Alibaba’s (NYSE: BABA; HKEX: 9988) stock has staged an impressive rebound, climbing sharply after its latest earnings call. The numbers themselves were hardly eye-catching, but investors focused on something different.

Management stressed a new story built around cloud computing, artificial intelligence, and overseas growth.

That shift in focus gave the market a reason to take a fresh look at the company, even as challenges in its core e-commerce business remain.

Earnings Breakdown

Alibaba’s first quarter of the fiscal year ending 31 March 2026 (Q1 FY2026) results came in mixed.

Revenue was RMB 247.7 billion (US$34.6 billion), up only about 2% higher year on year.

If you take out businesses that were sold, growth looks a lot better at roughly 10% year on year, showing the core operations are still moving in the right direction.

Operating income eased to RMB 35.0 billion, and adjusted EBITA slipped 14% year on year as the company kept spending heavily on Taobao Instant Commerce and technology upgrades.

Net income jumped 76% year on year to RMB 42.4 billion, helped by gains on investments and the sale of Trendyol.

Strip those out and the picture is softer, with non-GAAP net profit down 18% to RMB 33.5 billion compared to RMB40,691 million in the same quarter of 2024.

Earnings per ADS came in at RMB 17.98.

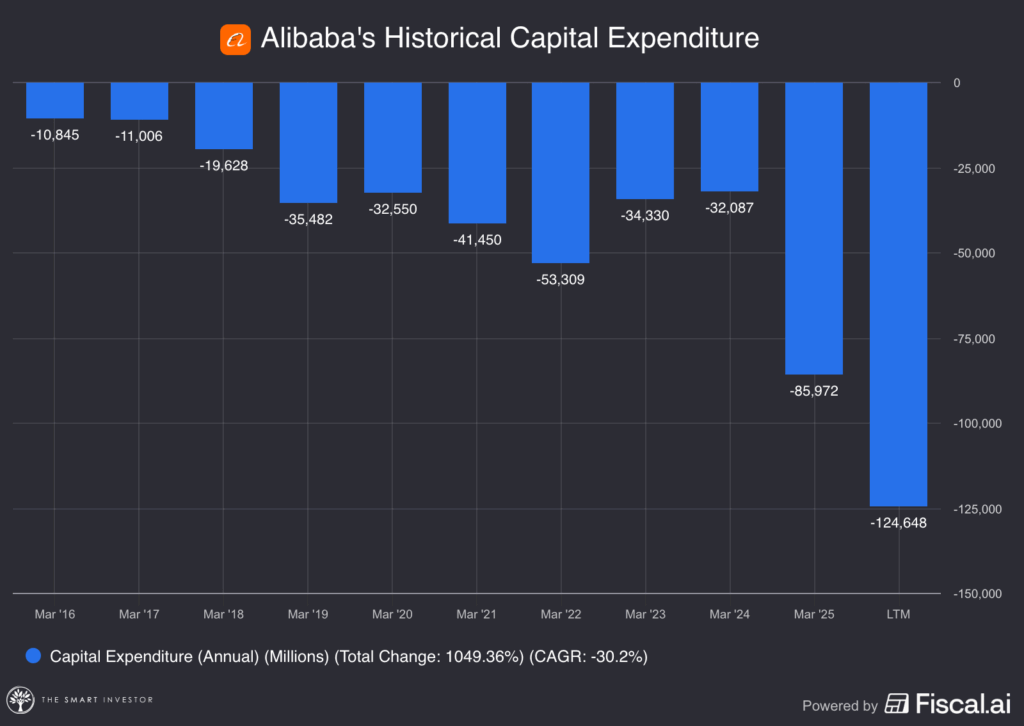

Cash flow was where the strain really showed.

Operating cash flow slipped to RMB 20.7 billion, down about 39% in the same quarter in the previous year, and free cash flow turned negative at RMB 18 billion after being comfortably positive a year earlier.

The swing wasn’t a surprise given how much Alibaba is plowing into cloud infrastructure and other new projects, but it does underline how expensive this expansion has become.

Even so, the company still ended the quarter with a hefty RMB 585.7 billion (US$81.8 billion) in cash and investments, enough of a cushion to keep funding growth without running into trouble.

Growth Engines Driving the Rally

At a glance, the earnings were far from impressive.

What really lifted Alibaba’s stock was not the revenue or profit headlines.

The excitement came from the way management talked about where growth will come from next.

Much of the call focused on cloud computing and artificial intelligence, a signal that Alibaba is slowly reshaping its story from a pure e-commerce giant into something broader.

The cloud division, often viewed as sluggish in the past, finally showed momentum with growth of about 26% year on year.

That stood out because it broke a stretch of disappointing results.

Even more impressive, sales tied to AI products rose at triple-digit rates for eight consecutive quarter in a row.

For investors, this was proof that Alibaba is not just experimenting with AI.

It is starting to turn those efforts into revenue.

The company also introduced Qwen3-Max, a large language model with over a trillion parameters.

Parameters are the values a model learns during training that guide how it processes language.

The more parameters there are, the more detail the model can capture, which usually means it can understand context better, generate more accurate responses, and handle a wider range of complex tasks.

Moreover, they pointed to a new partnership with Nvidia (NASDAQ: NVDA) aimed at building out practical AI tools.

To back this up, Alibaba revealed plans for new data centers in Europe and Latin America, showing that it wants its cloud business to have a global footprint.

For many investors, this marked an important shift in perception.

Worries about regulatory crackdowns and a soft domestic consumer base gave way to optimism about new growth pillars.

The call made Alibaba sound less like a company stuck in the past and more like a contender in the race to build the next generation of cloud and AI platforms.

Beyond Earnings and AI: The Food-Delivery Price War

Another factor to watch is the price war in food delivery and instant commerce.

Platforms like Alibaba’s Ele.me and rival Meituan (HKEX: 3690) have been burning cash on subsidies and free deliveries to win share.

This drives volume but hurts margins, adding strain to Alibaba’s broader e-commerce business.

The government has now stepped in.

Regulators summoned Alibaba, Meituan, and JD.com (NASDAQ: JD; HKEX: 9618), warning them against “irrational” price cuts and drafting new rules to curb subsidies and improve fee transparency.

The message is clear: Beijing wants to end the destructive race to the bottom.

For Alibaba, that could be a relief.

If subsidies cool, margin pressure eases and management can focus more on strengthening Taobao and Tmall.

A fairer playing field would give its core e-commerce business a better chance to recover, instead of being dragged down by costly battles in food delivery.

Get Smart: Alibaba’s stock bounced not on the numbers, but on the narrative

Alibaba’s quarter wasn’t spectacular, but the story around it was.

By stressing cloud, AI, and overseas growth, management gave investors a reason to look past soft revenue and cash flow.

At the same time, Beijing’s warning on the food-delivery price war may bring some relief to margins, giving Taobao and Tmall more room to improve.

With plenty of cash on hand, Alibaba can keep funding new bets while steadying its core business, a mix that explains why the stock has bounced back.

Big Tech is spending hundreds of billions on AI, and the ripple effects are just beginning. Our new investor guide shows how AI is changing the way companies generate revenue, structure their business models, and gain an edge. Even if you already know the major players, this report reveals something far MORE important: The why and how behind their moves, and what it means for your portfolio. Download your free report now.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclaimer: Evan owns shares of Alibaba.