When economic uncertainty forces most companies to retreat, those with fortress balance sheets go on the offensive.

A downturn isn’t a crisis for them—it’s an opportunity.

With a cash-rich and low-debt financial profile, these companies have the resources to reward shareholders immensely as they continue to execute on their innovation and growth, while others are holding back amid market headwinds.

Need some examples?

Let’s turn the spotlight to four US blue-chip powerhouses.

Alphabet (NASDAQ: GOOGL): The technology and advertising giant

Alphabet is the parent company to Google, which needs no introduction.

The search giant commands close to 90% of the global search engine market, according to Statcounter.

This dominance translates into serious revenue: in 2025’s second quarter (2Q2025), Google Search alone brought in US$54.2 billion—more than half of Alphabet’s total revenue of US$96.4 billion.

Here’s the thing: this cash machine gives Alphabet an enviable financial position.

As of 30 June 2025, the Mountain View company sits on US$95.1 billion in cash and marketable securities.

Against long-term debt of just US$23.6 billion, that’s a net cash position exceeding US$71 billion.

This fortress balance sheet allows Alphabet to invest massively in AI infrastructure without worrying about quarterly profits. Better AI enhances search quality, which attracts more users and advertisers, generating more cash for further investments—a powerful virtuous cycle.

Of course, no business is without risks.

Regulatory scrutiny remains Alphabet’s primary concern, particularly around antitrust issues in its core search business.

However, the company’s deep pockets mean it can comfortably absorb regulatory expenses without material long-term damage.

Without a doubt, Alphabet’s financial strength positions it well to navigate both the AI revolution and regulatory challenges ahead.

Berkshire Hathaway (NYSE: BRK.B): The conglomerate led by the iconic Warren Buffett

Still guided by Warren Buffett’s steady hand, Berkshire Hathaway operates across a broad mix of industries from insurance to railroads to energy. While Insurance remains the primary revenue engine, other segments contribute reliable and steady cash flow.

Berkshire is known for its huge financial firepower. The company holds over US$339.8 billion in cash and T-bills, comfortably outweighing its US$127 billion in debt, representing a robust net cash position.

Moreover, its equity portfolio is massive. Valued at more than US$267 billion with unrealized gains exceeding US$188 billion, these investments continue to deliver material returns.

The strength of its balance sheet gives Berkshire an edge during market dislocations. When others are forced to step down and retreat, Berkshire steps up in acquiring undervalued assets, benefiting from its mispricing.

That said, some risks exist.

The inevitable leadership transition from Buffett to Greg Abel introduces some uncertainties. Also, given Berkshire’s sheer size, it’s harder to find outsized returns that smaller investors can chase.

Still, Berkshire’s disciplined approach to financial management, characterized by low leverage, high liquidity, and a long-term mindset, upholds its reputation as one of the most resilient businesses in the world.

Intuitive Surgical (NASDAQ: ISRG): The Pioneer in Robotic-Assisted Surgery

Intuitive Surgical is best known for its market-leading Da Vinci robotic-assisted surgery system.

Commanding nearly 60% of the global market share, it’s a clear leader in robotic surgery.

Intuitive’s revenue generation doesn’t stop at the initial, one-time sale of its Da Vinci systems.

To keep these systems operational, customers need to make regular purchases of its peripheral equipment. Together with service contracts, Intuitive derives recurring revenue with minimal additional costs.

Overall, it operates a high-margin, sticky business.

Its sustainability can be distilled into two structural advantages:

- High switching costs due to its premium pricing and the sheer level of inconvenience required to switch to an alternative system.

- High barriers to entry, due to the massive investments required to build viable alternatives by new entrants.

Intuitive is debt-free and holds US$9.5 billion in cash and investments on its balance sheet, making it financially pristine, unlike its capital-intensive peers.

Despite its advantages, no business is bulletproof. While disruption seems unlikely right now, it remains a possibility. That’s a risk to keep an eye on.

Still, with its fortress balance sheet, wide moat, and tailwind of a growing market, Intuitive’s growth is likely just getting started.

Meta Platforms (NASDAQ: META): The King of Social Media

Meta Platforms is the king of social media for good reasons.

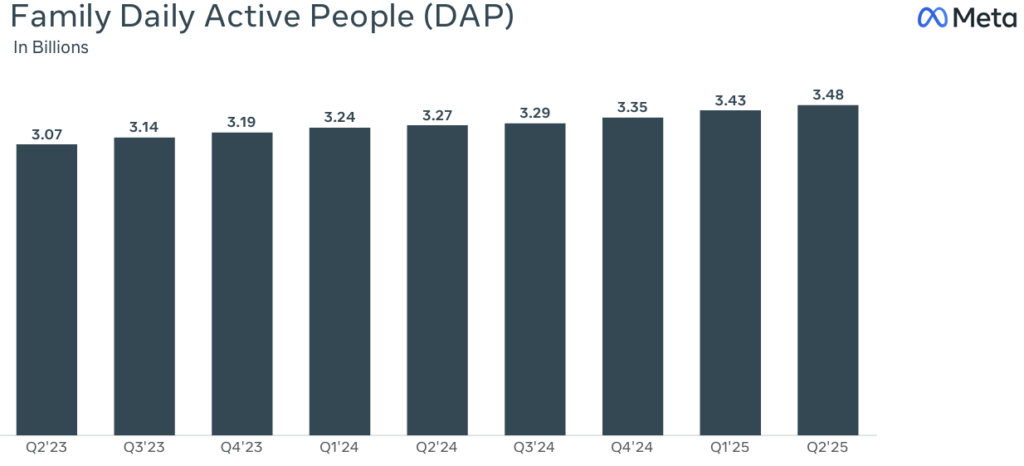

Its “Family of Apps”, which includes Facebook, Instagram, and WhatsApp, has consistently experienced growth in engagement every single quarter since 2Q2023.

Its Daily Active People (DAP) reached a peak of 3.48 billion in 2Q2025, powering its high-margin, digital advertising revenue.

This cash cow supports a war chest of nearly US$47.1 billion in cash and marketable securities. While it holds long-term debt under US$29 billion, it’s mostly investment-grade.

This gives it serious firepower to invest heavily in AI infrastructure and expand its data centre build-out without straining its balance sheet.

However, while Meta’s moonshot projects are ambitious, they are still in their early stages with unclear monetisation prospects. These are risks that investors aren’t blind to.

Regulatory heat and the competitive pressures from TikTok also pose challenges.

However, Meta’s financial strength allows it to absorb these costs and pivot effectively if necessary.

Overall, Meta’s strategic market dominance and superior financial firepower give it the resources not only to defend but also to deepen its competitive edge.

Get Smart: Fortress Balance Sheets, Relentless Growth

Despite operating in different industries, these companies demonstrate fortress balance sheets, enabling them to invest massively in growth to secure long-term sustainability.

In a nutshell:

- Alphabet & Meta are Tech giants that use their immense cash flow from advertising to fuel aggressive AI and cloud infrastructure expansion.

- Berkshire Hathaway epitomizes a classic value investment approach, leveraging market turmoil to acquire undervalued assets.

- Intuitive Surgical is a debt-free, leading innovator in robotic surgery. Its prevailing leadership is shielded by its high switching costs and barriers to entry.

These companies derived immense financial firepower through clear strategic advantages, offering investors asymmetric upside amid an increasingly volatile market.

Generative AI is reshaping the stock market, but not in the way most investors think. It’s not just about which companies are using AI. It’s about how they’re using it to unlock new revenue, dominate their markets, and quietly reshape the business world. Our latest FREE report “How GenAI is Reshaping the Stock Market” breaks the hype down, so you can invest with greater clarity and confidence. Click here to download your copy today.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Larry owns shares of Alphabet, and Meta Platforms.