stands as Singapore’s largest REIT. It owns 26 properties, 21 of which are in Singapore, that are collectively worth $27 billion.

The REIT’s properties consist of retail malls, offices, and integrated developments. They include popular spots in Singapore such as Raffles City Singapore, Plaza Singapura, Tampines Mall, and CapitaSpring.

In the first half of 2025 (H1 2025), CICT’s distribution per unit (DPU) grew 3.5% from last year to S$0.0562. This was helped by good rental increases of 7.7% for retail properties and 4.8% for offices.

CICT has raised its DPU for four consecutive years since 2020. In FY2020, unitholders received S$0.0869 per unit. This increased to S$0.104 in 2021, S$0.1058 in 2022, S$0.1075 in 2023, and S$0.1088 in 2024. It’s worth noting that the REIT’s DPU increased even with financing costs largely rising during this period.

If the next six months hold steady, CICT’s on track for another year of higher DPU.

The trust has got some momentum going, with the positive rental reversions mentioned earlier. In addition, the upgrades at Lot One and Tampines Mall are moving along as planned, so higher rental income isn’t far off.

CICT remains a solid choice for people who want steady returns from properties in Singapore’s downtown area.

CICT’s unit price of S$2.32, as of 7 November 2025, gives it a trailing yield of around 4.8%.

Frasers Centrepoint Trust — Everyday Retail, Everyday Returns

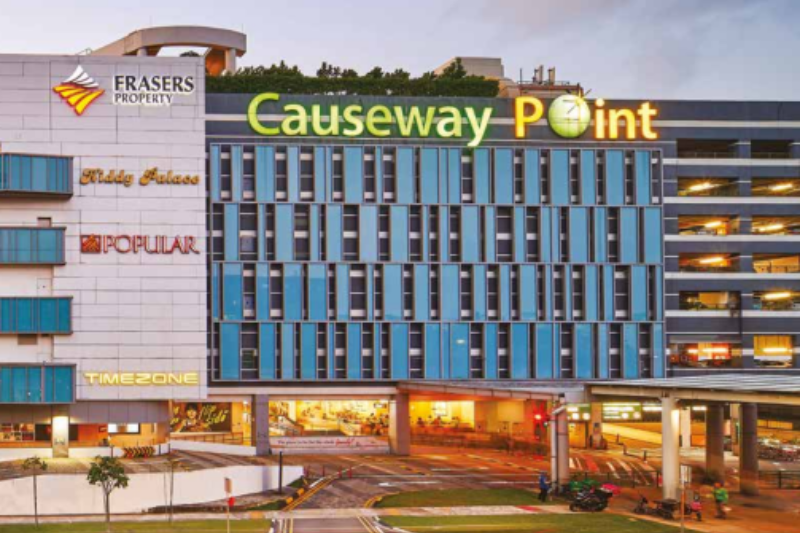

Frasers Centrepoint Trust (FCT) focuses on popular suburban malls in Singapore, such as Causeway Point, Northpoint City, and Tampines 1, that cater to people’s daily shopping needs. That is as defensive as it gets.

In FY2025, FCT had an impressive 98.1% occupancy rate across its retail portfolio, despite the departure of Cathay Cineplexes as a tenant from Causeway Point and Century Square.

Without Cathay Cineplexes, FCT’s overall occupancy would have been nearly perfect at 99.9%.

The financials are strong. Gross revenue in FY2025 rose 10.8% year-on-year (YoY) to S$389.6 million. Net property income increased 9.7% to S$278.0 million.

In May 2025, FCT completed its S$1.17 billion purchase of Northpoint City South Wing, giving it full ownership of the entire Northpoint City development. Additionally, FCT sold Yishun 10 Retail Podium for S$34.5 million.

FCT declared a DPU of S$0.12113 cents for FY2025, up 0.6% from the previous year’s S$0.12042.

At a current price of about S$2.28 per unit, that represents a yield of 5.3%.

The trust maintained its overall leverage at 39.6% and reduced its average borrowing cost from 4.1% in FY2024 to 3.8%.

Rental reversions rose a robust 7.8%.

Shopper traffic increased by 1.6% YoY, while tenants’ sales climbed 3.7% within the same period.

Tampines 1’s asset enhancement was completed over a year ago, while Hougang Mall’s renovation is ongoing and expected to finish in September 2026. These projects are set to further boost the portfolio’s performance.

FCT provides investors with stable income and a defensive option in Singapore’s suburban retail market, supported by high occupancy, prudent capital management, and daily shopping by consumers.

Singapore Exchange — The Defensive Market Backbone

SGX stands alone as Singapore’s only securities and derivatives exchange, giving it a firm lock on the market.

In FY2025, it earned 30.3% of its revenue from equities trading, 26.6% from derivatives, 24.8% from fixed income, currencies, and commodities, and the rest from market data and connectivity services.

Since FY2021, SGX has never missed a dividend.

For FY2025, it paid a dividend of S$0.375 per share, up from S$0.345 the year before. The company has plans to raise its payout by S$0.25 per share each quarter from FY2026 to FY2028.

At a share price of around S$16.82, that works out to a trailing yield of around 2.2%.

SGX’s trading volumes have risen due to rate volatility, and their reliable fees and clearing services allow them to weather market fluctuations. The company is also expanding into sustainability-linked products, ETFs, and increasing its presence in global FX and derivatives trading

ST Engineering — A Pillar of Stability and Innovation

For newcomers seeking a stable income source, SGX remains notable for its stability and consistent dividends.

ST Engineering stands out for being reliable while still offering room to grow.

With three main divisions – Aerospace, Defense and Public Safety, and Urban Solutions and Satcom – the company has exposure spanning security and transport to smart-city technology.

In H1 2025, ST Engineering pulled in S$5.92 billion in revenue, up 7% YoY, driven by growth across all its three business segments.

Net profit was better, climbing 20% to S$403 million from S$337 million a year ago.

ST Engineering’s massive S$31.2 billion order book as of 30 June 2025 looks set to lock in revenue for the next few years.

Moreover, ST Engineering intends to cut S$1 billion in costs by 2029, which would help boost earnings and thus its dividend.

The company just declared a dividend of S$0.08 per share for H1 2025, unchanged from a year ago.

This means the company’s total dividend for 2025 is likely to reach S$0.17 per share, matching last year’s amount.

With its current share price (as of 7 November 2025) at S$8.29, the dividend yield comes in at around 2.1%.

SATS — Feeding Global Travel Growth

SATS leads the way in Singapore’s aviation catering and ground handling scene. With the recent acquisition of Worldwide Flight Services (WFS), the company’s operations now span 27 countries, up from 13 prior.

In FY2025, SATS posted impressive numbers: Revenue jumped 13% year-on-year, hitting S$5.82 billion. Flights handled climbed 5.8%, cargo volume moved up 15.1%, and meal volumes produced grew 11.6%.

EBITDA came in at S$1.036 billion, rising 32.7% from S$780.6 million.

Operating profit almost doubled, reaching S$475.7 million, thanks to strong travel demand and smooth integration of acquisitions.

Net profit was S$243.8 million, a massive leap from S$56.4 million last year, up 332.3%.

In just two years, SATS has pulled off S$103 million in EBITDA synergies, beating its own goals.

The company’s balance sheet looks better, too. Gross debt-to-equity dropped to 1.53x from 1.60x a year ago.

With this stronger performance, SATS brought its dividend to S$0.050 per share for the year, up from just S$0.015 previously.

With share prices at S$3.47 as of 7 November 2025, this translates to a yield of around 1.4%.

As SATS keeps unlocking savings and benefits from its bigger network, it stands out for investors hoping to ride the ongoing recovery in global aviation.

Why These Five Work Well Together

Combined, these stocks create a varied initial portfolio.

CICT and FCT offer reliable dividends from real estate.

SGX and ST Engineering provide stable growth and resilient profits.

SATS offers cyclical growth from its travel-oriented business.

A balanced allocation of S$2,000 to each provides exposure across finance, infrastructure, property, and transport, which are all sectors crucial to Singapore’s economy.

This mixture may offer a total yield of about 3.2%, striking a balance between stability and growth opportunities.

Get Smart: Build Early, Stay the Course

When you own solid blue-chip stocks like CICT, FCT, SGX, ST Engineering, and SATS, you set yourself up for steady growth and regular income.

It’s not just about picking the right names, either. Small, consistent moves, like reinvesting your dividends and holding on to high-quality stocks really add up over time.

That’s how compounding works. It’s simple, but incredibly effective.

Some companies cut dividends in a downturn. These 5 didn’t.

Find out which Singapore blue chips have weathered past chaos…and why they could be your portfolio’s anchors in the next wave of downturn. Download the report free.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Joseph does not own shares of the companies mentioned in this article.