Welcome to this week’s edition of top stock market highlights.

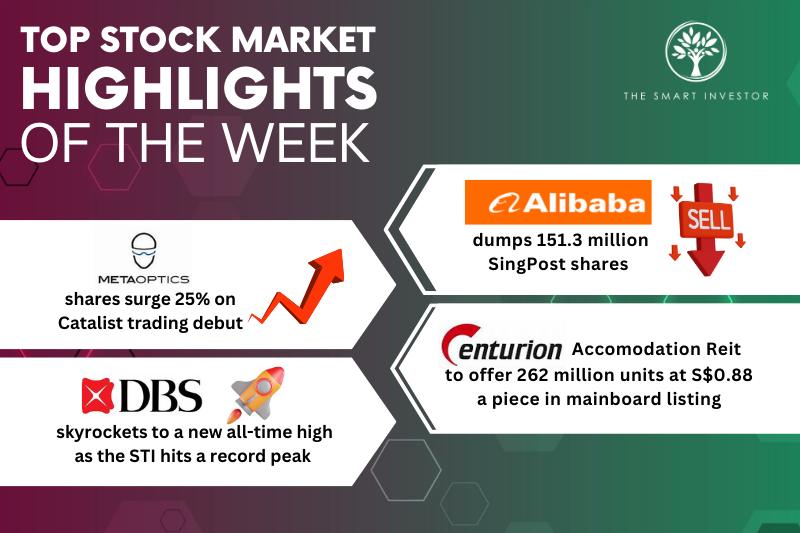

Singapore stocks delivered significant moves across multiple sectors this week, from Alibaba‘s (NYSE: BABA) strategic exit from SingPost (SGX: S08) to record-breaking performances by DBS Group (SGX: D05) and the Straits Times Index.

The Singapore Exchange (SGX: S68) also announced plans for a new index to track mid-cap stocks, while the Catalist board welcomed semiconductor optics firm MetaOptics (SGX: 9MT) with an impressive 25% IPO debut surge.

Alibaba Dumps 151.3 Million SingPost Shares, Slashing Stake Below 5%

Alibaba Group (NYSE: BABA) has significantly reduced its stake in Singapore Post Limited (SGX: S08) by offloading 151.3 million shares, bringing its ownership below 5%.

This substantial divestment marks a notable shift in the Chinese e-commerce giant’s investment strategy in Southeast Asia’s logistics sector and Singapore stocks.

The sale represents a strategic repositioning by Alibaba, which had been one of SingPost’s major shareholders since acquiring its stake as part of its regional expansion plans.

The move comes amid SingPost’s ongoing transformation efforts to strengthen its e-commerce logistics capabilities and expand its regional network presence across Southeast Asian markets.

For SingPost, this change in its shareholder base could signal a new chapter in its corporate development.

The Singapore postal and logistics company has been actively pursuing growth opportunities in the rapidly evolving e-commerce fulfillment space, particularly across Southeast Asia.

The exit of a major strategic shareholder like Alibaba may prompt questions about future partnerships and strategic direction, though it also potentially opens doors for new investors who share SingPost’s vision for regional logistics dominance.

MetaOptics Technologies Soars 25% in Catalist Board IPO Debut

Semiconductor optics company MetaOptics Technologies (SGX: 9MT) made an impressive entrance to the SGX’s Catalist board on 9 September 2025, with shares surging 25% above its initial public offering (IPO) price of S$0.20.

The stock opened at S$0.21 and climbed to S$0.25 during morning trading, before closing the day at S$0.24, making it one of the strongest Singapore IPO debuts this year.

The company’s S$6 million placement of 30 million shares was fully subscribed, attracting 209 placees and demonstrating solid investor appetite for technology stocks on the SGX.

MetaOptics, which specialises in developing single-layered glass lenses called “metalenses,” represents a unique addition to Singapore’s growing technology cluster and the Catalist board listings.

Chief Executive and Executive Chairman Mark Thng expressed confidence in the company’s capabilities, noting that MetaOptics is currently the only Singapore company developing metalenses technology.

The four-year-old firm plans to use the IPO proceeds primarily for product development and research, with 20-30% allocated for Asia-Pacific expansion.

Despite posting a net loss of S$2.3 million in 2024 on revenue of just S$79,440, Singapore stock investors appear optimistic about the company’s growth potential in the specialised semiconductor optics market.

With over 235 million outstanding shares, MetaOptics now commands a market capitalisation of approximately S$47.2 million. The listing adds to SGX’s technology cluster, which has a total market capitalisation of S$113 billion.

Centurion REIT Launches S$230 Million Mainboard Listing at S$0.88 Per Unit

Centurion Accommodation REIT is set to offer 262 million units at S$0.88 apiece in its upcoming mainboard listing, targeting to raise approximately S$230 million.

This significant capital-raising exercise marks another milestone for Singapore’s real estate investment trust (REIT) sector and the SGX mainboard.

The accommodation-focused Singapore REIT, which specialises in workers’ dormitories and student accommodation properties, is positioning itself to capitalise on the growing demand for purpose-built accommodation solutions across Singapore and the region.

The mainboard listing represents a step up from its current status and could provide the REIT with enhanced visibility among institutional investors and access to a broader investor base.

The pricing of S$0.88 per unit reflects the manager’s confidence in the underlying portfolio’s value and income-generating potential.

Given the essential nature of worker and student accommodation, particularly in land-scarce Singapore, Centurion REIT offers Singapore stock investors exposure to a defensive and resilient asset class with stable rental income streams.

The successful completion of this offering would provide Centurion (SGX: OU8) with substantial capital for potential acquisitions and asset enhancement initiatives, positioning it well to benefit from the ongoing recovery in foreign worker numbers and the return of international students to Singapore and the region.

DBS Bank Crosses S$53 as STI Index Hits Record 4,367 Points

DBS Group (SGX: D05) continued its remarkable rally, crossing the S$53 mark for the first time and propelling the Straits Times Index (STI) to a new record high of 4,367.51 points.

Singapore’s largest bank by market capitalisation has significantly outperformed its local peers Overseas-Chinese Banking Corporation (SGX: O39) and United Overseas Bank (SGX: U11), cementing its position as the market leader among Singapore blue-chip stocks.

The bank’s stellar performance reflects strong investor confidence in its digital transformation initiatives, robust asset quality, and disciplined capital management.

DBS’s consistent delivery of record profits, coupled with its generous dividend policy, has made it a favorite among both institutional and retail investors in Singapore stocks.

The STI’s push into uncharted territory underscores the broader strength of Singapore’s equity market, with blue-chip stocks benefiting from the city-state’s economic resilience and its position as a regional financial hub.

Year-to-date, the STI index has delivered impressive returns, outperforming many regional benchmarks and attracting global investors to SGX stocks.

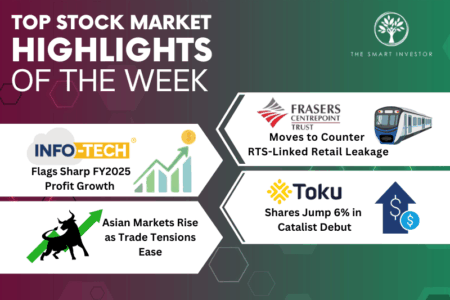

SGX to Launch New Mid-Cap Index Beyond STI’s 30 Components

In a significant development for Singapore’s capital markets, Minister Chee Hong Tat announced that the SGX will launch a new index tracking companies beyond the 30 constituents of the benchmark Straits Times Index (SGX: ^STI).

Speaking at the Singapore Institute of Directors’ conference on September 12, Chee highlighted this initiative as part of broader efforts to drive investor interest in Singapore-listed companies and mid-cap Singapore stocks.

The new SGX index will provide visibility to the next tier of large and liquid companies, many of which have been benefiting from the Equity Market Development Programme (EQDP).

This development recognises that while the STI represents Singapore’s largest companies, there is growing investor interest in mid-cap stocks on the SGX that may be undergoing business transformation, governance improvements, or capital management initiatives.

Minister Chee emphasised that modern investors in Singapore stocks are looking beyond headline earnings, seeking companies with compelling growth narratives and clear strategic direction.

The new index will help showcase these emerging champions and potentially create a pathway for their eventual inclusion in the STI index.

Over time, SGX hopes to develop additional indices covering areas such as corporate governance and sustainability, creating what Chee described as a “virtuous circle” that generates positive momentum for the entire Singapore stock market.

This strategic move aligns with SGX’s efforts to enhance market depth and provide investors with more diversified investment opportunities within the Singapore equity market.

When the market is unpredictable, where can you park your money with confidence? Our latest FREE report reveals 5 Singapore dividend-payers built to withstand global storms. Get it now and see what’s still worth holding.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!