As the saying goes, “time in the market beats timing the market”.

But should you simply buy any stock just to be in the market? Of course not.

The next decade of growth will be driven by themes including digital innovation, e-commerce expansion, and semiconductor dominance.

But not all companies will prevail.

Only a handful do – those whose business models are built for the long haul, not just riding the hype.

Here are three global growth powerhouses — Shopify (NASDAQ: SHOP), MercadoLibre (NASDAQ: MELI), and Taiwan Semiconductor Manufacturing Company (NYSE: TSM), or TSMC — that could compound investors’ returns for years to come.

Shopify: Integrated Commerce Stack

A leading global e-commerce platform that also provides point-of-sale systems for in-store retailers, Shopify is used by millions of merchants in around 175 countries.

Shopify’s front- and back-end infrastructure integrates seamlessly and spans payment processing (Shopify Payments) to logistics (Shopify Fulfilment Network).

As larger clients integrate Shopify’s e-commerce features across many functional layers, the cost of switching to alternatives is both costly and unlikely.

An important trend in the world of e-commerce could be agentic commerce, where AI agents facilitate transactions on behalf of consumers.

Shopify enables its clients to tap on the trend with a great example being the company’s recent commerce-partnership with OpenAI’s ChatGPT.

Beyond agentic commerce, Shopify also offers a diverse range of AI-powered features for clients, such as AI-driven personalisation, prediction and security.

It’s worth noting that Shopify remains a pure play on e-commerce, unlike diversified conglomerates such as Amazon.

Looking at Shopify’s key performance and financial indicators for the second quarter of 2025 (2Q 2025):

- Both revenue and gross merchandise volume (GMV) grew by 31% year-on-year (YoY) respectively

- Monthly recurring revenue (MRR) grew by 9% YoY, indicating an expanding merchant subscription base

- There were material improvements in net income, with these gains translating into stronger operating cash flow.

MercadoLibre: Latin America’s answer to Amazon and PayPal

MercadoLibre dominates e-commerce and fintech in Latin America, with a business often likened to a marriage between Amazon and PayPal.

According to DBS, it enjoys an estimated market share of 27% in Brazil, 68% in Argentina and 14% in Mexico.

Financially:

- Net revenues and financial income reached US$7.4 billion in 3Q 2025, up 39% YoY on a reported basis, and up 49% on a currency-neutral basis

- Net income was US$421 million, implying a net margin of 5.7%, down from 7.5% a year ago driven by currency impacts and higher taxes.

Looking at some key performance indicators for 3Q 2025:

- Unique active buyers for its e-commerce platform reached 76.8 million, 26% higher from a year ago, while GMV (gross merchandise volume) and items sold both grew impressively by 35% and 39%, respectively

- Mercado Pago, the company’s fintech arm, saw Monthly Active Users (MAU) increase 29% YoY to 72.2 million, as its strong value propositions attracted more users

- Mercado Envios, the company’s logistics arm, reported 172.9 million same & next day shipments, up 28% YoY

With its exposure to both e-commerce and fintech, MercadoLibre is positioned to ride Latin America’s rapid digitalisation wave for years.

TSMC: Crushing Guidance, Shrinking Chips

As the race for AI dominance goes into overdrive, TSMC has been a winner even when it isn’t building AI models. Instead, the company arms model builders with the necessary tool: The world’s most advanced semiconductor chips.

TSMC crushed expectations in its latest earnings for 3Q 2025:

- Net revenue rose 40.8% YoY to US$33.1 billion, topping its own guidance of US$31.8 billion to US$33.0 billion.

- Gross margin reached 59.5%, beating guidance of between 55.5% to 57.5%

- Net profit margin expanded to 45.7%, up 2.9 percentage points YoY.

TSMC’s earnings are expected to get even better, as management had guided 4Q 2025 revenue to be “between US$32.2 billion and US$33.4 billion” and gross profit margin to be “between 59% and 61%.”

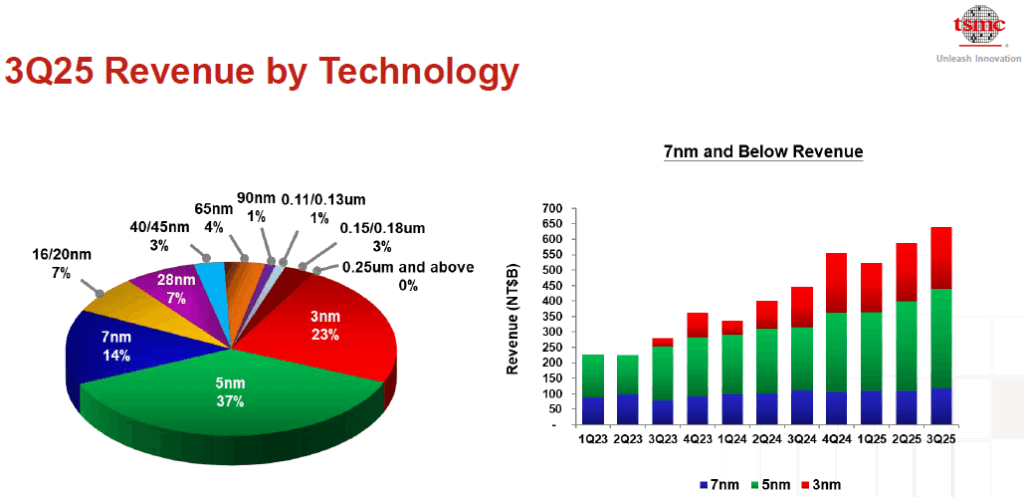

TSMC’s leading-edge nodes of 7nm (7 nanometers) and below contributed nearly three-quarters of its revenue in 3Q 2025:

But TSMC isn’t stopping at 3nm.

Its latest 2nm process technology is already projected for volume production later this year. When it comes to chips, the smaller the process technology, the more advanced the chip.

TSMC, which traditionally had Taiwan as its manufacturing base, is bringing manufacturing closer to its clients, particularly in the US, Japan and Germany.

Doing so enhances the supply chain resilience of its clients.

With a stranglehold on the world’s most advanced semiconductor technologies, TSMC could be a standout winner in the AI-driven chip boom.

Why These 3 Stocks Stand Out

What do these three have in common?

They are leaders in secular growth markets such as e-commerce, fintech, and semiconductors.

What This Means for Investors

Investments in Shopify, MercadoLibre, and TSMC since 2016, even though there were volatile episodes, have resulted in impressive compounded total returns ranging from around 1,000% to 4,700%.

The best may yet to be.

These companies have proven track records and structural tailwinds that could drive decade-long outperformance.

Get Smart: Buy Great, Hold Long

Research has shown that dead investors who buy and hold great companies have the best returns in the market.

If dead investors can do it, so can anyone.

Right now, Shopify, MercadoLibre, and TSMC are some of the strongest companies shaping the digital and technological world over the next decade.

Buy durable growth – and let time, not timing, do the work.

What are the stock secrets to Singapore’s “quiet millionaires?” Chances are, you’ll find at least one of their favourites in this free report. Download it now and see how these stocks could power your portfolio!

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Larry does not own shares in any of the companies mentioned.