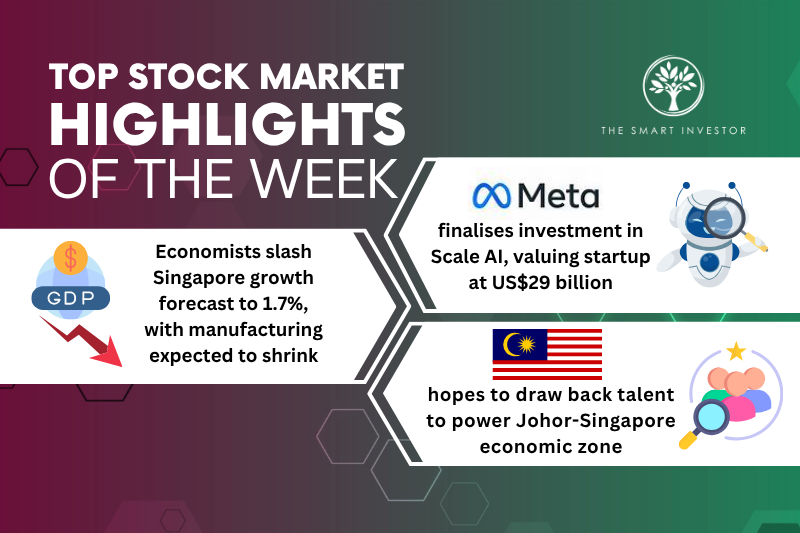

Welcome to this week’s edition of top stock market highlights.

Meta Platforms (NASDAQ: META)

Meta Platforms has concluded an investment in Scale AI, valuing the startup at over US$29 billion.

According to sources, the technology behemoth’s investment in Scale AI amounted to US$14.3 billion, giving Meta a 49.3% stake in the artificial intelligence (AI) firm.

Scale AI’s CEO and co-founder, Alexandr Wang, will join a new superintelligence unit within Meta that seeks to achieve artificial general intelligence (AGI).

AGI is a term used to describe machines that can match or even surpass human capabilities.

This deal is now Meta’s second-largest ever, just behind its US$19 billion purchase of WhatsApp back in 2014.

By buying a stake in Scale AI, Meta CEO Mark Zuckerberg could also take a sneak peek into what his competitors have been up to.

Many of these technology giants contracted Scale AI for data services.

Scale AI was valued at around US$14 billion just one year ago, with funding coming from Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), and Meta itself.

The startup was set up in 2016 and is famous for its accurately labelled data sets, which are used for training generative AI models.

These labels are manually done by gig workers who are recruited and managed by Scale AI.

Singapore’s growth forecast

Economists have downgraded Singapore’s full-year GDP growth and inflation expectations in the latest quarterly survey published by the Monetary Authority of Singapore (MAS).

This downgrade came on the back of deteriorating US-China relations and Trump’s raft of reciprocal tariffs announced in early April.

The median growth forecast is for Singapore’s economy to grow by 1.7% this year, dragged down by an anticipated manufacturing contraction.

This level is down from the previous projection of 2.6%.

The good news is that inflation is also expected to plunge, with core inflation expected to come in at just 0.8%, down from 1.5% in the previous survey.

That said, inflation could rear its ugly head again with Middle East tensions ratcheting up, as oil prices have recently surged in response to the unrest.

MAS is expected to further ease monetary policy at its next meeting in July to counteract this slowdown.

Despite the lowering of the official growth forecast, expectations are still within the original estimates of between 0% to 2% for growth, and 0.5% and 1.5% for inflation.

The respondents cited geopolitical tensions along with worsening trade relations as a key factor for the downgrade in the domestic outlook.

On the flip side, some factors could potentially boost growth.

These include a construction boom, with the recent announcement of the commencement of the construction for Changi Airport’s Terminal 5.

Interest rates could also be lowered if US economic growth remained tepid.

There could also be a potential fiscal support package should the government need to stimulate consumer spending.

Johor-Singapore Economic Zone

Malaysia has a goal of attracting hundreds of thousands of Malaysians to power the Johor-Singapore Special Economic Zone (SEZ).

The President and CEO of Iskandar Investment (IIB) said that this move does not set Malaysia up to compete with Singapore.

Instead, it is about creating symbiosis that will benefit both nations.

The idea of the SEZ is to have both countries work together to attract investment projects from around the world.

Although the zone’s infrastructure, which includes roads and power supply, has been set up, what’s lacking is the people.

Some positive factors that could draw Malaysians to work in the SEZ, rather than head over to Singapore, include more industry-relevant training, increased job opportunities, and a lower cost of living.

Mohd Noorazam Osman, CEO of the Iskandar Regional Development Authority, hinted that plans are underway to offer tax incentives and to establish a minimum starting salary of RM4,000 for graduates in Johor.

There is also the belief that many Malaysians may be willing to stay if salaries were half of what they could earn in Singapore, to avoid the daily commute between both countries.

Efforts to retain talent should also focus on what industries need, such as the identification of niche opportunities to supply digital assets to mature gaming and animation markets in Japan and South Korea.

Generative AI is reshaping the stock market, but not in the way most investors think. It’s not just about which companies are using AI. It’s about how they’re using it to unlock new revenue, dominate their markets, and quietly reshape the business world. Our latest FREE report “How GenAI is Reshaping the Stock Market” breaks the hype down, so you can invest with greater clarity and confidence. Click here to download your copy today.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of Meta Platforms.