After a meteoric run in 2024, US stock markets are once again hovering near record highs and once again, tech giants are leading the charge.

With rate cuts and AI investments accelerating, mega-cap tech looks poised to drive the next leg of the rally.

While several tech giants have delivered stellar returns, among them, Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), and Microsoft (NASDAQ: MSFT) stand out.

With AI leadership, cloud dominance, and diversified growth firing on all cylinders, they’re best positioned to power the market forward in 2025 and beyond.

Amazon: From Retail Roots to Multi-Pronged AI Growth

From its humble beginnings in the mid-1990s, Amazon now owns a suite of market-leading businesses far beyond retail in cloud computing, digital advertising and logistics.

Far from resting on its laurels, Amazon has aggressively innovated to become a major provider of AI-powered solutions, driving operational efficiency and improving margins through its AI stack:

- Trainium and Inferentia, Amazon’s custom-designed AI chips, are optimised for use within its cloud computing arm AWS.

- Bedrock allows developers to access a wide range of foundational models easily through unified APIs.

- SageMaker provides an end-to-end platform for developers and data scientists to develop and train custom AI models collaboratively.

Amazon’s trailing twelve-month (TTM) revenue is up 11% year-on-year (YoY) to US$670.0 billion, showing consistent long-term growth. For perspective, Amazon’s revenue in 2015 was just US$107.0 billion.

Remarkably, Amazon doesn’t just grow its top-line. It grew efficiently.

Its TTM net income grew 59% YoY, faster than its revenue, because of contributions from higher-margin businesses such as AWS and advertising.

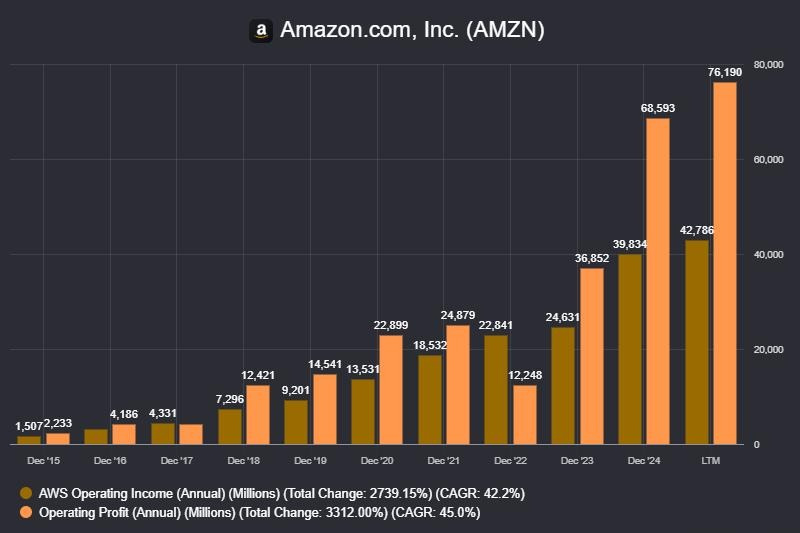

Indeed, the AWS segment alone consistently contributes more than half of Amazon’s total operating profit each year, underscoring its role as a major source of profit:

Although Amazon’s operating cash flow has mostly improved over time, increasing capital expenditure (CAPEX) has led to a falling trend in free cash flow (FCF) in the last few quarters.

This said, Amazon’s CAPEX is expansionary, meant for forward-looking growth. The CAPEX supports the retail business’s logistics automation, and AWS’s AI services and chip designs.

I expect Amazon to continue scaling its diversified suite of market-leading businesses in e-commerce, cloud computing, and digital advertising, maintaining a formidable multi-pronged growth engine.

Alphabet: AI Empire Delivering on All Fronts

Alphabet is a trillion-dollar tech empire with a fortress balance sheet.

Like Amazon, Alphabet has aggressively leveraged AI. It has been deploying its Gemini foundational AI model across its existing offerings, such as Google Search, Google Workspace, and Google Cloud Platforms.

It also returned capital to shareholders recently with a US$13.6 billion share buyback in the second quarter of 2025 (Q2 2025).

During the quarter, the Google Services segment grew revenue by 12% YoY and maintained a high operating margin of 40.1%. The growth was broad-based, with almost all services in the segment growing at double digits.

Google Cloud’s revenue grew 32% in Q2 2025, with its operating margin increasing from 11.3% a year ago to 20.7%, demonstrating a significant improvement in operational efficiency.

Despite Google’s FCF declining 61% YoY to just US$5.3 billion in Q2 2025 because of rising CAPEX, its TTM FCF remains substantial at US$66.7 billion. In fact, Alphabet’s annual FCF has been US$60 billion or more since 2021.

Overall, Alphabet’s AI transformation and consistent cash generation provides both growth and defensive appeal.

Microsoft: Cloud Giant, AI Bellwether, Dividend Machine

Traditionally known for its leadership in enterprise software, Microsoft is also one of the leading providers of cloud computing services worldwide, together with Amazon and Alphabet.

In Q2 2025, Microsoft’s cloud business grew at a high double digit YoY rate of 25%, significantly faster than other segments.

Microsoft is rolling out AI across its ecosystem. For example:

- In Azure, Microsoft’s cloud computing services platform, the company has launched Azure AI Foundry, which helps customers “design, customize and manage AI applications and agents at scale”

- Copilot, an AI assistant feature, has been integrated with Microsoft’s software products such as GitHub and Microsoft 365

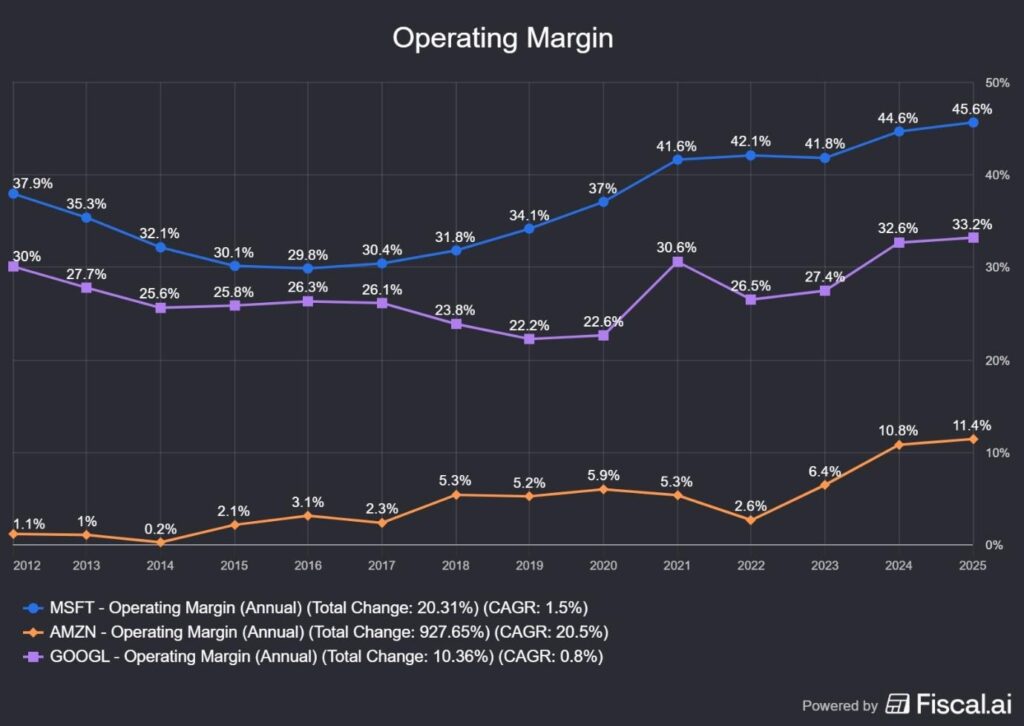

Notably, Microsoft’s operating profit margin is consistently higher than Amazon’s and Alphabet’s:

For total-return investors, Microsoft also pays a dividend and conducts share buybacks. It’s worth noting that Microsoft’s dividend has historically increased over time.

As a top games publisher on both Xbox and PlayStation, Gaming/Xbox is positioned to become Microsoft’s fourth revenue pillar as it pivots to a cloud-based recurring revenue model.

Overall, Microsoft’s ability to monetise AI across its cloud, productivity, and gaming businesses make it a balanced play on the AI-driven tech boom.

Risks to Watch

Regulatory headwinds are present, especially for Alphabet and Amazon. Antitrust scrutiny on their near-monopoly businesses creates transitory headline risks.

Use cases in cloud computing are shifting from compute-as-a-commodity to AI-driven productivity, making it less clear who will eventually lead in the evolved landscape.

Heightened risks of recessions because of macroeconomic reasons – such as geopolitical tensions and higher-for-longer interest rate – could place their profit margins under pressure.

Lastly, although the tech giants have strong business fundamentals, market-risks also exist if investors rotate away from growth to defensives.

Get Smart: Riding the Wave with Tech Titans.

Amazon, Alphabet, and Microsoft are surfing the business waves with distinct style and confidence.

These companies offer distinct flavours of tech exposure:

- Microsoft monetises its AI capabilities through its suite of enterprise productivity tools, achieving quality growth with high operating margin.

- Amazon incorporates AI for operational excellence, growing across a highly diversified range of businesses.

- Alphabet integrates AI in its existing consumer-facing platforms, while advancing other frontiers such as Gemini.

Instead of chasing the noise, the smartest investors follow the strength. And in 2025, it’s still some of tech’s biggest names.

Generative AI is reshaping the stock market, but not in the way most investors think. It’s not just about which companies are using AI. It’s about how they’re using it to unlock new revenue, dominate their markets, and quietly reshape the business world. Our latest FREE report “How GenAI is Reshaping the Stock Market” breaks the hype down, so you can invest with greater clarity and confidence. Click here to download your copy today.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosure: Larry owns shares of Amazon, Alphabet, and Microsoft.