It can be tough to sift through a bunch of companies to find out which ones make the best investments.

That job just got much tougher with the COVID-19 pandemic.

More than ever, safety and resilience are two important attributes that investors look out for.

There are still businesses that are chugging along fine, some even thriving and growing despite the tough economic conditions today.

As an investor, the challenge is to be able to identify these companies and add them to your portfolio.

What aspects should you watch out for to determine if a stock is truly worth a second look?

We present five signs you can look out for to find out if the stock you own is making good money.

- Gross and net margins

Source: Shareinvestor WebPro

First off, we look at both gross and net margins for the business.

Healthy gross margins indicate that the business has good pricing power and that it can either raise or maintain prices without fearing a loss of customers.

Net margins measure how efficiently the business is run and is a function of the level of expenses in relation to its revenue.

The above shows a snapshot of the five-year gross and net margins for Tractor Supply Company (NASDAQ: TSCO) or TSCO.

TSCO is the largest rural lifestyle retailer in the US and offers a wide variety of farming, gardening and pet products for recreational farmers and ranchers.

The company operates 1,904 Tractor Supply stores in 49 states and also operates 183 Petsense stores in 25 states as of 26 September 2020, employing around 40,000 workers.

TSCO has managed to keep its gross margin steady at between 32% to 33% over the last five fiscal years, demonstrating that it has solid pricing power.

During the pandemic, the retailer saw brisk sales as the rural community continued to tap on it for supplies.

Its net margin saw a gradual improvement from around 6.4% in 2016 to 7% in 2020.

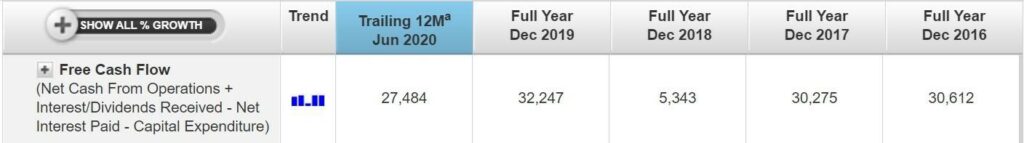

- Consistent free cash flow

Source: Shareinvestor WebPro

The second attribute to look at is the ability of the company to generate consistent free cash flow.

Free cash flow is defined as cash flow generated from core operations minus the capital expenditure that the business needs to incur to run the operations.

The presence of free cash flow is a boon for any business as this represents excess cash that builds up on the balance sheet.

Companies that display this trait also need not worry about being reliant on the banks or other lenders to fund their operations.

In short, free cash flow allows management to decide on how to deploy the excess cash generated.

It may choose to pay out a higher level of dividends, do share buy-backs or conduct a beneficial acquisition that boosts revenue and net profit.

VICOM Ltd (SGX: WJP) is a testing and inspection specialist for vehicles such as cars, buses and taxis. The group also conducts inspection and testing in fields such as mechanical, biochemical and civil engineering.

Over the past five years, VICOM has shown the ability to generate consistent levels of free cash flow.

For the fiscal year 2018, there was a dip in free cash flow as the company purchased a piece of land to relocate their headquarters. Stripping this out, free cash flow should be in line with the other four years.

- High return on equity

Source: Shareinvestor WebPro

The third attribute to watch out for is a high return on equity (ROE).

ROE measures the profitability of a business per dollar of share capital injected in the business.

A high ROE means that a business is more efficient in deploying its capital to generate profits.

Investors should observe if a company can generate consistently high ROE, with a level above 15% considered good.

Singapore Exchange Limited (SGX: S68), or SGX, is Singapore’s sole stock exchange operator.

SGX operates a platform for the buying and selling of equities and derivatives. The group also provides listing, clearing and settlement services for listed companies.

From the table above, SGX’s ROE has averaged around 35% over the past five fiscal years.

This demonstrates the group’s high efficiency in converting its capital into profits for shareholders.

- Revenue and net profit growth

Source: Shareinvestor WebPro

The next sign to look for is revenue and profit growth.

If revenue and net profit are growing consistently, this means the company is doing something right.

It may be latching on to new trends caused by the pandemic, or going one up on its competitors by providing a more compelling business proposition.

Investors need to double-check if the company is generating higher levels of free cash flow in tandem with the increase in revenue and profits.

AEM Holdings Ltd (SGX: AWX) offers system test and handling solutions for the semiconductor and electronic companies.

It has five manufacturing plants located in Singapore, Malaysia, China, Finland and France.

Since 2017, the group has gone through a multi-year growth spurt.

Revenue has grown by double-digits year on year for the last five years, while net profit has also surged.

AEM’s trailing 12-month net profit more than doubled year on year as the group enjoys the tailwinds from the digitalisation wave spurred by the pandemic.

- Rising dividends

Source: Shareinvestor WebPro

If a company is paying out consistent dividends, you can be sure it’s a money-making one.

Healthy levels of cash on its balance sheet or the ability to generate consistent free cash flow will translate to dividends paid out to reward shareholders.

Businesses that have raised their dividends over the years count as stocks you would want to own.

The above table shows the dividend payment history for Nike (NYSE: NKE).

Nike is a leading sports footwear and apparel company that has stores around the globe.

Despite the pandemic leading to temporary closures of numerous stores during January through June, the company has still managed to raise its full-year dividend for the fiscal year ended May 2020.

The company has raised its dividends every single year without fail for the last eight years and is also on track to report higher year on year dividends for its fiscal year 2021.

It recently announced a 12% increase in its quarterly cash dividend to US$0.275 from US$0.245.

The Smart Investor team used ShareInvestor WebPro to easily obtain the data needed for our analysis.

ShareInvestor WebPro provides a full suite of financial data and charts, and also has other cool features such as a personal portfolio transaction manager, stock news alerts, and more.

This December, The Smart Investor is offering our readers a special discount on top of ShareInvestor’s Christmas promotion.

Exclusive to Smart Investor readers only, ShareInvestor is offering a 25 + 8% discount off a 12 month subscription to WebPro. Readers will also receive a $10 GrabFood voucher!

This offer is only available until 10th December, so if you’d like to learn more about their offer, CLICK HERE or the button below.

Remember to use the promo code SGTSI10 to get the $10 Grab Food voucher!

Disclaimer: Royston Yang owns shares in Nike, VICOM and Singapore Exchange Limited.