Like most investors starting out, I thought investing was about waiting for the perfect time to buy a popular stock and then taking profits before the share price heads south.

I was unaware that I was treating investing like gambling and did not have any plan.

It didn’t take long for my pocket to suffer the consequences.

That was the moment I realised that the most powerful tool for successful investment wasn’t timing the market, it was the time in the market.

Timing the market sounds good in theory.

After all, who wouldn’t want to know the exact moment to enter the market, followed by the “perfect” timing to exit the market.

But what sounds good in theory does not hold up in practice.

Take the S&P 500, a widely-recognised benchmark for the US stock market.

According to Hartford Funds, for the period 1995 to 2024, 50% of the index’s best days (measured by percentage gain) occurred during a bear market.

This statistic reveals a telling truth: if you attempt to avoid a bear market, you risk missing out on the days with the best gains.

Here’s the scary part: Missing the 10 best days over the past 30 years would have slashed your returns by more than half.

In contrast, holding stocks for the long run increases your chance of a positive return.

The statistics bear this out.

According to wealth manager Ben Carlson, if you held the S&P 500 for a day, the chances of you getting a positive return is 51%, akin to a coin flip (based on a study of the index from 1950 to July 2025).

Extend that to a year, and your odds increase to 74% — not too bad.

But hold the index for 10 years and your chance of coming out ahead shoots up to 93% — and to top it off, for every 20-year period during this time, the index investor has gotten positive returns 100% of the time.

The lesson here? Time in the market trumps timing the market.

Now, getting positive returns are a great start but do you know what is better?

In one word, compounding.

Power of Compound Interest

Albert Einstein once called compounding the “eighth wonder of the world”.

The principle of compound interest is simple: the returns you earn from your principal amount (that’s the initial amount you started with), and the returns accumulate over time, creating a snowball effect.

Hence, the earlier you start, the more time your funds will have to generate higher returns.

Even small amounts can become significant in the future.

For example, take exchange-traded funds (ETF) such as the Vanguard S&P 500 ETF (NYSEArca: VOO), which tracks the S&P 500.

VOO has delivered an annual return of around 13.6% over the past 10 years.

However, if you look further back at the S&P 500’s long-term performance between 1957 and 2025, the annual return averages closer to 10.6%.

But what does the return mean in dollars?

For the purpose of this calculation, we will use the conservative figure.

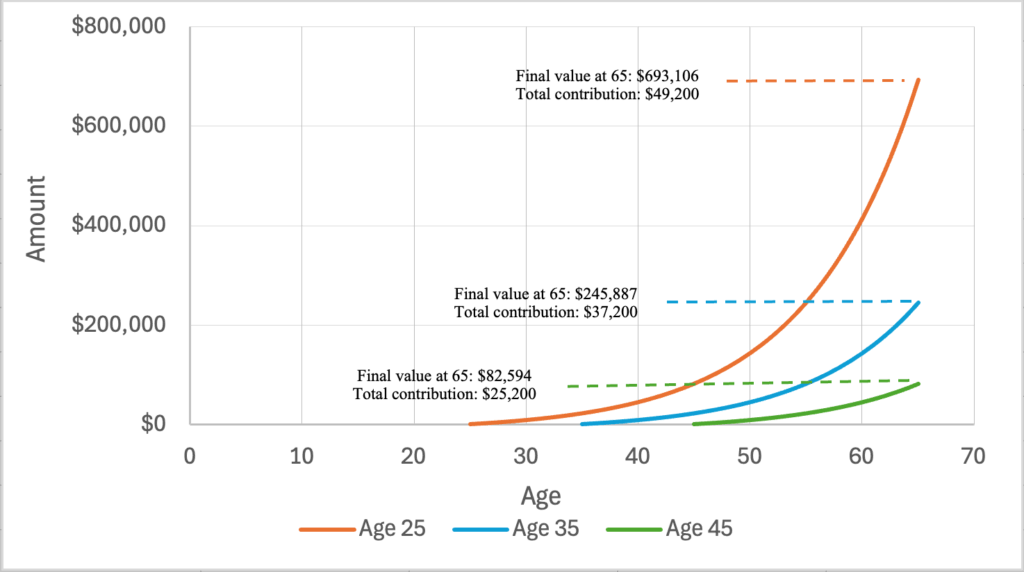

Assuming at 25 years old, you start making US$1,200 yearly contributions into VOO.

By the time you’re 65 years old, you would have contributed US$49,200.

Yet, your portfolio would’ve grown to an impressive US$693,106.

If you delay and start at 35, your portfolio will end up with roughly US$245,887.

Starting even later at 45 will leave you with just US$82,594 for retirement.

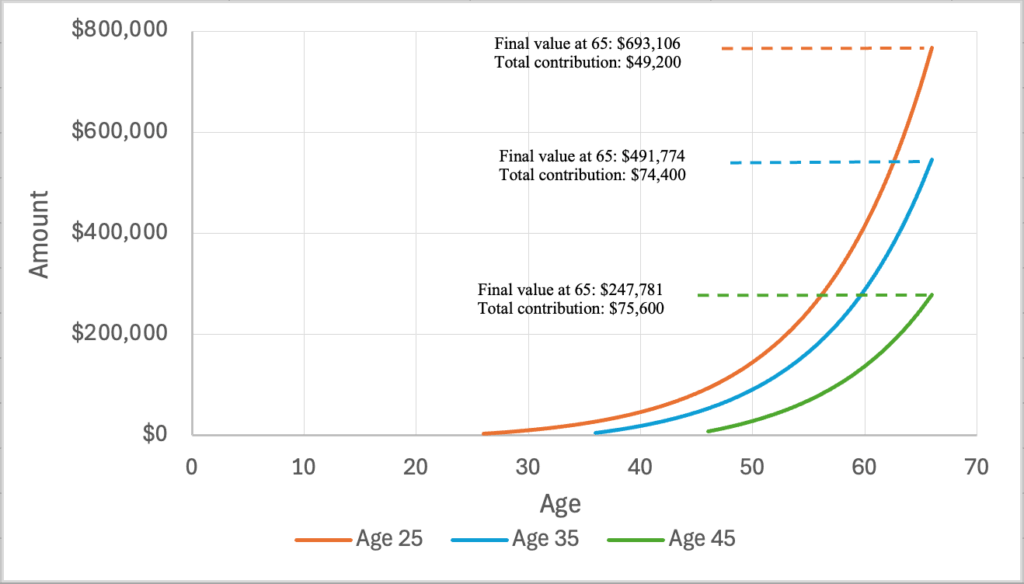

Now, you might think, why not just double my monthly contributions if I start later?

Smaller Contributions

Let’s compare:

- Starting at 25 with just US$1,200/year grows to about US$693,106 by age 65 with US$49,200 contributed.

- Starting at 35 with US$2,400/year grows to around US$491,774 with US$74,400 contributed.

- Starting at 45 with US$3,600/year only grows to US$247,781 with US$75,600 contributed.

As can be seen from this simple example, even doubling or tripling your contributions later in life cannot make up for lost time.

Risk Management

Here’s the rub: stock prices can be volatile.

They can move in either direction rapidly and unpredictably.

This is when time becomes your ally.

Having a longer time horizon increases the chance of a positive outcome.

However, if you are still fearful of market declines, consistency will be your best friend.

Committing to regular contributions of the same amount regardless of the market condition, you can take advantage of dollar-cost-averaging (DCA).

DCA means that you automatically buy more shares when the prices are low, and less when prices are high.

This helps to smoothen out volatility and reduces the emotional stress of trying to time the market.

Similar to exercising, you should not expect to see results immediately after one workout.

It all comes down to those small and consistent actions you take over time that create lasting results.

Get Smart: Time is Your Greatest Asset

You don’t need a large sum of money to start investing.

If you have a few dollars to spare, then don’t wait any further.

Investing isn’t about having a lot of money, it’s about making time your greatest asset.

Every month you delay is an opportunity lost.

Start taking those small consistent steps now and let time do the heavy lifting.

When the market is unpredictable, where can you park your money with confidence? Our latest FREE report reveals 5 Singapore dividend-payers built to withstand global storms. Get it now and see what’s still worth holding.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Charlyn owns shares of VOO.