With the market pricing in interest rate cuts soon, real estate investment trusts (REITs) could be among the first to benefit.

Lower rates result in cheaper borrowing costs, which is paramount for REITs since they usually take on loans to finance their properties.

Here are three REITs in Singapore worth watching this September:

CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust (CICT), stands as the first and largest real estate investment trust listed on the Singapore Exchange (SGX).

The REIT’s portfolio covers a vast array of properties including retail malls, office buildings, and integrated developments.

Among its well-known properties are Raffles City, Funan, and Plaza Singapura.

From the start of the year, CICT’s unit price has risen by 13.5% to S$2.20.

For the first six months of 2025 (1H25), the trust generated gross revenue of S$787.6 million, up 1.4% compared with the prior year’s first half.

Distribution per unit came in at S$0.0562, representing a 3.5% year-on-year increase.

Moreover, there were positive rental reversions of 7.7% for the retail portfolio and 4.8% for the office portfolio, while occupancy stayed relatively stable at 96.3%, signalling strong tenant demand and healthy leasing momentum.

CICT refinanced a portion of its debt in early 2025, lowering interest costs and strengthening its balance sheet.

The REIT’s aggregate leverage stands at 37.9%, providing some headroom for strategic and selective acquisitions.

Meanwhile, the trust has managed to lower its average cost of debt to 3.4% in 1H25 from 3.6% a year ago.

Importantly, with 81% of borrowings locked into fixed rates, financing costs should remain steady and predictable despite the uncertain interest rate environment.

Management Outlook

Moving forward, CICT is expected to benefit from lower borrowing costs if interest rates decline, while continuing to enjoy stable demand for its retail and office located in prime areas.

The current focus on green building certification and asset rejuvenation and operational efficiency will drive the long-term competitiveness of CICT.

CICT’s focus on green building certification, asset rejuvenation and operational efficiency will enhance its long-term competitiveness.

For instance, green-certified properties not only enjoy lower operating costs and stronger tenant demand but also provide access to sustainable financing options.

Rejuvenation initiatives help maintain asset relevance and improve yields.

Frasers Centrepoint Trust (SGX: J69U)

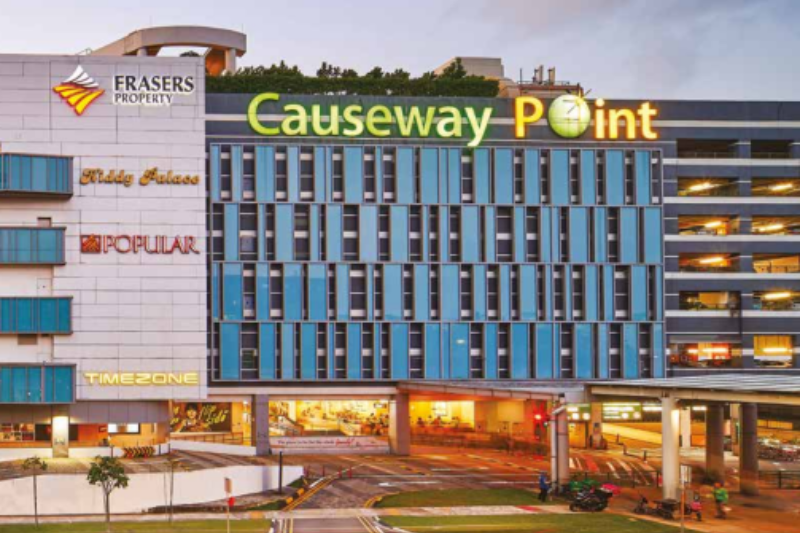

Frasers Centrepoint Trust (FCT) is a leading developer-sponsored retail real estate investment trust with assets under management of approximately S$8.3 billion as of 29 April 2025.

The REIT is the largest suburban retail mall owner in Singapore.

The shopping mall owner’s portfolio includes popular destinations such as Causeway Point, Northpoint City and Waterway Point, to name a few.

FCT’s unit price has risen 5.6% year to date (YTD) to S$2.23.

For the half year ended 31 March 2025, the REIT posted healthy growth across key metrics.

Gross revenue came in at S$184.4 million, up 7.1% from a year earlier, while net property income advanced 7.3% year on year to S$133.7 million.

Distribution per unit rose in tandem, increasing 7.3% year on year to S$0.06054.

The retail properties continued to show remarkable resilience with committed occupancy at 99.5%.

This stability stems from demand by necessity-driven tenants, including supermarkets, food & beverage operators, and healthcare services.

Furthermore, FCT has seen a fall in its cost of debt from 4.0% in 1Q25 to 3.8% in 2Q25 in part due to the lower interest rate environment.

FCT also achieved a positive rental reversion of 9% in 1H25 for renewal leases, reflecting the steady demand for suburban retail space.

Management Outlook

Moving forward, the manager is focused on optimising shopper traffic due to government support such as CDC, SG60 and Climate vouchers.

The manager expects a boost in spending, especially at supermarkets and essential retail located at FCT’s malls.

CapitaLand Ascendas REIT (SGX: A17U)

CapitaLand Ascendas REIT (CLAR) is Singapore’s largest industrial REIT with a diversified portfolio covering sectors such as Business Space, Life Science, Logistics, Industrial, and Data Centres.

The properties span Singapore, Australia, the US, and the UK/Europe, and possess diversified and defensive characteristics.

Lagging behind the first two REITs, CLAR’s unit price has risen 4.7% YTD to S$2.69.

In the first half of fiscal 2025 (1H FY2025) ending 30 June 2025, CLAR reported a softer performance.

Gross revenue declined 2.0% year on year to S$754.8 million, while NPI slipped 0.9% to S$523.4 million.

DPU also edged down 0.6% to S$0.07477, reflecting the impact of weaker rental contributions and a larger unit base during the period.

However, CLAR saw its portfolio occupancy soften slightly to 91.8% compared to its prior 92.8% in 1H FY24.

Furthermore, the REIT’s aggregate leverage remained stable at 37.4%, while its average cost of debt improved to 3.7% with 76% of borrowings hedged.

CLAR also achieved a positive rental reversion of 9.5% in 1H25 all while keeping portfolio occupancy rate steady. This metric shows continued strong demand for CLAR’s properties.

CLAR is actively enhancing its portfolio with six projects worth S$498.4 million, focused on development, redevelopment, and asset enhancement to drive higher returns.

1. Acquisition under Development (S$94.8m)

Summerville Logistics Center, Charleston (US) – Logistics asset targeted for completion in 4Q 2025.

2. Redevelopments (S$379.6m)

27 IBP, Singapore – Business Space & Life Sciences, S$136.0m, completing in 1Q 2026.

5 Toh Guan Road East, Singapore – Logistics, S$107.4m, completing in 4Q 2025.

Logis Hub @ Clementi, Singapore – Logistics, S$136.2m, completing in 1Q 2028.

3. Asset Enhancement Initiatives (S$24.0m)

Aperia, Singapore – Industrial & Data Centres, S$22.7m, completion in 4Q 2025.

Management Outlook

Management expects global uncertainties to remain high due to trade war, inflation uncertainty, and central bank policies.

However, they believe that CLAR is well positioned for resilience due to its diverse real estate holding across different sectors and countries.

The manager also emphasised a continued focus on sustainability initiatives which includes asset upgrades and green financing to strengthen portfolio resilience and long-term value creation.

Imagine a life where steady income flows, no matter the market. Our new free report, “Retire Early with Dividends,” reveals how. We’ve pinpointed 5 dependable Singapore dividend stocks that offer a proven, stress-free path to financial freedom. Stop just dreaming and start building your early retirement plan today. Your free guide awaits here.

Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!

Disclosures: Evan does not own any of the REITs mentioned.