Last Friday, Nanofilm Technologies International Ltd (“Nanofilm”) (SGX: MZH) launched its initial public offering (IPO) at an issue price of S$2.59.

The nanotechnology and advanced material company’s stock was 30.6 times over-subscribed.

This overwhelming subscription was unsurprising.

After all, Nanofilm offers a rare opportunity for local investors to own a technological growth stock.

The stock’s share price increased by 12.4% to S$2.91 on its first day of trading.

Set up in 1999, Nanofilm engages in three different business segments.

They are: advanced materials, nanofabrication, and industrial equipment.

The business segments accounted for 69.5%, 5.3% and 25.2% of revenue respectively for the financial year 2019.

While it may be exciting to jump on the IPO bandwagon, we must remain rational as investors.

As with any stock, there are risks associated with it.

In this article, we will examine three specific risks that Nanofilm faces.

Dependence on a handful of customers

Nanofilm’s top five customers accounted for 67.5%, 72.8%, and 81.9% of revenue for the financial years 2018, 2019, and the first half of 2020 respectively.

Its largest customer was responsible for 45.6%, 51.1%, and 56.5% of revenue during the same period.

Being major customers, they exert stronger bargaining power and this fact does not work in Nanofilm’s favour.

For example, some contracts do not have a fixed term and grant the customer the right to terminate all or part of any purchase at any time without charge.

These unfavourable clauses mean that Nanofilm is at the mercy of its customers.

Also, if any of these large customers were to come under financial stress, Nanofilm will be directly impacted.

While this is a cause for concern, it is important to consider the nature of its customer relationships.

Due to the technical expertise required to produce Nanofilm’s products, the firm offers a differentiated service with few alternatives.

This lack of suitable alternatives creates a reliance on Nanofilm’s technologies.

This acts as a mitigating factor as these customers face high switching costs. Therefore, the risk of them forsaking Nanofilm for a competitor is also lowered.

Competitive market with high R&D & engineering costs

The company spent 5.4%, 6.4%, and 7.2% of revenue during the periods of 2018, 2019, and the first half of 2020 respectively, on research and development (R&D) and engineering expenses.

R&D and engineering activities relate to product innovation for the company and helps to drive revenue for the business.

These research projects are often lengthy and uncertain with no assurance that they will translate into revenue for the company.

In addition to this, the company also incurs capital expenditure in the form of manufacturing plants, engineering equipment and machines.

As a result, failure to convert these efforts into cutting-edge products could be detrimental to the company.

Investors, therefore, need to ensure that Nanofilm displays constant innovation so as to keep its product pipeline filled.

China operating risk

There are uncertainties with regards to the application of taxation for non-People’s Republic of China (PRC) enterprises with operations in China.

In cases where transfers of assets do not have reasonable commercial purposes, PRC enterprise income tax may apply to the company.

Income tax of 10% to 25% may be levied for assets moving into China, depending on how the government classifies its status.

Aside from taxation uncertainties, there are also regulations on loans to and direct investment in PRC entities by offshore holding companies.

This means that Nanofilm may be delayed or prevented altogether from transferring funds to its PRC subsidiaries.

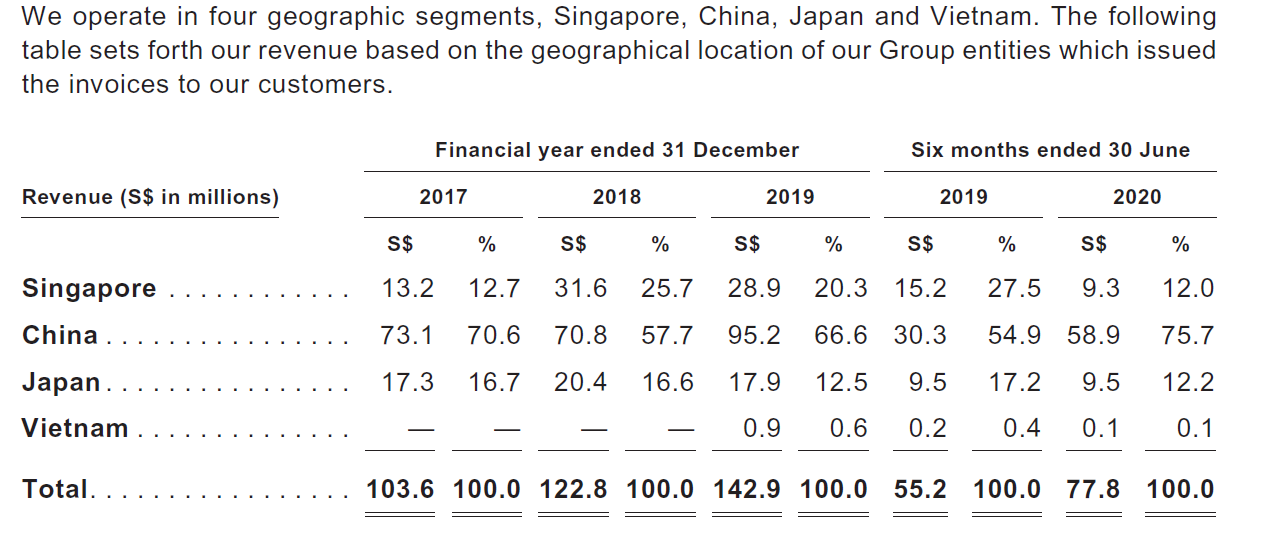

Source: Nanofilm’s IPO Prospectus

Considering that the majority of Nanofilm’s revenue came from invoices issued in China, these tax uncertainties and capital restrictions may spell trouble for the company.

However, China’s uncertain foreign investment environment may soon change.

In China’s communique of the fifth plenary session released last Thursday, the Chinese leaders laid out plans to become a technology superpower by 2035.

Within the communique, China’s 2021–2025 Five-Year Plan was also stated.

The Chinese government is expected to utilise tax incentives, public-private partnerships, and industrial policies to promote R&D investments from both domestic and foreign companies during this period.

Additionally, the country is looking to strengthen intellectual property rights.

These encouraging signs point to a possible opening up of the Chinese market to foreign technology stocks.

Nanofilm, which fits this description, should be a beneficiary of this policy.

Join us for an exclusive Telegram Q&A on 6 November 2020 at 12 noon where we’ll discuss dividend blue chips that have been winning in 2020… plus special coverage on one of Singapore’s hottest stocks! Details will be shared on our Telegram channel, so CLICK HERE to join our channel.

Before the Q&A, don’t forget to download our FREE report where we cover 4 dividend blue chips that have been winning in 2020! CLICK HERE to download now.

Disclaimer: Zachary Lim does not own shares in any of the companies mentioned.