When it rains, it pours.

Just when Optus thought it couldn’t get any worse, it did.

Over the weekend, Australia’s second-largest telco suffered yet another outage affecting a mobile phone tower site in New South Wales (NSW).

Optus said this latest incident is unrelated to the previous emergency call failure on 18 September 2025.

But the timing couldn’t be more damaging.

The latest outage affected a single cell site out of over 3,000 in NSW, affecting one person requiring emergency services — thankfully, they managed to call using a different phone.

By comparison, the 18 September 2025 incident was devastating, preventing 600 people across South Australia, Western Australia, and the Northern Territory from reaching emergency services for at least 10 hours, tragically resulting in three deaths.

The weekend disruption occurred just as Singapore Telecommunications (SGX: Z74) Group CEO Yuen Kuan Moon landed in Sydney for crisis talks with Communications Minister Anika Wells, accompanied by Optus CEO Stephen Rue and Singtel Chairman John Arthur.

What’s At Stake: Half of Singtel’s Revenue

For Singtel shareholders, these mounting incidents represent more than just headlines – they threaten a business segment that drives half the Singapore telco’s revenue.

The reputational damage is adding up, coming on the heels of a A$100 million penalty Optus accepted in mid-September for inappropriate sales practices between 2019 and 2023.

For the management’s part, Yuen struck an apologetic tone, stating the group was deeply sorry about the network incidents and committed to supporting Optus’s transformation.

He emphasised Singtel’s substantial backing, having invested over A$9.3 billion in Optus over the past five years, with much of that directed toward network infrastructure.

The company has moved swiftly to demonstrate accountability.

Optus chairman John Arthur announced the appointment of Dr Kerry Schott AO to lead an independent review of the triple-zero (Australia’s emergency number) failure, with findings expected before year-end and a commitment to make the report public.

Stephen Rue, who took the Optus helm just 11 months ago to spearhead its turnaround, faces the unenviable task of rebuilding trust while managing operational crises.

The new management team he assembled confronts not just transformation challenges but immediate regulatory scrutiny and potential financial penalties that could dwarf the recent A$100 million fine.

For dividend-focused investors, the critical question becomes whether these Australian headwinds will force Singtel to redirect capital from shareholder returns to crisis management and infrastructure upgrades.

The Optus Factor in Singtel’s Empire

Optus remains indispensable to Singtel’s financial overall make-up.

The Australian subsidiary generated A$8.2 billion in revenue for the fiscal year ended 31 March 2025 (FY2025), accounting for roughly half of the group’s total revenue.

It’s too big to fail, and too troubled to ignore.

Here’s the rub: Optus has been delivering better financial results amid its reputational crisis.

The subsidiary’s operating profit surged 55% year on year to A$446 million in FY2025, capping a remarkable turnaround in fortunes after years of revenue declines.

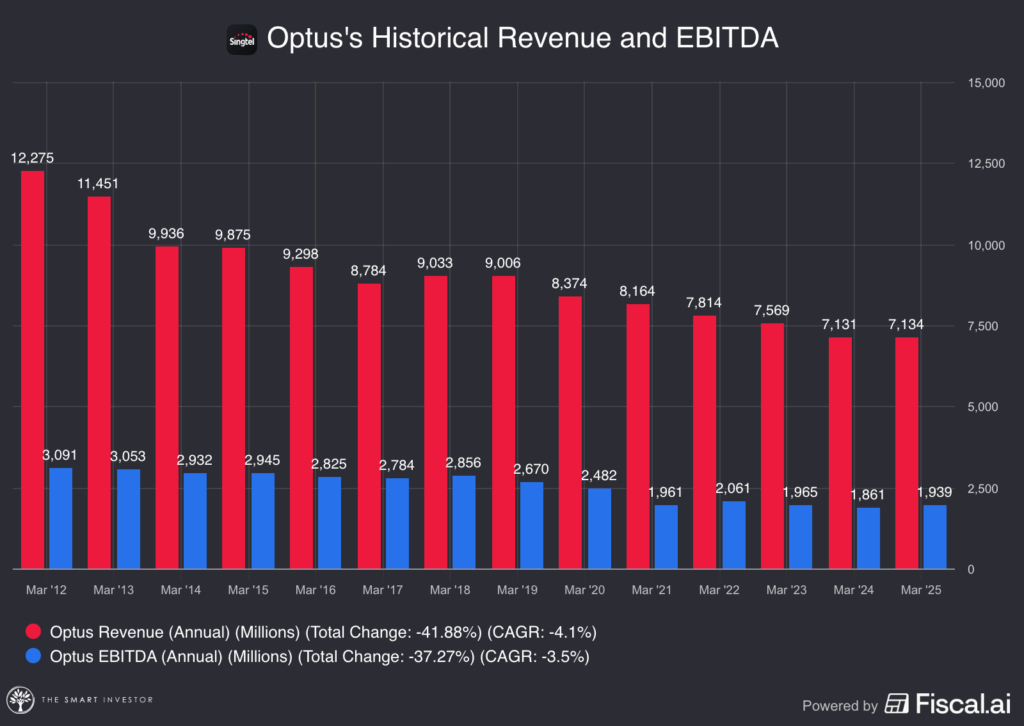

The graph below shows Optus’s revenue in Singapore dollars.

This momentum continued into the first quarter of FY2026, with earnings before interest and taxes (EBIT) jumping 36% on the back of successful mobile price increases implemented in June 2025.

The financial turnaround suggests that beneath the operational mishaps lies a business that is finding its footing.

Get Smart: Walking the Tightrope

When deaths are involved, no monetary value can compensate for the loss of life.

For Singtel shareholders, Singtel faces a delicate balancing act — supporting Optus through its crisis while maintaining shareholder returns.

The group has previously committed to pay out between 70% and 90% of its underlying net profits, and a value realisation dividend of between S$0.03 and S$0.06 per share annually in the medium term.

This commitment sits alongside a S$2 billion share buyback programme funded by capital recycling initiatives, which includes asset sales.

These shareholder-friendly moves signal confidence, but they also raise questions about capital allocation priorities given Optus’s infrastructure needs.

Investors will be watching closely on whether regulatory penalties and mandatory infrastructure investments will materially impact Singtel’s ability to maintain its dividend payouts.

For instance, the Australian government’s response to the independent review, due before year-end, could mandate costly network resilience requirements that dwarf current investment plans.

The telco’s ability to navigate this challenge will determine whether its Australian adventure is still alive or turn into a cautionary tale about the risks of offshore expansion.

Don’t let market uncertainty hijack your financial dreams. While headlines scream gloom, 5 Singapore companies have been quietly building wealth and paying reliable dividends. You’re probably overlooking them. Discover these resilient giants and their secrets to sustained income, even through global storms. Click here to download your free report now and secure your financial future!

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Chin Hui Leong does not own any of the shares mentioned.