Say goodbye to the morning rush, the school holidays are finally here!

For parents, this is your chance to step off the daily treadmill.

Turn off the alarm and settle in for a quiet movie marathon. Or head to the beach and build sandcastles with your little ones. Whatever your choice, the opportunity to unwind and spend time with your loved ones is precious.

And with a little extra cash in your pocket, these shared moments can be even more fulfilling.

Thankfully, May is one of the best months for dividends.

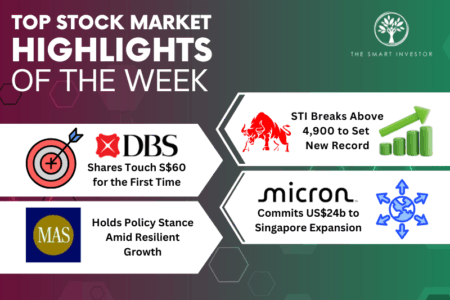

DBS Group (SGX: D05), for example, paid out S$0.54 per share in dividends around two weeks ago.

If you own 1,000 DBS shares, you will be S$540 richer just before the holidays come around.

Of course, DBS is not the only one paying dividends.

Shareholders of bourse operator Singapore Exchange (SGX: S68) or SGX were rewarded with S$170 for every 2,000 SGX shares owned.

These are just two examples of the many stocks paying dividends last month.

At our flagship service, the Smart Dividend Portfolio, there were no fewer than nine stocks paying out dividends in May. In total, the accumulated dividends collected since the start of the year is more than S$1,600.

Now, that’s a nice amount of cash to have on hand, right in time for the holidays.

So, if you want to treat yourself to a meal or go shopping, you now have the cash.

Wait, shouldn’t you invest in bonds instead?

Wait a minute, you can also earn income from bonds.

So, why not consider bonds instead?

They offer interest payments, just like dividends from stocks.

Sure, you could do that.

But just don’t expect high returns.

Bonds are typically designed with capital preservation in mind, rather than high returns.

The interest payments you’ll receive from bonds will usually be lower than the dividends you get from stocks such as DBS.

This trade-off makes sense – bonds generally offer lower risk than stocks.

For instance, a Singapore one-year treasury bill currently offers a yield of around 3.57%.

In contrast, DBS gives you a trailing yield of 5.33%.

But wait, there’s more to consider: bond interest payments are fixed.

Dividends, on the other hand, can grow over time.

In the case of DBS, its quarterly dividend has grown from S$0.33 in 2022’s first quarter (1Q’22) to S$0.54 in 1Q’24.

Let us do the math for you: it’s a more than 63% increase over a two-year period.

At the moment, DBS looks set to payout at least S$2.16 per share in dividends for the full year, bringing its yield up to 6%.

Wait, aren’t stocks riskier?

Hang on a moment here, aren’t stocks riskier than bonds?

Yes, stocks tend to be riskier.

But it also depends on how you behave around stocks.

Some believe that a good investor should be able to catch a stock before it rises and sell the stock before it falls. As such, they resort to watching stock prices like a hawk.

Unfortunately, their behaviour is futile.

If you are afraid of stock prices falling, here’s the reality check.

Joel Greenblatt, Gotham Capital’s Co-Chief Investment Officer, said it best: unless you buy a stock at the exact bottom, which is next to impossible, you will be down at some point after every investment.

Here’s another surprise: you don’t even have to catch the lowest stock price.

In the case of DBS, The Smart Dividend Portfolio bought its shares at S$19.34 back in April 2020.

This buy price is definitely not the lowest price you can get the stock.

Yet, with DBS shares trading at around S$35.52 today, we’re not shedding a tear.

Mind you, buying shares of the local bank was not done on a whim.

The decision to invest was backed by years of studying DBS’s performance through different industry cycles, and observing the management’s behaviour when they are under pressure.

In short: we have done our homework.

Get Smart: Wait, isn’t stock investing a lot of work?

Alright, you may think, it can’t be that easy right?

Investing in stocks requires a lot of work, doesn’t it?

Yes, it does require significant work upfront.

In our view, the results are well worth the effort.

You see, the S$1,600+ in cash The Smart Dividend Portfolio received year to date was the result of the careful selection of Singapore stocks designed with a single purpose in mind: to provide a reliable source of income.

We’ll be frank: nobody can turn into an investing expert overnight.

But that’s what we are here for.

To save you the time and effort. And be with you along this journey.

We show our members how we build a Singapore dividend portfolio that pays out a steady income with the added bonus of capital appreciation over time.

Until next time…

We’ve discovered 5 SGX stocks that not only offer better returns than fixed deposits but also have the potential to beat inflation. Plus, these stocks provide capital growth and can significantly compound your wealth in the long term. If you’re looking to make your money work harder for you, download our FREE report for details on these five stocks.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Chin Hui Leong owns shares of DBS and SGX.