In 2005, I took a leap and bought units of Suntec REIT (SGX: T82U).

Today, two decades later, those units are still in my portfolio.

This long journey with real estate investment trusts (REITs) has taught me invaluable lessons.

Why REITs?

Over the past 20 years, REITs have surged in popularity, and for good reason.

They offer individual investors the chance to own property without the headaches of traditional real estate.

No estate agents, lawyers, or bank loans to manage.

Plus, REITs are flexible; you can sell a portion of your holdings—something you can’t do with a physical kitchen or living room.

Furthermore, Singapore has become a REIT hub.

The options are vast, spanning properties from Australia to Germany and the US, including hospitals, hotels, and industrial buildings.

In fact, over 80% of Singapore REITs (S-REITs) hold properties overseas.

With so many choices, the challenge becomes knowing what to look for.

Over time, my REIT portfolio has grown to six income-producing shares, three of which I’ve held for over a decade, and another two for nearly nine years.

Here are the key traits and trends you should look for:

Sustainable business models

A REIT’s longevity hinges on sustainability.

This key factor can manifest in several ways.

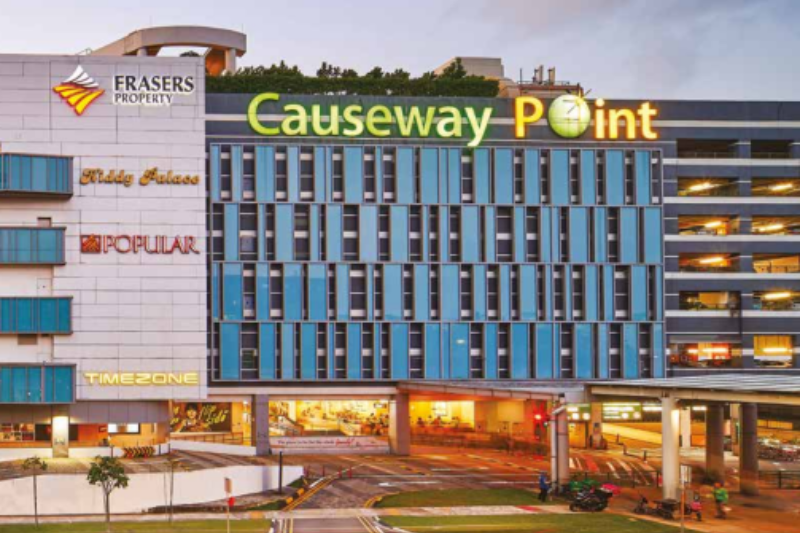

Location matters—Frasers Centrepoint Trust (SGX: J69U), for example, benefits from malls in growing, underserved housing areas.

Multinational sponsors like CapitaLand Investments (SGX: 9CI) or Mapletree Investment provide a steady pipeline of acquisitions and expansion opportunities.

Demographic trends also play a role.

With aging populations in Singapore and Japan, ParkwayLife REIT (SGX: C2PU), which owns hospitals and nursing homes, is well-positioned for growth.

Adaptability in a changing market

The rise of online shopping has challenged traditional retail.

However, physical malls aren’t obsolete.

But they must evolve.

Today’s malls need to offer experiences that online retail cannot—think rock climbing, urban farms, or performance theaters.

CapitaLand Integrated Commercial Trust’s (SGX: C38U) Funan mall exemplifies this adaptation.

It’s not just about buying things; it’s about providing a holistic experience.

REIT managers must adapt to stay relevant.

Growing distributions

Ultimately, the goal is consistent, increasing income.

When I first invested in ParkwayLife REIT in 2009, it offered a 10% yield.

Today, that yield-on-cost has grown to over 20% thanks to increasing per-unit distributions.

Patience has been key.

Over a decade, distributions more than doubled.

The risks: Debt and Refinancing

REITs have their downsides.

They must distribute 90% of their income to avoid taxes, leading to debt.

This means REITs rely heavily on their ability to refinance loans. During a credit crunch, this becomes a major risk, potentially leading to diluted shares or the need for unitholders to inject more capital.

Get Smart: Taking the the long view

Companies come and go, and business models change.

But well-located real estate tends to endure.

Suntec City, which I’ve held for 20 years, remains as popular today as when I first bought in.

For REIT investors, long-term patience can lead to both financial reward and peace of mind.

After all, isn’t that why we invest—to gain financial freedom and spend time on what truly matters?

Explore Singapore’s top “evergreen” stocks with our FREE report. It spotlights 7 Singapore blue-chip stocks with solid dividends and growth potential. Click here to download it now to create a flow of dividend income, regardless of market conditions.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Chin Hui Leong owns shares in CICT, Frasers Centrepoint Trust, ParkwayLife REIT, and Suntec REIT.