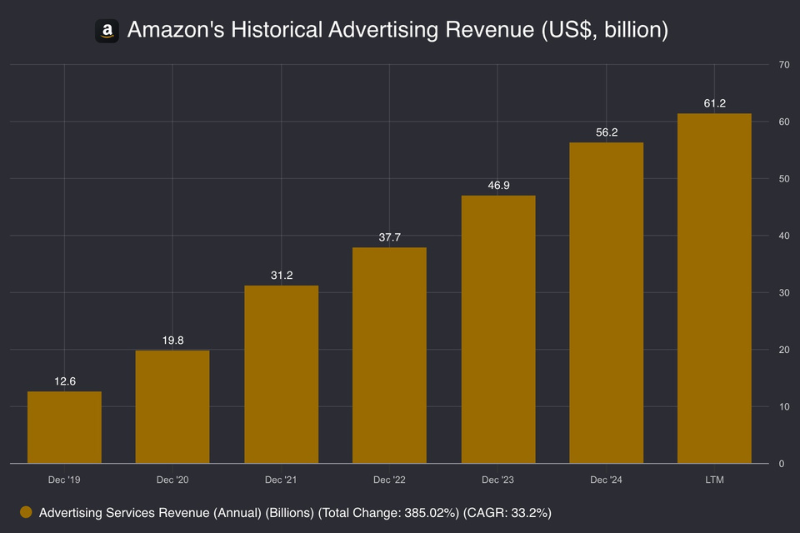

Amazon pulled in over US$61 billion in revenue from ads in the last 12 months, which is absurd when you think about it.

Most people expect numbers like that from Alphabet (NASDAQ: GOOGL) or Meta Platforms (NASDAQ: META), not from a shopping site.

The thing is, Amazon’s ads don’t look like the usual banners or pop-ups.

They’re tucked into the search results, sitting there like normal product listings.

People click without thinking twice, and that quiet trick has made Amazon a giant in digital ads.

With more of our spending moving online, this business is quickly changing how brands reach us and shifting who holds the power in advertising.

The Hidden Giant

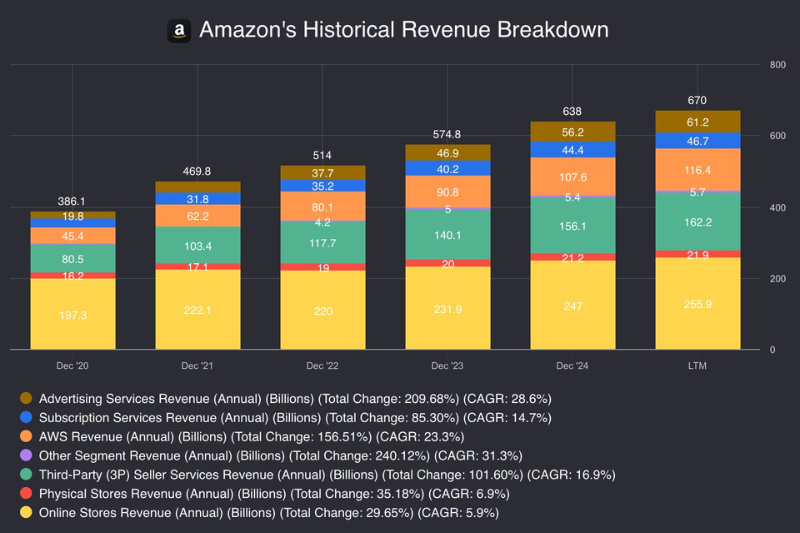

Most people think of Amazon as the place you buy everything from kitchenware to cloud servers, but its ad business is the segment that is growing the fastest.

In fact, Amazon’s advertising arm has become a multibillion-dollar engine, pulling in over US$56 billion in 2024, up nearly 20% compared to the previous year.

You can expect such growth from a smaller revenue base but we’re talking about a multi-billion dollar business here.

That pace of growth puts it ahead of many of its core retail segments, making ads one of the quiet but most powerful drivers of Amazon’s future, growing at a tremendously fast pace despite its scale.

The real advantage of Amazon Ads is timing.

People aren’t just scrolling, instead they are shopping.

That intent makes the online retailer’s ads more powerful than a random search or a social media post.

On top of that, Amazon knows what you’ve searched, what you’ve clicked, and what you’ve bought.

With that kind of data, plus total control over how and where ads show up, Amazon gives brands an end-to-end ecosystem where ads feel natural and tend to convert.

Crucially, budgets are shifting.

More brands are taking money away from search and social and putting it into retail media, with Amazon grabbing the biggest share.

Advertisers like the higher ROI, because these ads reach people who are already ready to buy.

While Google and Meta still lead overall, Amazon’s growth in ad revenue has been quicker in key areas, proving the online retailer is a force to be reckoned with.

Amazon isn’t the only one playing this game.

Walmart (NYSE: WMT), Target (NYSE: TGT), and other retailers are building their own ad networks.

That’s forcing brands and agencies to rethink how they spend.

The rise of retail media means marketers can’t just rely on Google search or Instagram ads, they have to show up at the digital checkout line.

Of course, Amazon has hurdles.

Google, Meta, TikTok, and a wave of smaller retail networks are all competing for ad dollars.

Regulators are also picking up on this, with concerns about antitrust and data privacy.

Any of these pressures could slow down Amazon Ads or force changes in how the business runs.

Amazon has plenty of room to grow.

Prime Video and Twitch provide video ad space — where the most ad dollars reside — while AI promises smarter targeting and more personalised campaigns.

Done right, these moves could make Amazon an even bigger player in the digital ad world.

Get Smart: Not a Side Hustle

Bottom line, Amazon’s ad business is no longer a side hustle.

It’s one of the company’s main profit engines.

In the fight for ad dollars, Amazon isn’t just competing with Google and Meta, it’s carving out its own rules of digital advertising.

Generative AI is reshaping the stock market, but not in the way most investors think. It’s not just about which companies are using AI. It’s about how they’re using it to unlock new revenue, dominate their markets, and quietly reshape the business world. Our latest FREE report “How GenAI is Reshaping the Stock Market” breaks the hype down, so you can invest with greater clarity and confidence. Click here to download your copy today.Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Evan owns Amazon shares.