Welcome to this week’s edition of top stock market highlights.

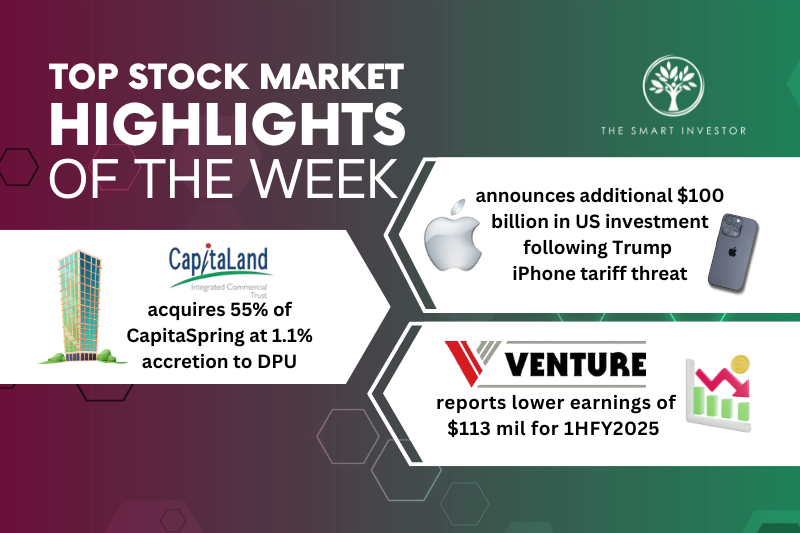

Apple (NASDAQ: AAPL)

Apple looks set to dodge the bulk of the tariffs imposed by US President Donald Trump.

The technology titan is preparing to announce plans to invest an additional US$100 billion in US manufacturing commitments to bring manufacturing back to the country.

This amount is in addition to the US$500 billion that Apple committed earlier, which includes working with partners to build an AI server plant in Texas.

Trump threatened to impose a 25% tariff on Apple’s devices if the company did not make any attempt to manufacture its iPhone in the US.

You could say that Apple’s announcement came just in time.

With the bulk of its iPhones manufactured in India, Trump had already levied a 25% tariff on all Indian exports into the US.

In addition, Trump has threatened to impose an additional 25% levy on India, bringing the total tariff rate to 50% as of this writing.

Investors should note that US-bound iPhones are mostly manufactured in India, while iPhones are still produced in China for the rest of the world.

Industry experts are not optimistic about Apple being able to completely manufacture an iPhone in the US because of the lack of skilled labour and limited supply chain resources.

On Apple’s part, the company is also not immune to the imposed tariffs.

It has taken a US$800 million hit thus far and anticipates an additional US$1.1 billion in related costs for its current quarter.

CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust, or CICT, announced the acquisition of the remaining 55% interest in CapitaSpring that it does not own.

The total consideration is S$1.045 billion based on an agreed property value of S$1.9 billion.

The acquisition outlay is S$482.3 million and will be funded via a private placement of new units of CICT at S$2.11 per new unit.

This property was purchased at an entry yield in the low 4% region, and will help to increase CICT’s Singapore presence.

CapitaSpring is a 51-storey integrated development with a 299-unit serviced residence.

It has 30 tenants and a committed occupancy level of 99.9%.

Post-acquisition, CICT’s portfolio value will grow from the current S$25.9 billion to S$27 billion.

There will be potential growth upside because of a limited new supply of core CBD Grade A office space in Singapore.

Post-acquisition, office assets will comprise 40% of the enlarged portfolio, up from the current 38%.

Distribution per unit for the first half of 2025 (1H 2025) will also witness a slight uplift, going from S$0.0562 to S$0.0568.

The REIT’s aggregate leverage will increase just slightly, going from 37.9% to 38.3%.

Venture Corporation (SGX: V03)

Venture Corporation is one of the blue-chip companies that also released its financial results for 1H 2025.

It was a mixed set of results for the contract manufacturer.

1H 2025 saw a downbeat set of earnings with revenue dipping by 8.8% year on year to S$1.26 billion.

The group’s net profit fell by 8.6% year on year to S$113 million.

Despite the fall in profit, Venture disclosed that its second quarter (2Q 2025) revenue and net profit rose 4.7% and 2.3% year on year, respectively.

With the quarter-on-quarter improvement, Venture has shown that the business is improving, albeit slowly.

The group also churned out a positive free cash flow of S$137.7 million for 1H 2025.

The board decided to declare an interim dividend of S$0.25 along with a special dividend of S$0.05, taking the total 1H 2025 dividend to S$0.30.

The special dividend reflects Venture’s strong financial position and demonstrates the group’s commitment to enhancing shareholder returns.

Venture’s connected global operations and long relationships with partners enable the group to co-create innovative products and supply chain solutions.

Explore Singapore’s top “evergreen” stocks with our FREE report. It spotlights 7 Singapore blue-chip stocks with solid dividends and growth potential. Click here to download it now to create a flow of dividend income, regardless of market conditions.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of Apple.