Growth stocks had a spectacular run last year.

The bellwether NASDAQ Composite Index surged by 43.4% for its best year since 2000.

The technology-heavy stock index could have more room to run as technology is at the forefront of human progress and advancement.

This simple fact means that investing in strong, growing technology stocks could help to lift your investment portfolio to higher levels in years to come.

We profile four successful technology companies that could make it to your buy watchlist of growth stocks.

Shopify (NYSE: SHOP)

Shopify is an e-commerce platform that equips entrepreneurs and small business owners with the tools and software required to run their businesses effectively.

The company reported an impressive set of results for the first nine months of 2023 (9M 2023).

Revenue grew 27.2% year on year to US$4.9 billion while gross profit improved by 25.4% year on year to US$2.5 billion.

Operating loss (excluding impairment charges) narrowed by 42.1% year on year to US$367 million.

For 9M 2023, Shopify also generated a positive free cash flow of US$459 million, reversing the free cash outflow of US$276 million in the prior year.

For the third quarter, the company’s gross merchandise value (GMV) rose 22% year on year to US$56.2 billion with growth in its global merchant base.

In the same quarter, the gross payment volume processed on Shopify Payments climbed 31% year on year to US$32.8 billion.

Shopify believes that it has a large total addressable market of US$849 billion, giving the business ample opportunities to grow its top line and market share.

Palantir (NYSE: PLTR)

Palantir is a software company that specialises in big data analytics.

Its software helps clients to manage their data, decisions, and operations more effectively.

Like Shopify, Palantir also reported a sparkling set of results for 9M 2023.

Revenue rose 15.7% year on year to US$1.6 billion with gross profit increasing by 18.4% year on year to US$1.3 billion.

The software company churned out a net profit of US$116.4 million for 9M 2023, reversing the US$404.6 million loss a year ago.

It was Palantir’s fourth consecutive quarter of profitability.

Free cash flow soared more than three-fold year on year from US$109.9 million to US$400 million.

Billings increased by 8% year on year for the third quarter of 2023 to US$550 million with the average trailing 12-month revenue per top 20 customer rising by 13% year on year to US$54 million.

As of 30 September 2023, Palantir had 453 customers representing a 34% year-on-year jump.

Its commercial customer count climbed even more, increasing by 45% year on year to 330.

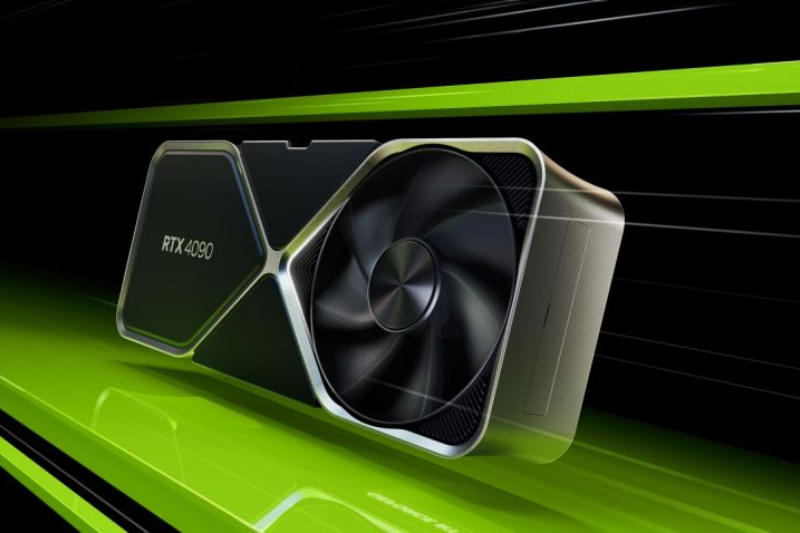

Nvidia (NASDAQ: NVDA)

Nvidia is a technology company that invented the graphics processing unit (GPU) used in gaming and personal computers.

The company is also driving advances in artificial intelligence (AI), creative design, autonomous vehicles, and robotics.

Nvidia is at the forefront of the generative AI wave and is also a key beneficiary of many companies’ transitions from general-purpose to accelerated computing.

The GPU company reported a sterling set of results for the first nine months of fiscal 2024 (9M FY2024) ending 31 October 2023 with more to come.

Revenue surged 85.5% year on year to US$38.8 billion while operating profit leapt more than six-fold year on year to US$19.4 billion.

Net profit jumped more than five-fold year on year from US$3 billion to US$17.5 billion.

Nvidia also generated a free cash flow of US$15.8 billion, up more than seven-fold from a year ago.

Investors should note Nvidia’s strong guidance for its fourth quarter, with revenue expected to come in at US$20 billion.

If it manages to achieve this revenue, it will be more than triple the US$6.05 billion of revenue it booked in the fourth quarter of fiscal 2023.

Microsoft (NASDAQ: MSFT)

Microsoft’s suite of software solutions has become a household name, with its Microsoft Office offering word processing, spreadsheet, and presentation functionality.

The technology company also offers cloud services and owns the business networking site LinkedIn.

Despite its size (Microsoft is a US$2.7 trillion company), the technology company managed to report a strong financial report.

For the first quarter of fiscal 2024 ending 30 September 2023, Microsoft’s revenue rose 12.8% year on year to US$56.5 billion.

Operating profit jumped 25% year on year to US$26.9 billion while net profit climbed 27% year on year to US$22.3 billion.

In particular, Microsoft’s cloud revenue grew 24% year on year to US$31.8 billion.

LinkedIn saw growth in talent solutions that enabled revenue to increase by 8% year on year while the number of sessions increased by 12% year on year with record engagement.

The technology company’s free cash flow also increased by 22.2% year on year to US$20.7 billion.

If you’re wondering about how you can leverage AI in your investment portfolio, and how it can boost your portfolio, good news! We just released an urgent Special Free Report to cover everything you need to know about AI and its implications for investors. Find out which listed companies are actively using AI to power their businesses and what you should do to prepare for the AI boom. Click here to download your free report now.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang does not own shares in any of the companies mentioned.