Welcome to this week’s edition of top stock market highlights.

Sheng Siong (SGX: OV8)

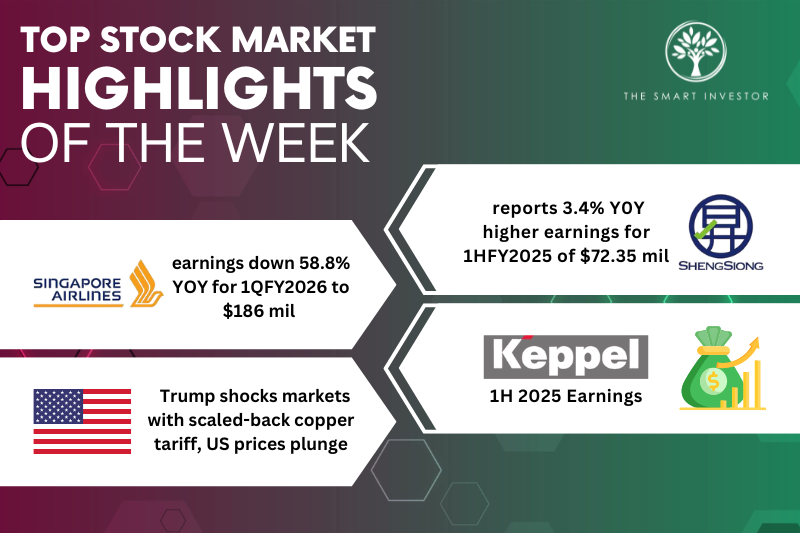

Sheng Siong released a resilient set of earnings for the first half of 2025 (1H 2025).

The retailer’s revenue rose 7.1% year on year to S$764.7 million while gross profit climbed 9.6% year on year to S$235.6 million.

Gross margin continued its upward climb, increasing from 30.1% to 30.8%.

Net profit increased by 3.4% year on year to S$72.3 million.

Sheng Siong maintained its interim dividend of S$0.032.

A total of five new stores were opened in 1H 2025, bringing the supermarket operator’s total store count to 80 as of 30 June 2025.

Another two stores were opened in July, and a third will open by the end of the third quarter of this year (3Q 2025).

At the end of 3Q 2025, Sheng Siong should have an increased store count of 83 stores.

Meanwhile, three tenders are awaiting results, and another three store tenders will be released by HDB by June 2026.

Management will continue to prioritise expansion in areas where the group has limited presence.

Its China operations contributed 2.7% of total revenue for 1H 2025 but saw an overall loss because of higher operating expenses from its sixth store, which commenced operations last year.

Singapore Airlines (SGX: C6L)

Singapore Airlines, or SIA, released its first quarter of fiscal 2026 (1Q FY2026) business update recently, and it was not a pretty picture.

The blue-chip carrier saw total revenue inch up 1.5% year on year to S$4.8 billion.

Total expenditure, however, increased by 3.2% year on year, led by an 8.5% year-on-year jump in non-fuel expenditure.

As a result, operating profit tumbled 13.8% year on year to S$405 million.

Net profit plunged 58.8% year on year to S$186 million.

The group’s passenger load factor crept up 0.7 percentage points to 87.6% but yields slid 2.9% because of stiffer competition.

SIA was also dragged down by a share of loss of associated companies as it started to equity account for Air India’s financial performance following the integration of Vistara into Air India.

As of 30 June 2025, SIA’s operating fleet consisted of 204 passenger and freighter aircraft with an average age of seven years and nine months.

In addition, 72 aircraft were on order at the end of the quarter.

With the closure of Jetstar Asia, SIA will ramp up capacity to various Asian destinations such as Malaysia, Sri Lanka, and Thailand.

The airline industry continues to face a volatile operating environment, and SIA will be nimble and proactive in responding to these challenges.

Keppel Ltd (SGX: BN4)

Keppel Ltd also released its 1H 2025 earnings during the week.

The group is making healthy progress under “New Keppel”, which excludes the group’s non-core portfolio earmarked for divestment.

New Keppel’s net profit climbed 25% year on year to S$431 million for the half year, with recurring income rising 7% year on year to S$444 million.

Notably, annualised return on equity (ROE) touched 15.4% for 1H 2025, an improvement from 13.2% in the previous corresponding period.

Funds under management (FUM) continued to climb, touching S$91 billion as of 30 June 2025.

Management is confident of achieving its S$100 billion FUM target by the end of 2026.

An interim cash dividend of S$0.15 was declared, unchanged from 1H 2024.

Keppel also announced a S$500 million share buyback programme where shares repurchased will be kept as treasury shares or may be used to conduct acquisitions.

The group announced S$915 million of asset monetisation year-to-date, and has identified over S$500 million of potential divestments to come.

Trump’s copper tariffs

A 50% tariff will be imposed on copper pipes and wiring as announced by President Donald Trump on 30 July.

However, this tariff fell short of the sweeping restrictions expected and also excluded input materials such as ores, concentrates, and cathodes.

This announcement caused US copper prices to plunge more than 17% as traders expected higher domestic prices.

Trump first released news of this tariff back in early July and hinted that it would apply to all types of copper products.

However, the actual announcement mentioned that the tariff will apply only to pipes, tubes, and other semi-finished copper products.

Taking effect on 1 August, the tariff will also cover cable and electrical components where copper is a major component.

However, Trump said he may still impose additional tariffs as he requested an update on the domestic copper market by June 2026.

With the information, the US President will then decide on whether to impose a phased universal import duty on refined copper of 15% commencing in 2027, and 30% by 2028.

Imagine a life where steady income flows, no matter the market. Our new free report, “Retire Early with Dividends,” reveals how. We’ve pinpointed 5 dependable Singapore dividend stocks that offer a proven, stress-free path to financial freedom. Stop just dreaming and start building your early retirement plan today. Your free guide awaits here.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang does not own shares in any of the companies mentioned.